While few Brits envy China’s political system, some might look upon the Chinese economy and feel a twinge of inadequacy.

The Chinese have industries; we have industrial heritage museums. They run trade surpluses; we sink deeper into debt. They construct high-speed rail lines across thousands of kilometres; we cancel HS2. It’s hard to avoid the conclusion that we’re not just bourgeois — we’re decadent, too.

Except that, behind the facade of heroic productivity, the Chinese economy suffers from some all too familiar weaknesses.

The most obvious parallel is property. Whether in China or the UK, bricks and mortar is seen as a sound investment (thanks to escalating prices and the free flow of capital). The big difference is that while British developers struggle to provide enough new homes, their Chinese counterparts have been able to build, build, build — thanks to a planning system that eats Nimbys for breakfast.

The result is a building boom so big that it’s exhausted demand — leaving behind a lot of unwanted apartment blocks and a basically bankrupt property sector. Which, as previously noted, is why foreign investors are pulling out as fast as they can.

As for domestic investors, the great Chinese debt crisis is spilling over from property to finance. Last week brought the news that Zhongzhi — one of the largest of China’s so-called “shadow banks” — was in financial trouble. According to Reuters, the company “told investors it is heavily insolvent with up to $64 billion in liabilities”.

The shadow banking sector in China is huge — accounting for 40% of all loans. Though shadow banks tend to look and act like conventional banks, they aren’t regulated to the same degree. If one of them fails, it shouldn’t matter — but given the risk of contagion in a sector worth $3 trillion, some form of bailout seems likely.

In fact, Government efforts to keep the plates spinning are now plain for all to see. For instance, Bloomberg reports that regulators may soon allow conventional banks to offer unsecured loans to certain property companies. That sounds like throwing good money after bad, but it will take the pressure off the property sector, if only for a while.

Another major development is that the Government is unexpectedly borrowing an additional one trillion yuan (over £100 billion), which is exactly what you’d expect if the central authority were having to prop up a tottering system of debt-ridden property companies, financial institutions and local governments (who often fund the housing and infrastructure developments which fuel Chinese growth).

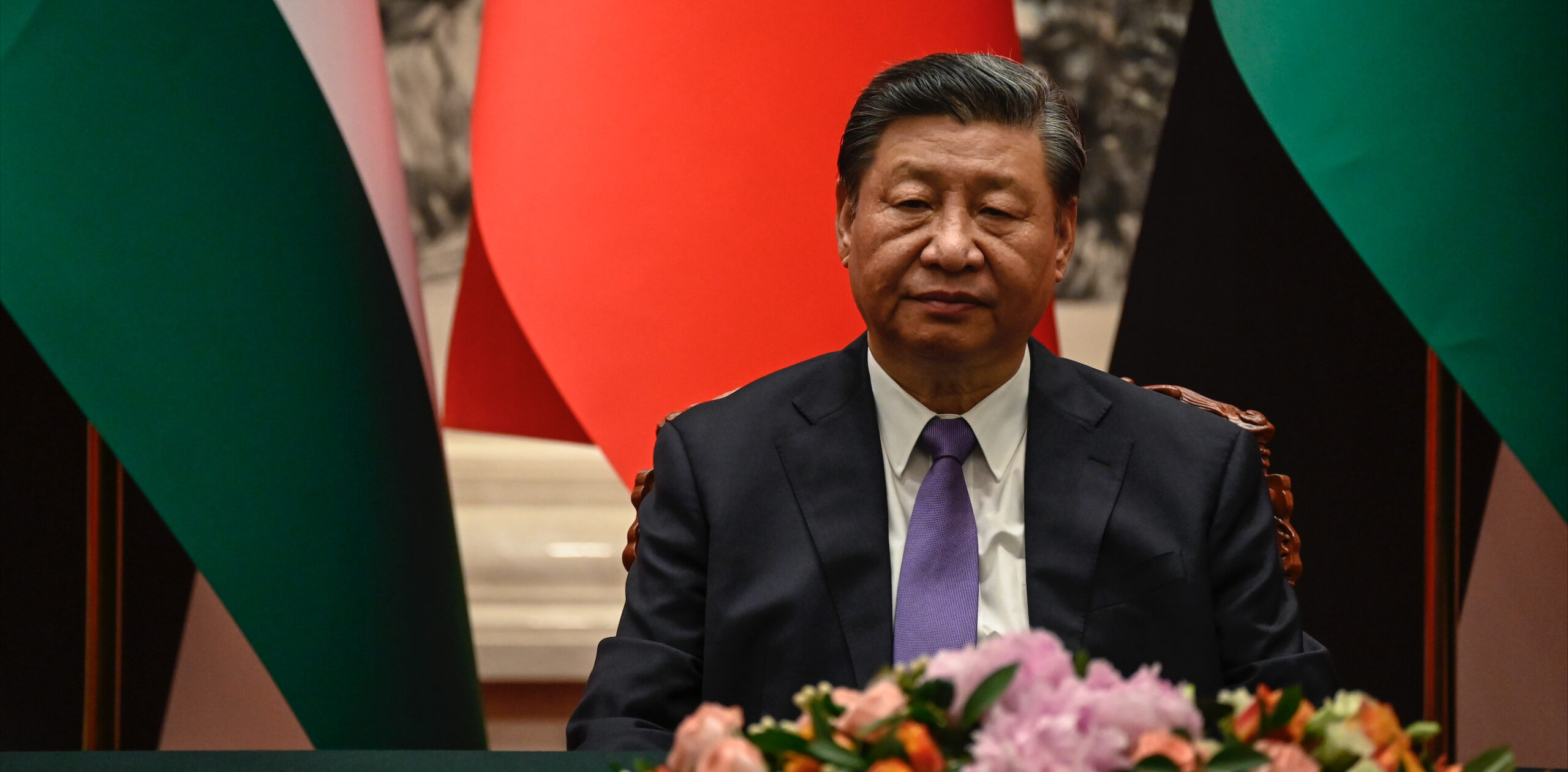

Of course, none of this means we should be complacent about our own economic failings. But it does mean we can reject the dangerous delusion that democracy is the reason why we’re in such trouble. In theory, a government that doesn’t have voters to worry about can take the tough decisions needed to secure the nation’s long-term prosperity. And yet China finds itself in a financial mess as bad as our own, if not worse.

President Xi Jinping may still use his clout to fix his country’s structural problems. However, if all he does is add to China’s debts while putting off reform, then he’s no more effective — but less sackable — than our own politicians.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe