Over the last year, Republican criticisms of the ESG (environmental, social and corporate governance) movement have grown fiercer. Deriding it as “woke“, a “scam“ and even “a worldwide human satanic organised effort”, GOP figures have attacked ESG over what they perceive is a front for an increasingly political — namely Left-wing — agenda.

Now Republicans are waging their anti-ESG offensive at a legislative level — and with some success. As of January 2023, nearly half of all US states either have some kind of anti-ESG restriction or have blacklisted ESG actions, according to an Energy Monitor analysis. In fact, anti-ESG “developments” have rapidly outpaced pro-ESG measures over the past three years, illustrating how this once relatively anonymous campaign is going mainstream.

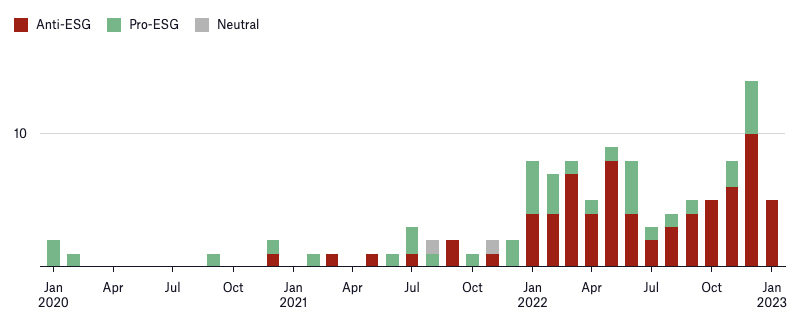

Although “developments” are rather broad in definition, ranging from strongly worded letters by state legislators to the banning of ESG in legislation, the chart below shows that an anti-ESG backlash appears to be underway. Indeed, anti-ESG developments were virtually non-existent between January 2020 to January 2021, but soon start to rise significantly after January 2022. This was most evident in Republican states.

Of the 73 anti-ESG developments since 2020, over half (55%) were directed at the broader ESG spectrum, while a further 29% targeted the energy and climate sector. The remaining 12 developments were aimed at social corporate practices (primarily firearms-related). The success of these measures has, however, been variable: according to Energy Monitor’s analysis, more than 50% of pro- and anti-ESG measures failed or died in committee, while roughly one in three have already passed and one in ten are pending.

These developments barely constitute a dent in the ESG industry, which is worth $4.5 trillion in the US alone and is expected to double in size by 2026. Nonetheless, the movement is gathering momentum at not just a state level, but at a federal one too. This week, Republicans (and a selection of Democrats) voted to end a controversial rule by the Biden administration that allows retirement funds to consider climate change and other factors when choosing companies to invest in. The White House responded by promising to veto the resolution.

Still, this has not deterred GOP presidential contenders (past and present) from jostling to spearhead the anti-ESG campaign. Reacting to the vote, former vice-president Mike Pence tweeted his “disappointment” that “President Biden is putting ESG and woke policies above hard-working Americans’ retirement accounts!” And last month, Florida governor Ron DeSantis announced legislation “to protect Floridians from the Woke ESG Financial Scam”. There is even an anti-ESG fund manager planning to run in the 2024 Republican primaries.

Main Edition

Main Edition US

US FR

FR

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeInvestment companies have a fiduciary responsibility to investors. That means they need to focus ONLY on making money. Ridiculous predictions of doom in hundreds of years do NOT factor into the equation. Civil suits from investors should punish companies that ESG.

The people advocating for today’s ESG would suddenly cringe with horror if the acronym became GCV, Guns and Christian Values.

Totally agree. ESG is another level of bureaucracy and cost that offers nothing but lower returns to investors and skews markets. Who are the self-appointed guardians of ESG and how do they get paid?? If I was still in finance now would be a good time to open a fund that offered “ESG FREE!”.

Such funds do exist.

Such funds do exist.

The people advocating for today’s ESG would suddenly cringe with horror if the acronym became GCV, Guns and Christian Values.

Totally agree. ESG is another level of bureaucracy and cost that offers nothing but lower returns to investors and skews markets. Who are the self-appointed guardians of ESG and how do they get paid?? If I was still in finance now would be a good time to open a fund that offered “ESG FREE!”.

Investment companies have a fiduciary responsibility to investors. That means they need to focus ONLY on making money. Ridiculous predictions of doom in hundreds of years do NOT factor into the equation. Civil suits from investors should punish companies that ESG.

Anything that halts the fascist eco sandaloids and their naive internet zombie legions of myopic followers, is superb news!

Anything that halts the fascist eco sandaloids and their naive internet zombie legions of myopic followers, is superb news!

“These developments barely constitute a dent in the ESG industry, which is worth $4.5 trillion in the US alone and is expected to double in size by 2026.”

These ESG numbers that continually get thrown around simply never add up. For example, a trends report from the US SIF Foundation states, “Total US-domiciled assets under management (AUM) using SRI [socially responsible investing] strategies grew from $8.7 trillion at the start of 2016 to $12.0 trillion at the start of 2018.”

In January 2020, my colleagues and I used Bloomberg’s fund screening function to screen for general attributes associated with any and all types of U.S. domiciled ESG funds. We derived a total of about $230 billion. Since Bloomberg doesn’t track every public fund, we estimated another $50 to $70 billion could be added to this total. Using $300 billion seemed to be a credible estimate, representing a little over 1% of total U.S. market assets based on the Wilshire 5000 full market cap of $33.8 trillion as of 12/31/19.

Just a cursory glance at the total assets in some of the largest ESG funds should be enough to make anyone question how these ESG trillions are being calculated.

“These developments barely constitute a dent in the ESG industry, which is worth $4.5 trillion in the US alone and is expected to double in size by 2026.”

These ESG numbers that continually get thrown around simply never add up. For example, a trends report from the US SIF Foundation states, “Total US-domiciled assets under management (AUM) using SRI [socially responsible investing] strategies grew from $8.7 trillion at the start of 2016 to $12.0 trillion at the start of 2018.”

In January 2020, my colleagues and I used Bloomberg’s fund screening function to screen for general attributes associated with any and all types of U.S. domiciled ESG funds. We derived a total of about $230 billion. Since Bloomberg doesn’t track every public fund, we estimated another $50 to $70 billion could be added to this total. Using $300 billion seemed to be a credible estimate, representing a little over 1% of total U.S. market assets based on the Wilshire 5000 full market cap of $33.8 trillion as of 12/31/19.

Just a cursory glance at the total assets in some of the largest ESG funds should be enough to make anyone question how these ESG trillions are being calculated.

Excellent post. Thanks for sharing

Excellent post. Thanks for sharing

ESG is a scam. Passively managed funds make less money than actively managed funds. ESG funds are actively managed. They are a wizard marketing ploy to halt the growth of passive funds. Follow the money. Simples.

“Passively managed funds make less money than actively managed funds.”

I’m guessing you meant to write that passive funds make more money, on average, than actively managed funds?

I was thinking that too, I believe he’s got it the wrong way round

I was thinking that too, I believe he’s got it the wrong way round

“Passively managed funds make less money than actively managed funds.”

I’m guessing you meant to write that passive funds make more money, on average, than actively managed funds?

ESG is a scam. Passively managed funds make less money than actively managed funds. ESG funds are actively managed. They are a wizard marketing ploy to halt the growth of passive funds. Follow the money. Simples.

What a peculiar article and chart. This reads more like conspiratorial dogma than a genuine observation of trends.

You mean you like ESG and resent politicians legislating against it?

The article seems to be creating a narrative almost out of thin air, painting whole states as anti-ESG on minimal observations. Astroturfing comes to mind.

It’s more about states that disallow investment of various state controlled funds. Not an insignificant amount.

It’s more about states that disallow investment of various state controlled funds. Not an insignificant amount.

The article seems to be creating a narrative almost out of thin air, painting whole states as anti-ESG on minimal observations. Astroturfing comes to mind.

You mean you like ESG and resent politicians legislating against it?

What a peculiar article and chart. This reads more like conspiratorial dogma than a genuine observation of trends.

One would have thought that retirement funds have some sort of duty to consider the future of the planet as affected by climate change when considering investments. After all, they are in it for a much longer term than most investors, and it is the medium and long term which climate change affects. It is not possible to deny that climate change is occurring, and the overwhelming (by a massive amount) of those who study such matters consider human activity to be the prime cause; investment funds work on probability so that must be a major factor in their considerations.

I deny it… there you are.. done!

Rubbish.

can I came to your next flat earth society meeting ?

“the overwhelming (by a massive amount) of those who study such matters consider human activity to be the prime cause”

Not so massive actually:

https://dailysceptic.org/2022/11/11/41-of-climate-scientists-dont-believe-in-catastrophic-climate-change-major-new-poll-finds/?highlight=climate%20change

There is a difference between accepting that the climate is changing. And accepting the ‘catastrophic’ climate change. The big, globally funded lunatic green lobbies that give the movement a bad name are the catastrophy, militant sort. Giving the previously chill and pretty reasonable green movement with a hippy vibe – a bad name. Let’s remember there are varying takes on this subject. That not everyone is a militant green nutter that thinks the world is ending for raising environmental concerns.

Yes the climate is changing. But here’s the real shocker: the climate has never not been changing. The solar cycle is much stronger than any effect carbon is likely to have. And a single massive volcano could erupt tomorrow that would make send us into decades of winter. We should spend our money building our resilience to climate changes, not magically thinking we can ever render the climate to be stable.

I think that’s a really fair point on the fact the climate has always been changing, that big natural events can cause massive, fast alterations, that is part of what makes this such a difficult subject to make head and tail of. It is a contested subject and it should be really, its a massive thing to try and comprehend and model. I think that’s fair to say ‘stable’ is not what the target should be. We have had periods throughout history of warmer temperatures.

This can’t be about sacrificing freedoms for some weird rushed in ‘green’ dystopia, that would be the wrong thing to do. I think the bigger movement has got lost on that, especially driven by the bigger business and organisations involved that are actually pretty far removed from the original green movements. I think the climate debate distracts in some ways from other environmental issues we could give more coverage to and actually solve, and in solving them it would help to restore balance perhaps anyway without getting hung up specifically on temperature changes all the time.

Resilience to whatever changes, yes.

We need volcano control, now!

I think that’s a really fair point on the fact the climate has always been changing, that big natural events can cause massive, fast alterations, that is part of what makes this such a difficult subject to make head and tail of. It is a contested subject and it should be really, its a massive thing to try and comprehend and model. I think that’s fair to say ‘stable’ is not what the target should be. We have had periods throughout history of warmer temperatures.

This can’t be about sacrificing freedoms for some weird rushed in ‘green’ dystopia, that would be the wrong thing to do. I think the bigger movement has got lost on that, especially driven by the bigger business and organisations involved that are actually pretty far removed from the original green movements. I think the climate debate distracts in some ways from other environmental issues we could give more coverage to and actually solve, and in solving them it would help to restore balance perhaps anyway without getting hung up specifically on temperature changes all the time.

Resilience to whatever changes, yes.

We need volcano control, now!

Yes the climate is changing. But here’s the real shocker: the climate has never not been changing. The solar cycle is much stronger than any effect carbon is likely to have. And a single massive volcano could erupt tomorrow that would make send us into decades of winter. We should spend our money building our resilience to climate changes, not magically thinking we can ever render the climate to be stable.

lol, dailysceptic – not exactly a site with integrity.

And the BBC is?

Well yeah, when compared to some bloke’s blog that used to be called lockdownsceptics. Why would you form an opinion on information from here unless it meets your needs for confirmation bias?

Well yeah, when compared to some bloke’s blog that used to be called lockdownsceptics. Why would you form an opinion on information from here unless it meets your needs for confirmation bias?

And the BBC is?

There is a difference between accepting that the climate is changing. And accepting the ‘catastrophic’ climate change. The big, globally funded lunatic green lobbies that give the movement a bad name are the catastrophy, militant sort. Giving the previously chill and pretty reasonable green movement with a hippy vibe – a bad name. Let’s remember there are varying takes on this subject. That not everyone is a militant green nutter that thinks the world is ending for raising environmental concerns.

lol, dailysceptic – not exactly a site with integrity.

Mega corps are not what we need fronting any green movement I don’t think. They should stick to business and stay out of government. Esgs are not a good way to go about fixing stuff I don’t think.

Fund managers receive market data every single day.

They are bonused annually on total fund performance.

With this kind of short term horizon, it would be difficult for anyone to maintain a long-term focus.

I think it was Mark Twain who has a famous quote about how it is unlikely for any man to be motivated inconsistent with how he is paid.

Actually fund managers mainly take flat fees based on the amount of money in the fund. They make money whether the fund does well or underperforms. But here’s the obscenity that explains all of ESG – fund managers charge nearly double for ESG funds. And of course the ESG funds also underperform, but the you’re not supposed to care. The whole thing is nothing but a charade for separating investors from their money. And almost always the main investors are those who in turn manage other peoples money – pension funds etc. Anyone managing their own money will be singularly focused on return.

I think it was……… Upton Sinclair?

Actually fund managers mainly take flat fees based on the amount of money in the fund. They make money whether the fund does well or underperforms. But here’s the obscenity that explains all of ESG – fund managers charge nearly double for ESG funds. And of course the ESG funds also underperform, but the you’re not supposed to care. The whole thing is nothing but a charade for separating investors from their money. And almost always the main investors are those who in turn manage other peoples money – pension funds etc. Anyone managing their own money will be singularly focused on return.

I think it was……… Upton Sinclair?

The climate has always changed, for thousands of years, long before there were many persons on the planet. Colder, warmer, wetter, drier, in different areas at different rates. What is malicious about ESG is the sense that the only thing that can be done is to punish the poor by removing their comforts. We’ll adapt, as we have always adapted. And in 50 years, when it is swinging the other way, we’ll adapt back.

The current fad is just another excuse for the over-powerful to get more controls over the rest of us. Clear off, and take Greta with you.

Not just punish the poor, but starve them:

https://dailysceptic.org/2023/03/03/half-the-world-faces-starvation-under-net-zero-policies-say-two-top-climate-scientists/

You need some lessons from Greta.

Ha Ha Ha Ha Ha!

Ha Ha Ha Ha Ha!

Not just punish the poor, but starve them:

https://dailysceptic.org/2023/03/03/half-the-world-faces-starvation-under-net-zero-policies-say-two-top-climate-scientists/

You need some lessons from Greta.

No. Funds have one duty which is to maximise the returns for their investors. Full stop. That’s it. Should funds be considering the existence of a superior being, or whether there might be alien life, or whether a man can be a woman (or vice versa)? Stop the nonsense

I guess it depends if one believes the world can be improved by having ethical business practices.

I guess it depends if one believes the world can be improved by having ethical business practices.

So much is wrong with your statement. How on earth can any sane, educated person claim that man is the prime cause of climate change on a planet that is 4 1/2 billion years old and has gone through massive cycles of ice and heat during that time without human activity? It is utter lunacy in plain sight.

Besides, if you advocate for this ESG movement, what happens when corporations suddenly change course and begin to advocate for gun rights, Christian values and putting an end to abortion? Heaven forbid?

Some homework for you: Pick up any encyclopedia of your choice and read what it says under ‘Climate Change’.

I’ve never seen anyone reference an encyclopedia as the definitive word on a complex controversy. I don’t know if that is quaint, a joke, or just strange.

I’ve never seen anyone reference an encyclopedia as the definitive word on a complex controversy. I don’t know if that is quaint, a joke, or just strange.

Some homework for you: Pick up any encyclopedia of your choice and read what it says under ‘Climate Change’.

If this is so self evidently the only sound long term investment play for said long term strategy funds, then why do they need to be coerced by government (and eg Blackrock) to make said investments?

Totally agree, they have huge sums and really ought to have policies to invest ethically

Who decides on the ethical stance. YOU????? anyone who tries to force me by any means to invest my loose change in a particular manner will be told where to go and may even be pushed in that direction.

Sorry, your post wasn’t up and I think my post was only a few seconds behind yours – I’ve basically repeated you… Not intentional.

The original comment referred to pension fund investment. Seems to me like a valid moral stance for those funds to make ethical choices.

