Frank Rumpenhorst/DPA/PA Images

The people’s verdict on capitalism is damning. 65% of Brits and 58% of Americans believe in capitalist economies the poor get poorer and the rich get richer. The gaping chasm between executive and worker pay appears to prove the point. And there’s little evidence to show sky-high pay is linked to stellar performance.

A decade on from the financial crash, the visible failure of too many businesses executives to show humility, and business owners to rein in obscene pay packets has left ordinary people questioning what capitalism has to offer them.

Executive pay is out-of-control

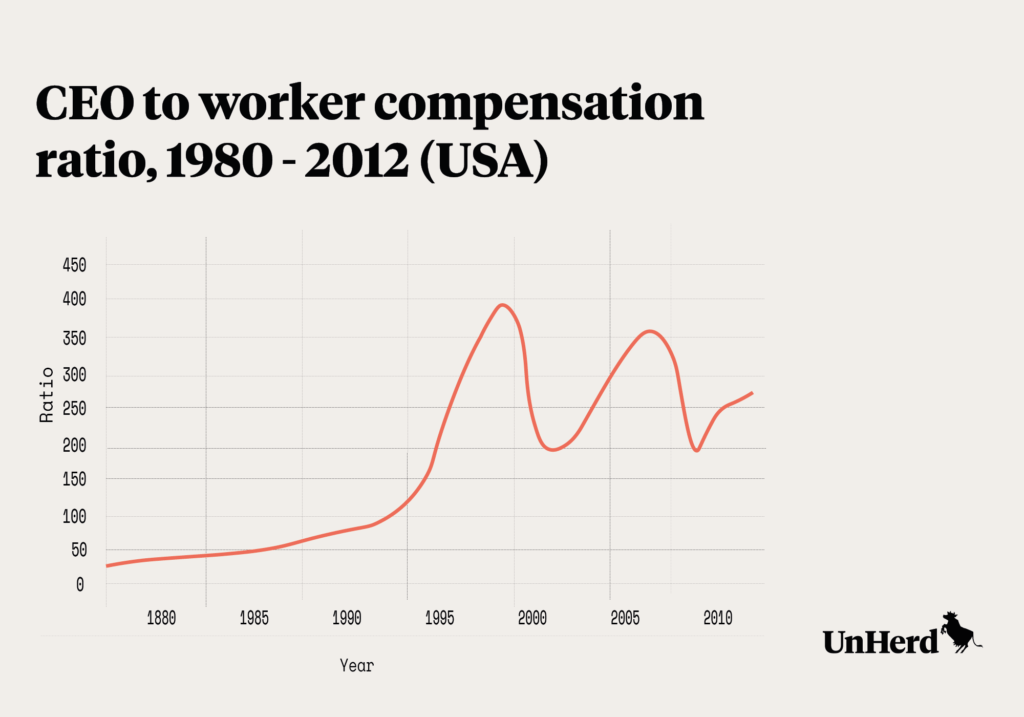

In 1965, CEOs of major US companies earned twenty times that of a typical worker. Just twenty years later they earned 59 times more.

In 2007, immediately before the financial crash, the ratio was a staggering 345 to one.

While the crash led to some adjustment, CEO pay remains 276 times higher than that of workers[1. Lawrence Mishel and Jessica Schieder, CEOs make 276 times more than typical workers, Economic Policy Institute, 3 August 2016].

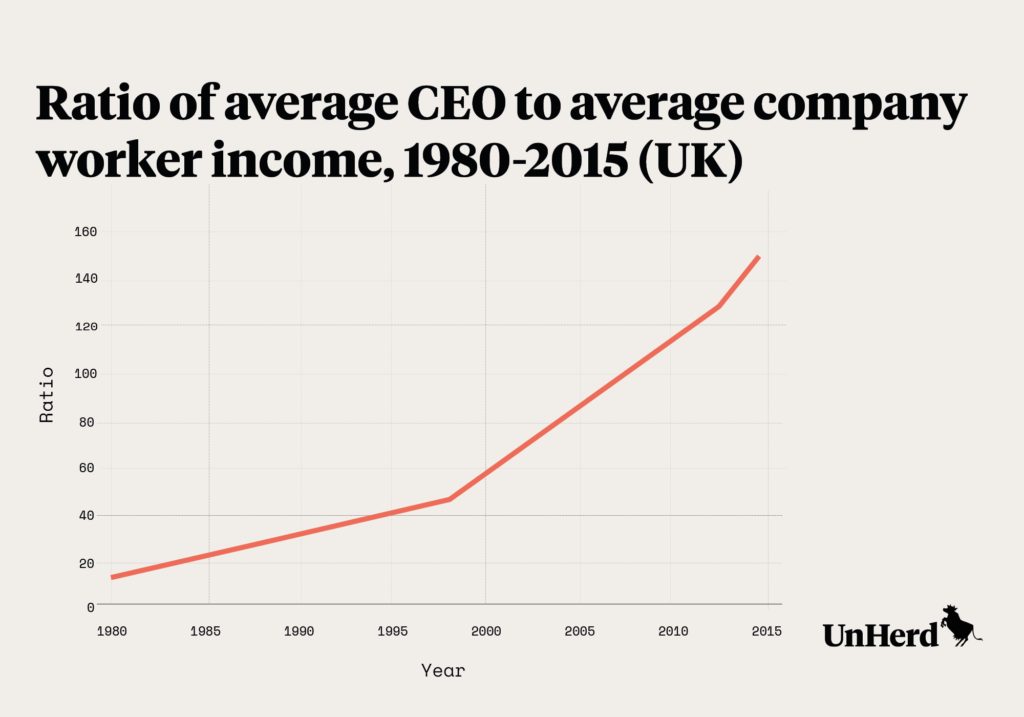

The UK has followed a similar, though somewhat less extreme, trend. In 1980, CEOs were paid between 13 and 44 times their average employee, by 2013 FTSE 100 bosses earned around 130 times the average worker[2. FTSE 100 bosses now paid an average 130 times as much as their employees, High Pay Centre, 18 August 2014].

It is not hard to see how a proposal by Britain’s hard-left Labour leader, Jeremy Corbyn, for top pay to be capped at twenty times the wage of a company’s lowest paid worker could find support among 57% of the British public[3. George Bowden, ‘Jeremy Corbyn Wage Cap Policy ‘Backed By Majority Of Brits’, New Poll Finds’, Huffington Post United Kingdom, 14 January 2017]. While the average CEO pay package was almost £5.5 million in 2015, just a quarter of the FTSE 100 companies were accredited as Living Wage employers – committed to paying a minimum £8.45 an hour in the UK[4. 10% pay rise? That’ll do nicely, High Pay Centre, 7 August 2016]. In America, 50% of the public favour limiting the pay of big business executives[5. ‘Americans’ Views on Income Inequality and Workers’ Rights’, The New York Times, 3 June 2015].

Growing disparity can be observed across developed nations, but America’s pay gap, and to a lesser extent Britain’s, are particularly acute. Contrary to popular argument, it is not because the market for CEOs is so fierce – analysis by the High Pay Centre of appointments in the Fortune 500 found over 80% were internal promotions. And University of Delaware Research found internal promotions were higher performers[6. Luke Hildyard, “Huge executive salaries are vital to UK competitiveness”, New Economics Foundation, July 2013].

In fact, other countries have managed without resorting to such excess. An internationally comparative measure is compiled by Bloomberg, with America and the UK topping the list for developed nations[7. This compares the ratio of CEO compensation to per capita GDP adjusted for purchasing power; Wei Lu and Anders Melin, ‘The Best and Worst Countries to Be a Rich CEO’, Bloomberg, 16 November 2016]. By this measure bosses in America make 300 times that of the average person, while British bosses earn 230 times as much. The ratio for Australia is 113 to one, in France it is 70:1 and in Denmark 83:1, clearly showing that sky-high pay is not a prerequisite of capitalism, but rather a feature of particular market models. Models that have lost the faith of the public.

The rise of share options as part of executive compensation is one reason for this disparity. Already large CEO pay packets in American and UK firms have risen in line with stocks, widening the differential between the pay of executives and their subordinates[8. Frederick Guy, Earnings Distribution, Corporate Governance and CEO Pay, ESRC Centre for Business Research, University of Cambridge, June 1999]. American CEOs are particularly likely to have these incentives compared to their European counterparts. Weak corporate governance is another factor, with European firms more likely to experience closer scrutiny from creditors and independent boards. In contrast, American firms are more likely to combine the CEO and Chairman role, plainly undermining the independent scrutiny function of the board[9. Martin Conyon, John Core and Wayne Guay, ‘Are U.S. CEOs Paid More Than U.K. CEOs? Inferences from Risk-adjusted Pay’, Review of Financial Studies, April 2009]. Harvard Law School found that as well as being an “inherent conflict of interest”, having a combined CEO/Chairman costs more, presents greater risk and delivers lower stock returns over the long term[10. Paul Hodgson, ‘The Costs of a Combined Chair/CEO’, Harvard Law School Forum on Corporate Governance and Financial Regulation, 13 July 2012].

If the reputational and ethical reasons for pay restraint are insufficiently compelling, investors should consider the findings of Morgan Stanley Capital International’s analysis of company pay[11. Data from 2009 to 2014, using the All Country World Index; Samuel, Block, Income inequality and the intracorporate pay gap, Morgan Stanley Capital Investments, April 2016]. On average, companies with lower pay gaps (smaller than the sector average) performed better than those with high gaps (higher than average). The report’s findings are tentative, but MSCI suggest some possible reasons for this: employee cost-saving initiatives exacerbate the pay gap without necessarily improving profitability, and executive remuneration is often tied to short-term performance and lacking independent checks and balances.

Executives are abusing their power in setting their own pay

It is executive (abuse of) power rather than performance that has driven pay, and absentee shareholders and poor corporate governance has let this happen. The MSCI study found 54% of companies lacked fully independent compensation committee oversight. Research by Harvard Law School clearly shows the cost of poor governance: a separate CEO and chairman model costs 75% of what a combined CEO/chairman costs. Even more tellingly, a separate CEO and with independent chairman, someone who has no current or former business relationship with the company, is even cheaper, with the CEO and independent chairman both making less[12. Paul Hodgson, ‘The Costs of a Combined Chair/CEO’, Harvard Law School Forum on Corporate Governance and Financial Regulation, 13 July 2012].

Shorty after the crash, Lord Myners, then a Minister in the UK Treasury and himself a former banker, criticised shareholders for behaving like “absentee landlords”, abdicating their responsibilities to challenge pay and behaviour. The madness of a business owner allowing their staff to set their own pay is obvious to most, yet despite the so-called “shareholder spring” this year, few FTSE 100 businesses have lost votes on pay.

Shareholders should think again. Analysis by Marianne Bertrand and Sendhill Mullainathan found that in companies with poor governance, CEOs typically pay themselves more for improvements in profit which arise from luck. They are also more likely to award themselves stock options at lower cost. Adding a large shareholder to the board led to a sizeable reduction in pay for luck, for example, by 23-33%[13. Marianne Bertrand and Sendhill Mullainathan, ‘Do CEOs Set Their Own Pay? The Ones Without Principles Do’, National Bureau of Economic Research, March 2000].

The relationship between pay and performance is broken

Ironically, in a model where compensation is increasingly linked to stock value, the rewards senior bankers receive bare little relation to sustained performance. Instead, incentivising short-term profit maximisation leads to reckless behaviour of the sort that brought about the financial crisis.

Recruiting and keeping talent is core to any business, and generous pay packages are one way of competing for the best. ‘Star’ traders in particular are coveted by financial institutions who believe their individual brilliance will deliver millions in profits. Todd Edgar, for example, was reportedly enticed to move to Barclays from JP Morgan with a two-year £30 million cash and shares package for him and his team.

But star performance is often about more than the individual. One study looked at the performance of ‘star’ investment analysts when they transferred from one bank to another[14. Boris Groysberg, Ashish Nanda and Nitin Nohria, ‘The Risky Business of Hiring Stars’, Harvard Business Review, May 2004]. Rather than justifying their sky-high pay packages through improved company performance, 46% of those so-called stars performed worse in the first year, generally by around 20%. And far from being a transitional blip, performance was still lower after five years. On top of that, the study found hiring stars had a negative effect on a company’s stock price. The authors are clear: “companies cannot gain a competitive advantage by hiring stars from outside the business”. Yet firms are competing for these ‘masters of the universe’, driving pay packages that are more and more extravagant.

There is no reason to think this hubris is confined to the financial sector, though the pay packages there are the most extreme. The authors of the ‘stars’ study extended their analysis to look at twenty top General Electric managers who took up top jobs elsewhere, finding similar problem with the portability of stardom[15. Jim Heskett, ‘Why Do We Chase Stars?’, Harvard Business School, 4 November 2010].

Tellingly, another academic paper found that when new CEOs are appointed and paid less than standard for the industry and company size, share performance is roughly average. But when CEOs are appointed on above average packages, they deliver lower returns: “excess pay appears significantly negatively linked to forward profitability”[16. Michael Cooper, Huseyin Gulen and P. Raghavendra Rau, Performance for pay? The relation between CEO incentive compensation and future stock price performance, November 2016].

Capitalism works when it benefits the majority. When wealth creation appears to accrue to an elite few, capitalism appears not as a force for good, but a force for greed. Gordon Gekko writ large. The financial crash vividly exposed the “fat cats” as undeserving of their sky-high pay and that their high pay encouraged them to act unwisely. Their reckless behaviour cost millions of ordinary people their jobs, homes and life savings. And yet a decade on, the gap between executive pay and the wages of ordinary workers is almost as wide as before the crash. If public faith in capitalism is to be restored, the connection between pay and performance must also be restored. Executive pay must be brought under control. Capitalists must themselves end the era of the undeserving rich.

This article is the first instalment in a three part series on the challenges facing capitalism. The second part will be published tomorrow.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe