Almost 70 years ago, John Kenneth Galbraith explained that during a bull market there is a period when an embezzler enjoys his ill-gotten gains, but the victim does not yet know he has lost out. Think of rich Europeans who invested with Bernie Madoff, and spent their summers in Saint Tropez and their winters in Saint Moritz believing that Madoff was compounding their assets at a steady 12% a year. While the “bezzle” was on, the economies of Saint Moritz and Saint Tropez hummed along nicely, and the world seemed better off. In this interval, there were two engines of “unfounded” economic activity: Madoff bought watches, yachts and holiday homes, while the investors he was conning spent as if their balance sheets were still rock solid.

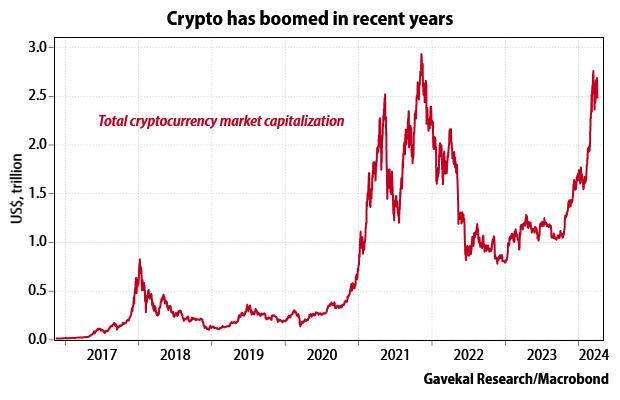

This idea is notable again in light of the $2.5 trillion in crypto market capitalisation that essentially emerged from nowhere five years ago. The resurgence in cryptocurrency prices again raises the question: what really is its “value proposition” — or put another way, what function does it serve?

Most industries earn money because they make our lives better. Microsoft makes money because it helps us manage information; Netflix because it entertains us; McDonald’s because it feeds us. Absent a social function, it is hard to understand why an industry should make lots of money for a long time. We need shelter, food, clothing, transportation and entertainment, and will pay the entities that duly satisfy us. So exactly what value do cryptocurrencies provide to society?

Most industries earn money because they make our lives better. Microsoft makes money because it helps us manage information; Netflix because it entertains us; McDonald’s because it feeds us. Absent a social function, it is hard to understand why an industry should make lots of money for a long time. We need shelter, food, clothing, transportation and entertainment, and will pay the entities that duly satisfy us. So exactly what value do cryptocurrencies provide to society?

The answer does not seem to be that they make transactions easier and cheaper. More than a decade after the emergence of Bitcoin, cryptocurrencies are still very far from being a means of exchange. Rather, their main purpose seems to be that of a “store of value”, if a volatile one. Talk to any cryptocurrency enthusiast and the main argument is that Bitcoin, Ethereum and others will help protect capital in the context of unfolding currency debasement — which brings us back to Galbraith’s bezzle.

If, as many crypto enthusiasts believe, Western democracies are on the cusp of massive currency debasement in order to maintain their welfare states, the roughly $100 trillion held in global government bonds is worth, in real terms, a small fraction of that amount. But if this scenario turns out to be wrong, the $2.5trillion of crypto money represents today’s bezzle.

Calling government bonds a bezzle could be seen as crude sensationalism. No one is suggesting that bonds will not be paid back. Most Western sovereign debt issuers are neither Argentina nor Greece, and almost all bonds will be redeemed at par. The question is what the purchasing power of par will be. And, just as crypto has gathered pace, the returns on bonds have gone from bad to worse. Investors in US treasuries suffered real-terms purchasing power losses in all of the last three years, and the trend is set to continue in 2024. Worse still, for the past 20 years US treasury investors have essentially made no real return. That represents a genuine euthanasia of the rentier.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeHow will they do that then? More crypto speculation?

Historically there are few investment classes that have been unprofitable over decades (so recent US Treasuries are a bit of an anomaly). Crypto as a class may well be profitable over decades, but there will be specific exceptions and periods of retreat. When one buys crypto of one specific kind, and at one point in time, the buyer crystallises these risks, just as has always happened with more established asset classes.

Unless you bought TerraUSD or most of the NFT’s, no chance of recovery.

What a strange piece. Starts out as an accurate analysis of crypto, then veers into a rant against government bonds.

Precious metals as a store of value? Gold and silver are presently valued about 2X the price they held 15 years ago. Hardly keeping up with inflation. Gold and silver have value, but are not a good investment.

And crypto is nothing more than a digital version of Beanie Babies or Cabbage Patch Dolls, if your memory goes back that far. I can use crypto to send money here or there, but it has absolutely no intrinsic value. Which is why the crypto market fluctuates so wildly.

As for bonds, US Treasury bonds aren’t a great investment directly, but investing in a bond fund is a safe, if conservative, path.

But at least gold and silver are worth more than they were. Those who kept cash (and I know some) lost significant amounts to inflation, especially here in Canada where their meagre interest was taxed.

“I can use crypto to send money here or there, but it has absolutely no intrinsic value.”

This statement is self-contradictory. Crypto is a means of exchange, and one having useful properties not available by any other means. It therefore possesses an “intrinsic” value of being this useful thing.

It is worth pointing out, too, that gold has a fairly small “intrinsic” value because it is useful for only a very few applications. Making jewellery out of it that is only valuable because it’s made of gold in the first place hardly proves anything. Gold is valuable simply because a consensus has existed for thousands of years that it is valuable, and that consensus emerged because of gold’s relative rarity, its durability, and the certainty that there were no major new sources of gold anywhere that would debase the value of existing stocks. Bitcoin possesses all those properties as well, and in addition is its own medium of exchange. It is also important to note that something can possess an intrinsic value that still does not make it a useful store of value because it is something that is eventually consumed. The interesting history of the M-Pesa system in Kenya was sparked off by the discovery that Kenyans having no bank accounts were nonetheless trading with each other using transferrable mobile phone airtime credits to buy and sell other goods and services – the credits themselves were consumable and therefore non-durable, but the simple fact that they were a transfer medium sufficed all on its own to develop a stable system of exchange.

And the part of the article that attacks government bonds does have relevance to the cryptocurrency debate, because it questions how legitimate are the criticisms of crypto that come from established financial actors, when established financial instruments themselves cannot provide even a reliable hedge against inflation, let alone real returns.

Still, the initial point about the “bezzle” might turn out to be correct. Satoshi Nakamoto (assuming he exists at all) owns about 1.1million Bitcoins and they don’t trade in bitcoin markets. In addition, the top 1% of bitcoin wallets hold 90% of the total existing supply. It is clear that the market in Bitcoin is at present rigged to create artificial scarcity: nobody can be sure that the top 1%ers won’t dump part of their holdings to drive the price down or that this hasn’t been happening already.

The only part I disagree with is that for it to be a “bezzle” as described by Galbraith and compared with Madoff, it has to be a deliberate scam. It is very obviously not a scam – or not just a scam, at any rate – because Bitcoin is new and revolutionary technology. The most incredible thing about it is that nobody has managed to hack it yet. It’s now 15 years old, has created a brand new fintech industry in that time which will eventually revolutionise payments, legal agreements, public records, trading systems, identity security, financial security etc, and still the original thing, Bitcoin itself, is stable, secure and functional. I believe that this fact is widely underappreciated.

Crypto is a catch all term that covers bitcoin ( an astonishing decentralised currency that goes up over time, although with large draw downs of 70-80% when the hype bubble bursts . Seems like a loss but usually follows a gain of 800%1500%) and a vast array of centralised scams that are basically pump and dump schemes.

“Such trends are likely to continue until we see a significant shift in fiscal policies across the developed world.”

There aren’t too many things one can count on for sure as an investor. However, I do think, at least in the U.S., we can count on this significant shift not occurring until the crisis induced by reckless fiscal and monetary policies is at our throats.

Bitcoin is an alternative form of custody for cash, not an alternative payment system for the developed world. And Ethereum has a role to play in almost all blockchain applications.

Nothing new in this piece or in the comments thus far. I do think Bitcoin’s historically extreme volatility is now largely behind us as institutional players have stepped into the arena. Unless central banks start to recognize Bitcoin has the potential to become a decentralized central bank for the entire world and thus make every effort to kill it, it’s not going away.

Crypto serves another function: it is a well-documented mechanism for citizens of certain closed economies to exfil funds, when their nation’s banks won’t allow it.

I am surprised that the author did not discuss the folly of fiat currency, given the largesse that has taken hold in central banks…again…

Yet, corporate stock, touted as a solid, responsible investment is…what? Stock is supposed to be valued as the NPV of future dividends. Otherwise, congratulations, all you bought was an expensive piece of paper. Corporate leaders are told to buy back shares, rather than pay dividends, as the share price rises out-of proportion to the retired shares. That sounds a lot like the same model as crypto.

I’ve been saying ever since the financial crisis that anyone buying government bonds cannot be doing it in the expectation of making a real return. I read a worrying article a few years ago (can’t recall where otherwise I’d post the link) which claimed that government regulators were quietly using their discretionary power to force pension funds to remain regular purchasers of government debt – this had become necessary because pension fund managers were warning that falling yields would force them into a bond strike.

I have no evidence for this except for what we all know: that bond yields in recent years have been below the rate of inflation and therefore possessed a negative real rate of return that was known at the time of sale. So why have pension fund managers still been buying them?

Hmmm. I’m not particularly interested in cryptocurrencies- they seem like a completely obvious territory of shysters, hucksters and fraudsters to me. I’m not certain that their proponents REALLY think about them in terms of Government Bonds either – more like FOMO, I think.

The interesting thing about this article though, is whether it’s a reasonable assumption to conclude that Governments will debase currency to maintain standards of living. Surely, if that were true, they’d have let inflation rip? That’s the way to it, is it not? Either way, serious welfare cuts are coming across the developed world, whatever they decide to do and whatever they say.

This is the big story of our time.

People should save for retirement by buying real assets. I do not include collectibles. A rare stamp is just a ole piece of paper and its intrinsic value is wastepaper. The same applies to a lesser extent to articles of art. These go in and out of fashion and cannot be eaten in an emergency. Gold is already bid up in price and is not as fungible as desirable. Freeze dried food with a 10-year shelf life is a good choice. You will not starve while a hyperinflation cycle destroys the economy, but will you lose your house and with it your place to store the food. Consider a large tank of propane to heat your home. Will it last out the hyper inflation adjustment. Consider ingots of rare elements. Niobium or something with a higher rarity than gold but not bid up in price. The problem is that they may not be easily sold in an emergency. Some countries in Africa that have deposits of rare metals should coin them. Many would prefer to save them to gold.