Once upon a time, “ethical consumerism” meant customers opting to buy from companies whose products were in line with their values, for example by being organically farmed or sourced using fair trade. Now, it increasingly means companies opting to supply only customers who are in line with their values — even when the “values” themselves have nothing directly to do with the product.

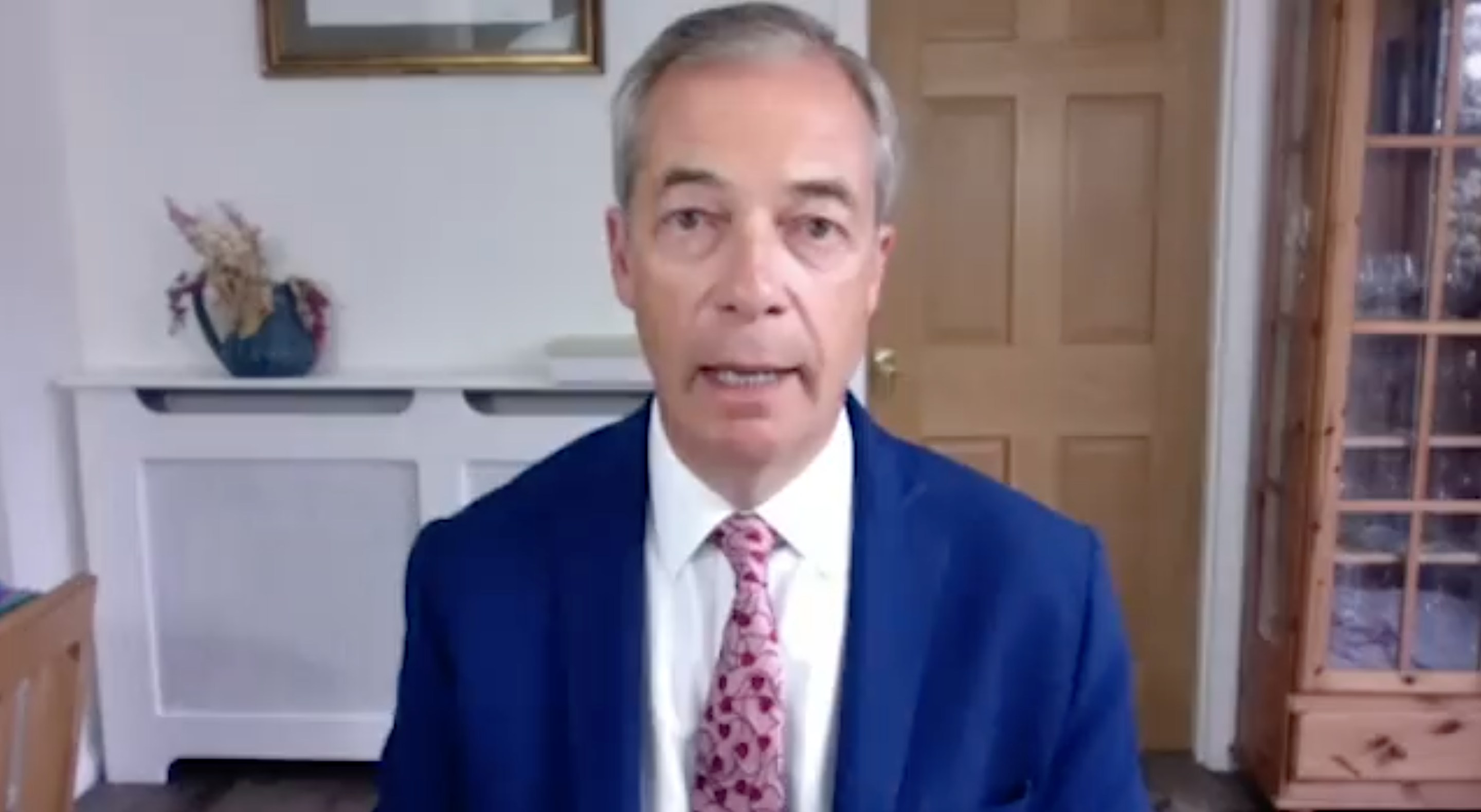

Nigel Farage recently claimed that his bank, which he hasn’t named, has informed him that his account will be closed down, offering no explanation except that this was a “commercial” decision. This isn’t the only such case. Rev Richard Fothergill recently had his account with Yorkshire Building Society closed after he queried the Pride regalia in his local branch. Just last week Stuart Campbell, the blogger who writes the Scottish nationalist and gender-critical blog “Wings Over Scotland”, reported being dumped without explanation by First Direct. Last year, Toby Young of the Free Speech Union had services withdrawn by PayPal — joined this year by the Triggernometry podcast and Laurence Fox’s Reclaim Party.

A spokesman for Yorkshire Building Society denied that anyone could ever have services withdrawn for “beliefs” — but added that the organisation might make the “difficult decision” to close an account if a customer “discriminates in any way”. Clearly, the bank doesn’t yet have a policy on views that are protected but also viewed by some as discriminatory. Maya Forstater, a founder of the Sex Matters campaign group, recently won a £106,000 payout from her former employer after she was dismissed for expressing gender-critical views.

Treasury Secretary Jeremy Hunt is said to be “deeply concerned” at the politicisation of banking services, and has promised a consultation on the subject within weeks. But it’s hard to see what this will achieve, when the criteria that are most likely prompting these policies are increasingly baked in some distance prior to intervention from national Government policy.

Environmental, social and governance (ESG) criteria play a growing role in financial services. The management consultant McKinsey reports that “consumers whose choice of banking was influenced by its purpose” control some $300 billion in assets, making “ethical consumerism” big business. So perhaps it’s unsurprising that Harvard Business Review recently argued companies can’t stay neutral on ethical matters, as they’ll find themselves roped into the culture wars whether they like it or not.

This means the criteria for what counts as “ethical” are codified and tracked via rigid metrics bedded into companies’ IT systems, which then shape how those companies report their performance, which in turn drives investor behaviour. I suspect such procedures are in most cases viewed without irony by their designers and supporters as politically neutral, and as sound business practice — despite the fact that some of these metrics, notably but not only the “LGBT lens”, fall into that grey area where (as in the Forstater case) questions of “discrimination” are in truth highly political and often collide with protected belief.

A long way downstream of this, then, what of individuals who haven’t signed up to the politicised beliefs increasingly baked into a growing proportion of the financial services industry? In effect, they find themselves in a position where banks’ procedures are calibrated such as to exclude them by default, if they trigger certain filters — supported by the institutional weight of a growing subset of international financial services reporting and compliance infrastructure.

We only need to recall that Hollywood practises censorship in China, and no company flies the Pride flag in Saudi Arabia, to see that corporations are responsive to local governance conditions. But restoring fairness in financial services will take stronger measures than one non-binding “consultation” from the UK Treasury.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe