Spain’s election, which took place on Sunday, looks unlikely to produce a government. Once again, the country’s democracy has returned a result that promises dysfunction. Yet for those who followed the polls in the run-up to the election, the result was not enormously surprising. The incumbent Socialist Workers’ Party (PSOE) did slightly better than some polling predicted, but we are only talking about a margin of +2%.

The real story of the election could be read in the polls before the Spanish public voted: the incumbent party has maintained a respectable level of support throughout the past four years. True, the conservative bloc increased its vote share in this election, but the fact that the PSOE managed to avoid a rout is nonetheless surprising.

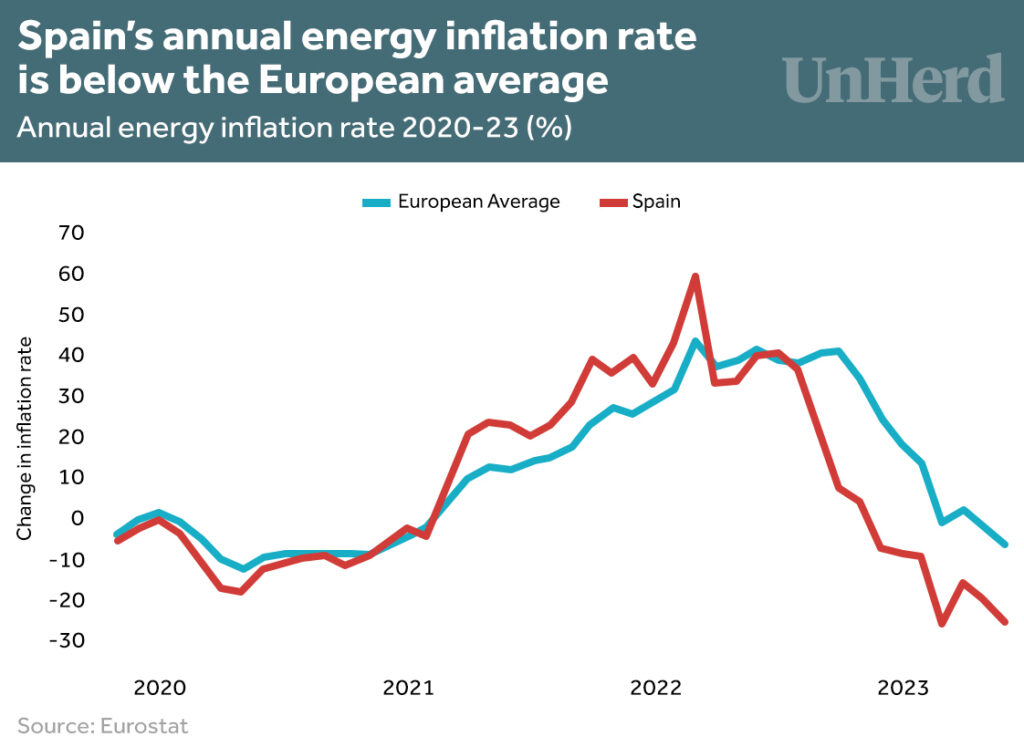

The lockdowns and, especially, the energy price shock have demolished governing parties across Europe. From the Conservative Party in Britain to Emmanuel Macron in France to the Social Democrats in Germany, the Ukraine-induced cost-of-living crisis has spared no one. What, then, makes the Spanish case unique?

The first fact that stands out is that inflation in Spain has come down far quicker than in other European countries. In June, its annualised inflation rate stood at 1.6%, far below the European average of 5.5%. The reason for this appears to be a much sharper decline in energy prices in Spain than elsewhere on the continent.

The most likely explanation for this is its idiosyncratic energy import mix. Due to its location, Spain imports an unusually large amount of natural gas from North Africa, mainly from Algeria, which provides it with greater cover than EU countries which were more dependent on Russian gas.

Spain’s rapidly declining inflation rate is also allowing the country to grow much faster than its European counterparts. In the first quarter of 2023, Spain had the highest real GDP annual growth rate on the continent (4.2%) whereas the EU as a whole saw growth of only 1.1%. Spain, therefore, is something of an outlier — its economy is doing comparatively well, and for that reason the incumbent party wasn’t punished at the polling booth.

Main Edition

Main Edition US

US FR

FR

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeVery good chart on the Economist link on this page. Use it to look at the Real Prices increase in the cost of housing compared to Q1 1975. The top of the list are all the Anglo nations:

1.Ireland 285% higher

2.Britain 244% higher

3.Australia 232% higher

4.Canada 220% higher

5.New Zealand 210% higher

By comparison the other G7 nations

France 153% higher

USA 66% higher

Germany 30% higher

Italy 8% lower

Japan 27% lower

“Proof that the youngsters just need to knuckle down and stop eating avocado on toast, it was just as hard to buy a house in our day etc etc etc”

This is what happens when housing stops being seen as shelter for a family and instead used as a commodity to be exploited. If the government’s of those countries wanted to improve their stagnating productivity the best thing they could do would be to start building council houses en masse in order to reduce people’s living costs. Every penny/cent that is sucked up in housing costs is less money people are able to spend in the wider economy that creates profits, jobs and growth.

True Billy Bob but with the caveat that you don’t just want to suck millions of new people into the country to live in the new council houses. That would have no effect on house prices as undersupply would continue. You need to limit immigration numbers as well as building new council housing stock.

In my dream scheme, new housing stock would be rented well below market rate exclusively to married couples*. Once that couple had their first baby**, they would be eligible to buy the house at well below market rate (which would provide the capital to build a replacement council house on the scheme).

This would both bring down the price of housing and encourage early family formation which over time should push up birth rates. These families would have married parents who own their own house, which gives them the best chance of avoiding family break-up.

*married couples where the youngest of the couple is younger than 35 and where they can afford the rent. Includes same sex marriages.

**including adoption

True Billy Bob but with the caveat that you don’t just want to suck millions of new people into the country to live in the new council houses. That would have no effect on house prices as undersupply would continue. You need to limit immigration numbers as well as building new council housing stock.

In my dream scheme, new housing stock would be rented well below market rate exclusively to married couples*. Once that couple had their first baby**, they would be eligible to buy the house at well below market rate (which would provide the capital to build a replacement council house on the scheme).

This would both bring down the price of housing and encourage early family formation which over time should push up birth rates. These families would have married parents who own their own house, which gives them the best chance of avoiding family break-up.

*married couples where the youngest of the couple is younger than 35 and where they can afford the rent. Includes same sex marriages.

**including adoption

“Proof that the youngsters just need to knuckle down and stop eating avocado on toast, it was just as hard to buy a house in our day etc etc etc”

This is what happens when housing stops being seen as shelter for a family and instead used as a commodity to be exploited. If the government’s of those countries wanted to improve their stagnating productivity the best thing they could do would be to start building council houses en masse in order to reduce people’s living costs. Every penny/cent that is sucked up in housing costs is less money people are able to spend in the wider economy that creates profits, jobs and growth.

Very good chart on the Economist link on this page. Use it to look at the Real Prices increase in the cost of housing compared to Q1 1975. The top of the list are all the Anglo nations:

1.Ireland 285% higher

2.Britain 244% higher

3.Australia 232% higher

4.Canada 220% higher

5.New Zealand 210% higher

By comparison the other G7 nations

France 153% higher

USA 66% higher

Germany 30% higher

Italy 8% lower

Japan 27% lower

Do you really believe the Spanish government numbers?

Do you think they are dodgy?

Do you think they are dodgy?

Do you really believe the Spanish government numbers?