Let's not forget the real culprit. (Hollie Adams/Bloomberg via Getty Images

The Prime Minister was handed a surprise reprieve today as inflation stayed flat at 4%, defying economists’ expectations of another rise. Already the Chancellor, Jeremy Hunt, has jumped on the news as evidence that the Government’s plan is “working” and we can expect much more of the same. But as the UK limps towards another recession, it’s hard to shift the conclusion that Britain’s economic cognoscenti really don’t know what they’re doing. For years, we’ve been lavished with promises of growth, investment and impressive economic programmes — only for each to turn to dust. The truth is that, concealed by our incessant focus on short-term inflation data are far more significant issues of economic management.

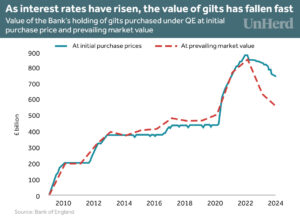

Last week, to no fanfare whatsoever, the Treasury Committee released an extensive report on a set of policies the Bank of England has undertaken over the past few years. The report’s immediate focus was on the Bank’s recent Quantitative Tightening (QT) programme, which promotes higher interest rates. But read properly, it was an attempt to assess Britain’s central bank policy since 2008. QT, after all, was a direct attempt to unwind the Quantitative Easing (QE) programmes that were put in place in response to the financial crisis. To judge its effectiveness, the report had to look at the Bank’s monetary policies over the past 15 years. Suffice it to say it made for damning reading.

In a capitalist economy, financial markets should have one job and one job only: the allocation of capital. They should look at various businesses and assess their viability. Those they assess as being viable should then access funding on good terms; those that are not viable should not.

But since the onset of QE, the City has largely become an arm of the Bank, constantly watching its every move for signals about what to do next. The reason for this is straightforward: the QE programmes have given the central bank almost total control over the government bond market, partial control over the corporate bond market, and a large degree of influence over stock prices. If you are an investor and you want to make money, the easiest way to do so is to guess what the Bank is going to do next.

There are, as a result, plenty of investment professionals consulted in the report, all of whom have firmly bought into the QE/QT framework. Each provides their own minor assessments: one will say QT is being undertaken too fast, another will say that it is being undertaken too slowly — and, at the end of the day, the Bank will fall somewhere in the middle. All very sensible, all very orderly. Until it isn’t.

In fact, what is so striking about these assessments is their lack of clarity. Beyond the fundamental virtue of the QE/QT framework, the only point that everyone agrees on is that they really have no way to know what is going on. The Bank, as the report makes clear, “is uncertain about the macroeconomic and money supply effects of QT”. Elsewhere, it notes that “the Bank is taking a ‘leap in the dark’ by embarking upon a major monetary operation without specifically and separately tracking its effects”. Indeed, at one point, the Governor himself admits this, explaining that such uncertainty is “why we keep QT under constant review”.

Main Edition

Main Edition US

US FR

FR

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeSo, shouldn’t the ‘People In Charge’ know what they’re doing? I guess not …….. may as well be in airplane with a baby pilot happily pushing buttons and pulling levers, hoping that, eventually, something good will happen ……..

I can remember even 10-12 years ago when the Bank of England started ploughing ahead with Quantitative Easing, that plenty of people said it was a bad idea. We’re paying the price now in any case.

Not to worry, we’ve since traded competence in high profile roles like this for one’s ability to lecture on the merits of extreme DEI policies.

Bailey was picked primarily because he was the only candidate who professed any faith at all in the Brexit project. Little surprise then he has proven to be incompetent in the field of economics. Nothing to do with DEI at all although you’ll get plenty of chimps applauding that one here.

Oh dear, please not the old ‘it’s all because Brexit’ bollox again.

Britain is stagnating because we live under a financial system that taxes productive activity in order to reward middle class rent-seeking. Where do you think all the unearned property wealth you’ve accumulated while the country got poorer has been coming from? Do you think it grew on a tree? What is funding your pension? Debt, mostly.

Economic success comes from circumstances where small businesses can grow to become big ones. Those circumstances no longer exist here – and they certainly don’t exist in the EU. Name three iconic French, German or Italian businesses that are less than fifty years old?

Please stop with the because Brexit nonsense.

none of that is relevant to what I said.

That’s a novel way of avoiding an argument you know you can’t win.

Whereas arguing a different point altogether is a technique as old as time.

Intellectual bankruptcy. You should apply to join the Court of Directors (!) of the BoE

Initial argument: we have no one competent in power because of DEI!

My response: Bailey was appointed primarily on the basis of his belief in Brexit rather than any DEI box-ticking. (also noting that I said chimps on here would applaud regardless)

Response to that: Britain is financially stagnating and it’s nothing to do with Brexit.

My response: okay but that’s not really what anyone was talking about.

Your response: intellectually bankrupt.

Chimps: applauding.

Ergo ‘faith in Brexit’ = economic incompetence. That’s the proposition I was arguing with. You don’t even understand your own posts. BTW: you are not quite the intellectual giant you imagine yourself to be – so perhaps a little less superciliousness, ‘chimps’ etc, eh?

Still not blaming anything on Brexit and your initial response is entirely unrelated

If I misunderstood your post it’s because you don’t express yourself with sufficient clarity. The above is another good example, borderline illiterate.

Bailey has only been there for a few years. The real villain is Mark “shiny suit” Carney. I believe he is now at the UN, the sort of place where his lack of competence will be a ply rewarded. I imagine he will turn up somewhere in the EU next

Nope, he’s in line to be the next PM of Canada. Or was, until the magnificent Pierre Poilievre appeared on the scene to wreck his chances.

The alternative would have been catastrophic defla Fortunately people like you will always be kept away from macro economic policy making

DEGLATION?

Is that a technical term beloved of the Square Mile?

So the best course of action would to have not needed QE. Unfortunately Alan Greenspan and Ben Bernanke thought they could deal with any issues by QE and so ploughed on pumping the debt bubble regardless of the obvious problems building up.

QE may have saved us from catastrophic deflation but the concept of QE created the mess in the first place.

It was all about keeping house prices artificially high. Why, one wonders? In the 1930s massive house building brought down rents to about 1/3rd of the 1920s. A catastrophic deflation? Britain did better during the great recession than the US.

Thanks mainly to Stanley Baldwin and Neville Chamberlain, and NOT to WSC or Ramsay MacDonald.

Shocking. What peril we are in. This article does not go on to investigate the aftershocks of the Zero Interest Rate Regime the QE was designed to sustain. Over a decade of companies and mortgage owners plied with and drunk on super cheap money & inflating assets. Clowns like Carney re wired the plumbing of western finance with miles of dodgy fragile pipes . The consequences of this heroin addiction are made worse by the final insane magic money and bailout experiments in lockdown. It could never last. Will we mirror Japan and take 30 years to recover from a Bubble?? How?

Quantitative Easing during the Covid pandemic was a profoundly political act. Lockdowns would have been politically impossible if the government had sought to close businesses and throw people out of work without compensation. But the scale of the compensation required was unaffordable unless the BoE stepped in to hold down the cost of government borrowings via QE. Such money printing was inherently inflationary and the risk of higher inflation was pointed out at the time. However for ideological reasons the MPC, and most economists and financial journalists drawn from the same professional class and subject to the same social pressure not to be “Covid deniers” by expressing doubts over the viability of Lockdown, ignored those warnings.

Correct. As with the inter war appeasers, these are The Guilty Men. QE, magic money and co stant welfarist bailouts are Crime A. The property boom which has made housing unaffordable to a majority is Crime B. The suffocation of enterprise by the risk averse EU Regulatory Regime is Crime C. Uncontrolled public service crashing mass immigration is Crime D. Net Zero Degrowth and insane bureaucratic Diktat on Energy is Crime E. What a mess this technocratic new Progressive Blairite Order has made.

Add Crime F: young people being able to start families due to unaffordable housing. Crime G: loss of talented young people through emigration due to absurd housing costs. Crime H: the creation of a new rentier class living at the expense of the rest of us (landlord Blair being a prime example, green high priestess Lucas another one). Crime I: the higher education scam with student loans that can neer be repaid.

I probably missed a few !

The inter-war “appeasers” were not Guilty Men; they were realists. They knew Britain could not win a short war or afford a long one.

In brief, a war would bankrupt and ruin Britain…and so it proved.

In fact, Churchill’s policy was to appease Italy and Japan, and therefore was also an appeased.

Quite right Sir! This ‘Guilty Men’ calumny has gone on long enough.

To fight the Great War was asinine, to fight the Second suicidal.

What utter nonsense. If they had stood up to Hitler much earlier there might have still been a small war, but not the disaster WW2 was financially.

Churchill correctly was trying to stop the formation of the Axis, an intelligent strategy to isolate Nazi Germany. One which would have probably worked if not for the Guilty Men.

We should have kept out it, let Russia and Germany tear themselves apart, whilst supplying BOTH with as many arms and as much equipment as they could possibly pay for. (In Gold).

Not only would this have taken us out of the ‘depression’ and boosted British industry, it would have filled our coffers and somewhat ameliorated the financial disaster of the Great War.

By skilful management we may have been able to prolong this conflict until both sides were thoroughly exhausted and only too happy to welcome post war British ‘investment’, again very much to our profit. Thus we would have retained our place as a Great Power with the US are only competitor.

Unfortunately, thanks to the ineptitude of WSC and others, we ended up as a pathetic broken beggar grovelling at the feet of the USA, and so it has remained. Still “ beggars can’t be choosers” as they say.

Utterly ridiculous remark. Are you aware that Russia and Germany were in alliance from late 1939, so far from taking each other apart, they would have taken Europe apart with great ease.

Do you know any history at all?

And the USA was a good friend to us after the war and enabled us to recover financial strength, culminating in the Thatcher years, so tragically thrown away by Gordon Brown after 1997.

Crude insult is one of the lesser branches of rhetoric and is usually avoided by those who prefer to engage in reasonable debate. Sadly not in your case however. I wonder why not?

Perhaps I should enquire whether you know any history at all, or are just an advocate for parroting tired old propaganda myths? Funnily I find such naivety rather charming in this day and age.

I do know quite a lot of history indeed, and the lead-up to WW2 is my specialist subject.

Debate is wasted on those whom ignore facts to create their own fantasy. Do carry on.

If it is your specialist subject you must surely know that the calumny The Guilty Men was wriiten inter alia by Michael Foot, and financed by Beaverbrook, who loathed Chamberlain.

The object was to destroy Chamberlain and allow Beaverbrook to attain power, or some measure of power…which it did.

However Beaverbrook wasn’t much good, and tge achievements of his department were despite, not because of him and often had started prior to his getting there. However he was a good self promoter.

Self praise is NO recommendation.

The USA most certainly was not a good friend to Britain. It coveted the British Empire and sought its demise…and achieved it.

It charged for the help given during WW2 firstly in cash/gold and then in the forced sale of British dollar assets and abolition of Imperial Preference in order that it could take the British markets.

After WW2 the USA at first sought to take over or destroy such remaining overseas power as Britain had (Suez…) and then, having got its b*lls in the ringer in Vietnam sought British assistance (“one brigade of the Black Watch”…Wilson refused..). The USA was furious when Wilson pulled out of East of Suez because it wanted at least moral support in its supposed countering of the ridiculous “Domino Theory” (now being re-cycled in respect of Russia.

Indeed it is likely the Cold War was entirely unnecessary. The USSR was devastated by WW2 and could neither have conquered or held Western Europe even if it wished to do so…which is doubtful. It wanted a zone of protection.

Stalin’s offer of a re-united and neutral Germany, as with Austria, should probably have been accepted. Britain could then have had a successful alliance with France, free from the USA’s influence, and jointly led a European economic zone, much to its profit.

The Cold War was absolutely essential for millions of American jobs, although military completely unnecessary as you correctly say.

However nobody wanted a return to 1929-1938 so ANY price/deception was worth it.

.

Where did you that expression “one Brigade of the Black Watch” from may I ask?

Incidentally up until November 1967 Wilson could legitimately claim we were ‘too busy’ elsewhere, eg, Borneo, South Arabia and Aden.

Even 1968 we still had the Dhofar War and BAOR* before the next adventure ‘Northern Ireland’ kicked off in September 1969.

It also probably no coincidence that in 1968 we also saw agreed to hand over Diego Garcia to the US for the construction of a major naval and airbase, with very unpleasant consequences for the 800 or so inhabitants, that still rumbles on to this very day.

.

(*50,000 troops approximately.)

I can’t immediately remember the source for the Black Watch quote and will try to find it…probably one of David Reynolds works.

I think it was Dean Rusk who said it, along with “don’t expect us to help if the Russians invade Sussex…”…that is in Britannia Overruled by Reynolds…

De Gaulle had the measure of NATO “no American President will risk New York for the sake of Lyons…”…or indeed anywhere else not in the USA.

Powell also understood the true nature of the “Special Relationship”…

I’m not sure the USSR would have accepted British investment. It certainly refused aid after WW2 because the terms were the opening up its economy to domination by US capitalism..with attendant consequences.

Beria, a first rate organiser and administrator (and frightful human being…but Britain deals with others like that..) was pro engagement with the West in the early 1950s…but didn’t survive to do so. I think Zhukov delivered the final “verdict”…

In my hypothetical scenario I did not envisage the USSR surviving.

More a case of a return of Brest-Litovsk.

“Stood up to Hitler”…with what? Britain had not re-armed and all political parties, and the people were against doing so because the economy couldn’t take it.

When re-armament occurred ( the “appeaser” Chamberlain…) it was to build up Britain’s defences, the RAF, not a continental mass army, which was entirely correct. The people would not tolerate that. The strategy was to check a German assault in the West by the French army, whilst blockading Germany economically by the Royal Navy. Regrettably thd Frech army wasn’t up to the job.

There was nothing realistic about waiting until Germany had added the populations, industrial capacity, and land borders of Austria and Czechoslovakia to its own before declaring war on it. Germany was intent from 1933 on becoming the dominant power in Europe, and avenging the losses of Versailles. That inevitably meant war with Poland, the USSR and France. That would have to drag in Britain if Germany gained control of the Channel ports. The “Guilty Men” sat on their hands while Germany built up its capacity to wage war faster than Britain could.

And by what ‘financial miracle’ was Germany able to build: “up its capacity to wage war faster than Britain could” pray?

Military strength is not just about having stronger finances. Germany didn’t need to be as economically strong as the UK and France to defeat them militarily. In WW1, it cost the Central Powers $11k to kill an enemy soldier; it cost the Entente and Allied Powers $36k. In both World Wars on a like for like basis the German armed forces were far more successful at killing and capturing the enemy than were the Allies. Given this military edge, allowing Germany to subsume the resources of Austria, Czechoslovakia and then Poland before facing them militarily was disastrous.

I have never doubted the prowess of the German Army in both World Wars but as Marcus Tullius Cicero said sometime ago “The sinews of war are infinite money.”*

Additionally the acquisition of Austria added little bar another bunch of even more fanatical N*zis.

Czechoslovakia however was a very useful gain thanks to the sophisticated arms industry based on Brno.

Poland an irrelevance due to the timing.

As I have said before it was a total disaster for the UK and the Empire to enter the war, particularly after the catastrophe of the previous one.

Three hundreds years of happy imperial profit and plunder we thrown away in five years of complete madness.

POSTED AT 19.50 GMT and immediately SIN BINNED.

Not the word N*ZI surely?!

(* Fifth Philippic.)

Poland was not an irrelevance because the Guilty Men in Britain and France continued not to wage war on Germany until war came to them in May 1940. Because of Munich, Germany was able to invade Poland from the north, west and south, and the visible French and British weakness had encouraged the Soviet Union to throw in its lot with Germany. Germany was only able to make the War as long, bloody and expensive as it did due to the way the Appeasers in government in Britain and France played into its hands from 1934 – 40.

It was only “as long, bloody and expensive as it did” due our political ineptitude and military incompetence.

I was hoping to broaden the discussion by mentioning Germany’s Mefo- bills ( or Me Fo Bills) and how enthusiastically they were purchased by Jews in the period 1934-I938, however that will have wait for another day.

In the meantime I have never doubted the prowess of the German Army in both World Wars but as Marcus Tullius Cicero said sometime ago “The sinews of war are infinite money.”*

Additionally the acquisition of Austria added little bar another bunch of even more fanatical N*zis.

Czechoslovakia however was a very useful gain thanks to the sophisticated arms industry based on Brno.

Poland was an irrelevance due to the timing.

As I have said before it was a total disaster for the UK and the British Empire to enter the war, particularly after the catastrophe of the previous one.

Three hundreds years of happy imperial profit and plunder we thrown away in five years of complete madness.

POSTED AT 19.50 GMT and immediately SIN BINNED.

Not the word N*ZI surely?!

(* Fifth Philippic.)

Yes. And those of us pointing it out were shouted down as being more concerned with money than people’s lives. Now, the realisation may slowly dawn that money, as an abstraction of resources, is devalued and as those resources it represents become more scarce that those resources are actually fundamentally important to people’s lives.

Did not that sage Lord Jonathan Sumption KS warn of these very perils on the 23rd March 2020 last?

Spot on-and the insanity of funding consumption whilst simultaneously shutting down huge swathes of production (ie lockdown/furlough) is feasible whilst we have zero/negative interest rates-as soon as rates increase the production gap has to be faced and “pop”

And QE from 2012?

QE from 2012 has had dreadful economic and social consequences. But in contrast to QE in 2020 and 2021, it was at least not implemented to support a particular political policy in contravention of the BoE’s own inflation mandate.

There’s a basic error in here. The B of E only has losses on the bonds it bought through QE if it chooses to sell them early in QT. It could hold them to maturity and redeem the coupon (original value) with no loss. Which it could do. It is unclear just why they are choosing to crystallise the loss.

That said, I’ve never been a fan of the QE program. Better in my view if we’d taken the earlier recessions when they fell due and let these clean up some of the junk in the economy (which is what they do). Instead, we have lots of zombie companies that still need to – and will in due course – fail that we’ve been propping up. And they wonder why productivity in the UK is low …

If you hold on to a purchase for 10 years or more, and only recover the nominal value of the purchase with no compensation for inflation, then you have made a real loss, no matter how you account for it. QE was initially justified by the requirement to offset deflationary pressures in the economy. The whole basis of the QE programme was that it would be unwound via QT when deflationary pressures ceased, rather than letting the BoE balance sheet balloon indefinitely.

True. But it’s a much smaller loss than bailing out at the bottom of the market as they’re doing. And you are being compensated by the bond interest. The B of E has been selling bonds when inflation and interest rates are high when their policy is to lower inflation. Given they’re at least partially in control of inflation, they should be buying distressed bonds when inflation is peaking and not selling …

It doesn’t work in real terms though. It operates on nominal value and they would have purchased for less than nominal value, receiving (meagre) interest along the way.

The problem here is that interest rates paid on reserves have spiked so much that they’re making a massive loss just paying the interest to commercial banks if holding to maturity.

e.g.

Buy 10y £1000 bond at 1% interest for £980. This creates reserves of £980 at the commercial bank on which your pay 0.1% interest.

You get £10 interest per year and £1000 at the end of the term = £120 profit. If paying 0.1% interest on commercial bank reserves for those ten years you’re in the black, redeem the reserves and you remit the proceeds to the treasury.

But if you do all the same but the interest paid on your £980 commercial bank reserve deposit jumps to 5% suddenly you’ve got to find ~£40 per year to pay interest on those reserves.

You still get the £1000 for your £980 purchase at the end of the 10 years but in the meantime you’ve paid out interest way above the interest you receive. The treasury (i.e. you, taxpayer) indemnifies that difference and pays it to a private bank who received the reserves for free.

And this is before we consider the inflationary impact of all that perpetual money creation and the presence of excess reserves!

Agreed and the indemnity was only ever in place as a veil to pretend we’re not engaging in direct monetary financing.

But as to losses: the BoE has to pay interest on the reserves created under QE at a floating rate but receives interest of 0.whatever% on the bonds. So it’s (or rather we are) making quarterly payments to commercial banks of free money on top of their free money.

One thing that is wilfully ignored in this debate is that the BoE has an objective of 2% inflation. To try and climb up to that target in the post-2008 demand-starved world they hit 0% interest rates and couldn’t do anything else but funky monetary policy.

The problem was that government was not spending. Independent central banks with strict mandates are conceived on the basis of profligate governments but the austerity era turned this around.

The fiscal side was entirely absent and, contrary to the advice of most economic textbooks, the government was actively sucking demand out of the economy or passively waiting for the free market to deliver (still waiting since the 80s!).

Everyone who now complains that the BoE is failing by not hitting the 2% target is hypocritical to argue that they have now failed by doing QE as an extreme measure to hit the same target.

QE is not just a story of central bank failure but one of utter government failure and the revindication of small-state, hands-off, neoliberalism.

Isn’t one of the issues that the BoE is only concerned with consumer price inflation? It’s QE policy sent asset prices soaring, but this seemed to have deemed a good thing, possibly because those doing the deeming were largely the beneficiaries of these rises. Price inflation, unless it becomes hyper inflation of course damages the wealth of those who benefitted from asset prices rises, while leaving many of those without assets unaffected as the minimum wages, pensions etc rise in line with inflation. That is of course until attempts to control inflation result in job losses, cuts in public services etc.

In short the BoE protects the rich whilst the rest get poorer.

One of the consequences of QE was allowing large corporate entities to get near zero interest loans that was then used for activities like stock buy backs and acquisitions. The market cap of these companies soared, particularly big tech. The money wasn’t used to reinvest in development (skills, training, infrastructure, modernisation etc.).

Indeed. One of the major issues is that CPI does not adequately including housing costs, so you get the bizarre spectacle of interest cuts to keep ‘inflation’ at 2% whilst houses, the biggest thing the vast majority ever buy, are rising 20% pa!

It hardly includes them at all. Isn’t there only a limited reference to rents?

Charles Goodhart came to speak at my school a couple of years ago. I asked if high house prices were a sign that the BoE had failed. No, he said. In effect, his answer was tgatvthe Bank had done what Gordon Brown had required. I tried to push him and suggest that it had still been remiss of the Bank to do something about asset price inflation, even if just pushing the politicians to take more notice but, no, he didn’t move.

One point to note is that the Reform Party are proposing to redeem and re-issue all the QE debt into a huge long term 2% bond.

They would then couple this with a system similar to that in (say it quietly) Europe where the QE reserves held by commercial banks receive lesser rates of interest.

Many of us haven’t missed it. The gini co-efficient is more BofE largesse. Bailey has been a bloody disaster. Lord King, the most discrete of commentators, has vented his frustration regularly. Certainly I wouldn’t hold all my assets in gbp at this point. More debasement incoming.

Quantitative easing without a depreciation of the exchange rate is effectively free money. Advocating against such action is profoundly unpatriotic

“Patriotism is the last refuge of the scoundrel.”*

(* SJ.)

The issues start long before the GFC (which didn’t come out of nowhere despite what was said at the time). Nor are they confined to the UK.

From almost the moment the BoE got independence in 97 they started to cut interest rates to try and keep inflation up at 2% (quite why the price of consumer goods coming out of China had to be compensated for by driving up other prices I’ve never understood). This fed into the housing boom that, along with PFI, allowed New Labour’s debt-fuelled economic boom and spending.

We’ve been paying for it ever since 2008, QE is just part of that story. High debt levels, unaffordable housing, infrastructure and NHS falling apart etc. And perhaps most worryingly a public that often doesn’t connect spending with cost. The numbers calling for interest rates to be cut without realising that that will cause house prices to rise is insane.

These details might be specific to the UK but much the same has happened across the West.

Very good article indeed. The Bank of England, for so long intelligent and prudent, has become in the last 20 years, utterly incompetent. This might be overcome if we had a Chancellor of the Exchequer who had some knowledge of what he is about. But Hunt is even more put of his depth than the Governor and his Court.

Both Governor and Chancellor have to be removed if there is any hope of improvement to the UK economy, short or long term.

The tragedy is that this will become the task, maybe the opportunity, of a Labour government.

As far as I can see the political and economic class don’t even see the problem. Independence of the BoE and CPI targeting have been disastrous but there’s no serious debate about removing either.

Agreed, they have been disappointing but independence was a sensible attempt to cure a serious problem.

Independence seemed an intelligent move, though it always was odd, coming from G Brown. But now I am much dubious; the politicians appoint the Governor and so they tend to be political appointments, of course. And we have had two really bad appointments, Carney and Bailey.

Plus why seperate off a key tool of economic management, the control of interest rates? Best to let the Treasury do the lot; its record is not much good either but at least the voters have an occasional opportunity to chuck the rotters out.

This excellent article is right on the money! So how come Andrew Bailey is still in post? Like so many of our other failed Regulators he seems impervious to criticism and unsackable. Are there no performance metrics set for any of these Regulators?? ( see also Ofgem, Ofwat etc etc). Are we so caught up by their independence that they have effectively become unaccountable?

Idiots lead by Donkeys … or is it Donkeys lead by idiots

From the economically illiterate government to the self serving regulators and BoE – a useless ship of fools the lot of them.

The Bank of England doesn’t serve the British population; it serves the financial institutions. Most of the people whose criticisms of the Bank are muted earn their large salaries at financial firms. Most of the economists who serve on the MPC hope one day to be rewarded by those same financial companies, even if they didn’t come from these institutions.

Excellent article.

This article is silly. A negative GBP balance on the BoE balance sheet is of zero concern. When you can create central bank liabilities in GBP you can’t run out of GBP.

The net effect of QE has been to transfer wealth from the poor to the wealthy, with a net impoverishment of the whole. Look up the Cantillon effect.

The Bank of England was created after the Dutch invasion of Devon in 1688. It financed the Second Hundred Years War that ended with a little fireworks display on the day after The Duchess of Richmond’s ball in Brussels in June 1815 and took the French down a peg or two. Then came World War I and World War II to take the Germans down a peg or two. Then the Cold War to take the Russians down a peg or two.

But the post 2008 ZIRP was to bail the Yanks out of their real-estate bubble culminating in the glorious victory of World War COVID.

Yes, and now what do we do to clean up the mess of the last 15 years?

Do you get the clue that our current central bankers don’t have a clue?