As inflation rages, strikes are taking place across Britain. The two phenomena are connected, and obviously so: understanding how is enormously important. Not only does it give us potential insight into the future trajectory of strikes and inflation, but it also allows us to get a sense of whether a wage-price spiral is taking hold in Britain.

A wage-price spiral is a situation where, after inflation takes hold, workers try to bid up their wages to keep pace with rising prices. But, faced with these rising wages, companies are then forced to increase their prices even more to offset the new, higher wage costs. This dance can go on interminably, meaning that inflation, which may have otherwise subsided, becomes entrenched in the system.

Wage-price spirals almost inevitably become a politicised affair, with those who consider themselves defenders of the working class denying their existence — or, if they are feeling even more radical, blaming capitalists for ‘price-gouging’. In recent days we have seen some credentialed people engage in denialism about this issue. Former permanent secretary to the Treasury Lord Macpherson, for example, declared that “public sector workers don’t create inflation”. Meanwhile, former deputy governor of the Bank of England Sir John Gieve questioned whether larger pay rises for public sector workers would significantly fuel inflation.

This is part of a broader trend, where Left-leaning economists deny the existence of a wage-price spiral altogether. Some claim that a spiral only exists when wage growth outpaces inflation; others claim that inflation must be accelerating for a spiral to be taking place.

In fact, there are only two relevant questions when looking at a wage-price spiral. Firstly, did the wage rises come before or after the inflation? This can give a sense of whether wage growth had a role in sparking the initial inflation. Secondly, what are the specific dynamics taking place between wages and prices? The two charts below help us understand both.

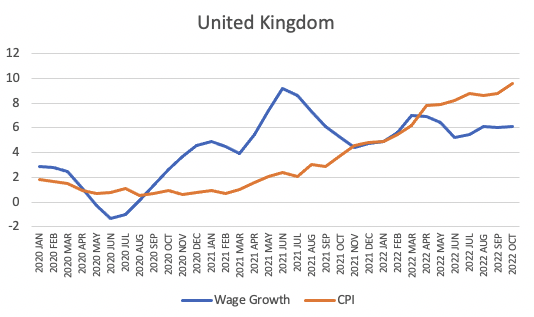

The first chart shows clearly that large wage increases in 2021 precipitated the inflation. This does not mean that these wage increases were the only cause of inflation, but it does suggest wage growth in 2021 was a factor contributing to the present situation.

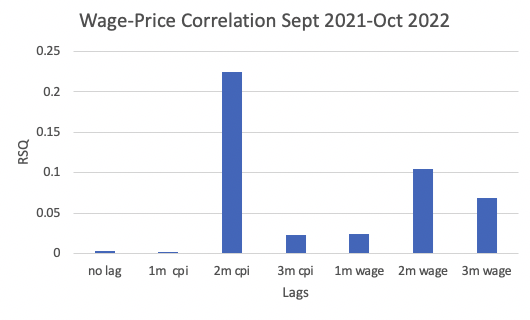

The second chart (below) shows the strength of the correlation between wages and prices adjusted for various lags. We have taken the data from September 2021 onwards, as this is when the serious inflation started. This may sound confusing, but what the chart shows is simple enough: wages tend to rise two months after an increase in inflation; then, two months after this rise in wages, prices also go up. These dynamics are clear evidence that a wage-price spiral is taking hold in the British economy.

What then of Lord Macpherson’s claim that public sector workers cannot create inflation? While it is true that, say, the NHS will not raise prices in response to higher wage demands by workers, nevertheless these higher wages will bid up the price of goods more generally. More importantly, rising wages in the public sector mean that private sector workers will demand higher pay to keep up.

The outcome of this mess is obvious: we have been here before. In the 1970s, Britain’s economy became embroiled in strikes during a period of high inflation. As time went on, the link between the two became obvious, public support of the unions withered, Margaret Thatcher was elected and the unions were defeated. Already, public support for the strikes is waning — net support has fallen from 19% in September to -3% in December. The government understands this, with one senior Conservative telling the Financial Times that public support for strikes “tends to fall the longer they go on”.

Former public officials and Left-leaning economists engaged in wage-price denialism may believe that they are protecting the working class, but they are not. Workers never win when wage-price spirals take hold for the simple reason that companies can raise prices much more easily than workers can raise wages, and so inflation-adjusted wages always fall.

In the longer term, the industrial disputes that wage-price spirals give rise to discredit unions in the eyes of the public and pave the way for laws that curtail their activity and diminish their power. The supposed experts in denial are not the champions of the working class and of working-class institutions: they are their gravediggers.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe