A protest against university fees. Credit: AFP / JUSTIN TALLIS / Getty

The British political Establishment is in the middle of a reorientation – towards a social and cultural outlook which is more communitarian, and an economic outlook which is shifting to the Left.

The 2016 Brexit vote has focused minds on the recalibration of our social politics, but the leftward economic shift of the Establishment, who are in some ways following the public, is less commented on. Indeed, while the Brexit vote explained the Conservatives’ rise in the Midlands and the North in the 2017 General Election, it was the popularity of Corbynomics which propelled Labour to near parity with the Conservatives two years ago – a spectre which haunts this election.

The figure of Corbyn obscures the fact that Labour’s economic statism and red-in-claw socialism is popular and has been for some time. A recent YouGov poll indicates that the unpopular Labour leader, with the worst opposition leader ratings of all time, has a manifesto whose contents, when polled, have majority support across the board.

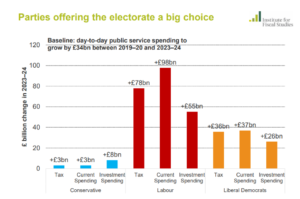

Survey after survey, and vox pop and after vox pop indicates that the British public are tired of austerity, tired of a battered and shabby public realm and now fully support better funding for public services, and more investment — even if this means higher taxes. The 2019 party manifestos reflect this new normal, with the Tories committed only to modest spending and tax rises, with Labour committed to shifting the country’s economics to the far Left.

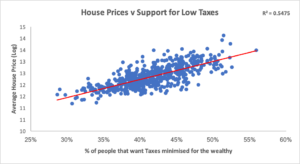

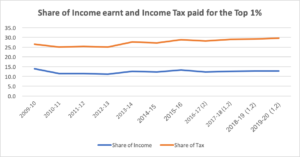

UnHerd has commissioned polling which indicates that only 30% of the public agree that “Tax rates for high earners should be minimised to keep the UK competitive”, with 42% actively disagreeing with this statement. In terms of electoral geography, FocalData has estimated that only 22 of Britain’s 632 parliamentary constituencies have more people than not committed to tax competitiveness. Indeed those high spending manifestos are a reflection of these sentiments.

Of the 22 seats that support minimising tax on high earners, 17 are in London – including, somewhat ironically, the constituencies of Jeremy Corbyn and Emily Thornberry; yet another issue on which the capital finds itself out of step with the rest of the country. In fact, it’s easy to assess how likely an area is to support minimising the tax burden on the richest simply looking at how high house prices and average wages are in a constituency.

Main Edition

Main Edition US

US FR

FR

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeA very entertaining and informative piece – thank you.

Fascinating topic, thanks.

Well, I have gone 50% part-time now. As a result, my net earning per hour have gone from £53 to £71 and the state is now a staggering £26,000/year worse off and I am 25% poorer but 50% happier.

This is what high tax rates do to the economy. They reduce productivity and tax revenue.

Good for you, thanks for your taxes, and yes – that is exactly what happens.