I wouldn’t worry too much about the planet if I were you, It’ll probably still be here long after we humans cease to exist.

I wouldn’t worry too much about the planet if I were you, It’ll probably still be here long after we humans cease to exist.

Sorry, your post wasn’t up and I think my post was only a few seconds behind yours – I’ve basically repeated you… Not intentional.

The original comment referred to pension fund investment. Seems to me like a valid moral stance for those funds to make ethical choices.

If a business makes a profit. That profit is that businesses earnings. What any business owner does with their profit should be a free choice.

Do you want me to start telling you to invest your spare wages in things deemed ‘ethical’?

Who gets to say what an ‘ethical’ investment is? Isn’t that the problem with esgs, actually they aren’t that helpful?

Who decides on the ethical stance. YOU????? anyone who tries to force me by any means to invest my loose change in a particular manner will be told where to go and may even be pushed in that direction.

If a business makes a profit. That profit is that businesses earnings. What any business owner does with their profit should be a free choice.

Do you want me to start telling you to invest your spare wages in things deemed ‘ethical’?

Who gets to say what an ‘ethical’ investment is? Isn’t that the problem with esgs, actually they aren’t that helpful?

You’ll be one of those people who denigrate as denialists those of us who reject climate catastrophism.

That’s the “E” part and might be valid. Most disagree about the Social part where DEI comes into play. But DEI is almost always gamed and DEI can be harmful to organizations if merit is of less import. “G” is simple nonsense about board makeup.

I deny it… there you are.. done!

Rubbish.

can I came to your next flat earth society meeting ?

“the overwhelming (by a massive amount) of those who study such matters consider human activity to be the prime cause”

Not so massive actually:

https://dailysceptic.org/2022/11/11/41-of-climate-scientists-dont-believe-in-catastrophic-climate-change-major-new-poll-finds/?highlight=climate%20change

Mega corps are not what we need fronting any green movement I don’t think. They should stick to business and stay out of government. Esgs are not a good way to go about fixing stuff I don’t think.

Fund managers receive market data every single day.

They are bonused annually on total fund performance.

With this kind of short term horizon, it would be difficult for anyone to maintain a long-term focus.

I think it was Mark Twain who has a famous quote about how it is unlikely for any man to be motivated inconsistent with how he is paid.

The climate has always changed, for thousands of years, long before there were many persons on the planet. Colder, warmer, wetter, drier, in different areas at different rates. What is malicious about ESG is the sense that the only thing that can be done is to punish the poor by removing their comforts. We’ll adapt, as we have always adapted. And in 50 years, when it is swinging the other way, we’ll adapt back.

The current fad is just another excuse for the over-powerful to get more controls over the rest of us. Clear off, and take Greta with you.

No. Funds have one duty which is to maximise the returns for their investors. Full stop. That’s it. Should funds be considering the existence of a superior being, or whether there might be alien life, or whether a man can be a woman (or vice versa)? Stop the nonsense

So much is wrong with your statement. How on earth can any sane, educated person claim that man is the prime cause of climate change on a planet that is 4 1/2 billion years old and has gone through massive cycles of ice and heat during that time without human activity? It is utter lunacy in plain sight.

Besides, if you advocate for this ESG movement, what happens when corporations suddenly change course and begin to advocate for gun rights, Christian values and putting an end to abortion? Heaven forbid?

If this is so self evidently the only sound long term investment play for said long term strategy funds, then why do they need to be coerced by government (and eg Blackrock) to make said investments?

Totally agree, they have huge sums and really ought to have policies to invest ethically

You’ll be one of those people who denigrate as denialists those of us who reject climate catastrophism.

That’s the “E” part and might be valid. Most disagree about the Social part where DEI comes into play. But DEI is almost always gamed and DEI can be harmful to organizations if merit is of less import. “G” is simple nonsense about board makeup.

One would have thought that retirement funds have some sort of duty to consider the future of the planet as affected by climate change when considering investments. After all, they are in it for a much longer term than most investors, and it is the medium and long term which climate change affects. It is not possible to deny that climate change is occurring, and the overwhelming (by a massive amount) of those who study such matters consider human activity to be the prime cause; investment funds work on probability so that must be a major factor in their considerations.