Spain’s election, which took place on Sunday, looks unlikely to produce a government. Once again, the country’s democracy has returned a result that promises dysfunction. Yet for those who followed the polls in the run-up to the election, the result was not enormously surprising. The incumbent Socialist Workers’ Party (PSOE) did slightly better than some polling predicted, but we are only talking about a margin of +2%.

The real story of the election could be read in the polls before the Spanish public voted: the incumbent party has maintained a respectable level of support throughout the past four years. True, the conservative bloc increased its vote share in this election, but the fact that the PSOE managed to avoid a rout is nonetheless surprising.

The lockdowns and, especially, the energy price shock have demolished governing parties across Europe. From the Conservative Party in Britain to Emmanuel Macron in France to the Social Democrats in Germany, the Ukraine-induced cost-of-living crisis has spared no one. What, then, makes the Spanish case unique?

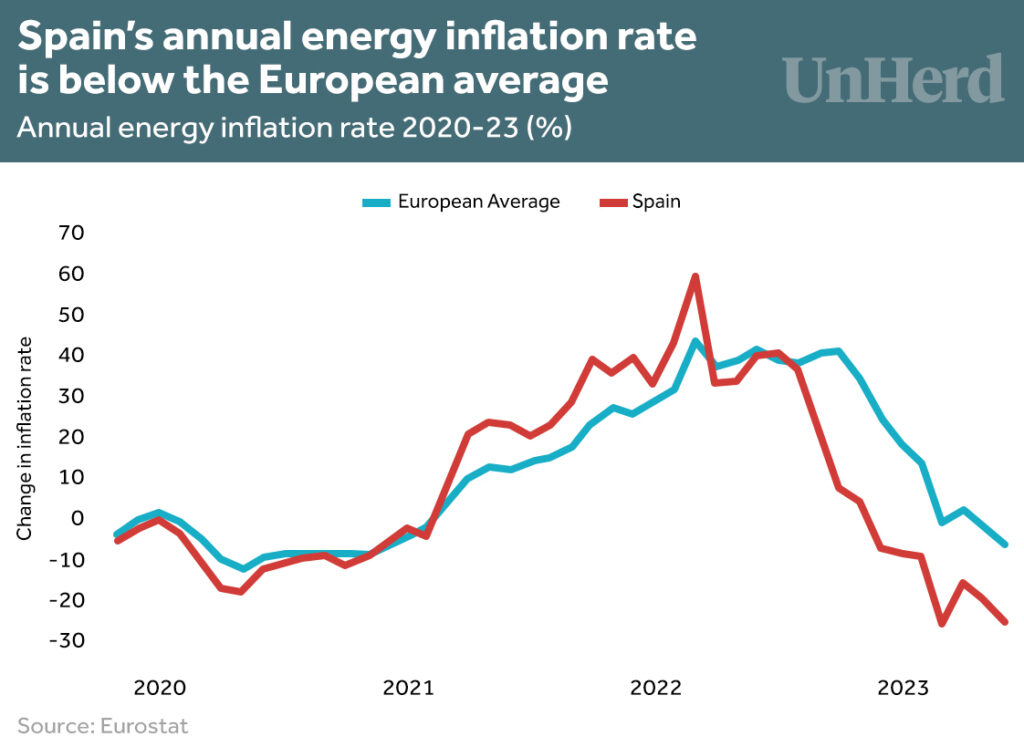

The first fact that stands out is that inflation in Spain has come down far quicker than in other European countries. In June, its annualised inflation rate stood at 1.6%, far below the European average of 5.5%. The reason for this appears to be a much sharper decline in energy prices in Spain than elsewhere on the continent.

The most likely explanation for this is its idiosyncratic energy import mix. Due to its location, Spain imports an unusually large amount of natural gas from North Africa, mainly from Algeria, which provides it with greater cover than EU countries which were more dependent on Russian gas.

Spain’s rapidly declining inflation rate is also allowing the country to grow much faster than its European counterparts. In the first quarter of 2023, Spain had the highest real GDP annual growth rate on the continent (4.2%) whereas the EU as a whole saw growth of only 1.1%. Spain, therefore, is something of an outlier — its economy is doing comparatively well, and for that reason the incumbent party wasn’t punished at the polling booth.

All this could change, however, because although Spain has a relatively low rate of inflation, it is the European Central Bank that sets interest rates. The most obvious sector under threat from Europe-wide interest rates is Spain’s housing market: while the country has not seen its house price-to-income ratio climb back up to 2007 levels (just before the property market collapsed), housing valuations remain stretched. The difference this time around is that these house prices are not being driven by mortgage borrowing. Rather, valuations are being boosted by foreign investment groups like Blackstone which are now Spain’s largest landlords.

There is already plenty of market chatter about Spain’s housing market cooling this year. The question then becomes: how resilient are these investment groups that are buying up so much Spanish property? The country’s employment numbers aren’t nearly as reliant on construction jobs as they were in 2008, but employment in the sector has grown 31% since its trough in 2013. Trouble in the housing market could spell trouble for the Spanish economy, and that could in turn spell trouble for Sánchez and his party.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe