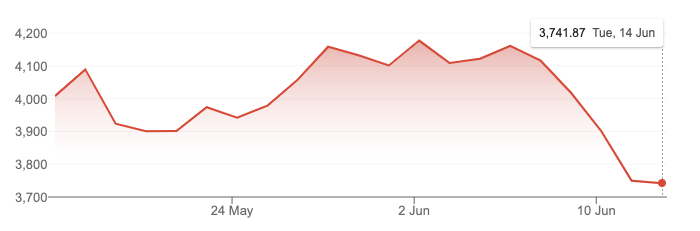

Yesterday the news broke that the S&P500 — which tracks the largest 500 publicly traded companies in the United States — entered a bear market. A bear market occurs when the stock market falls 20% or more from its peak. Such a fall often, but not always, indicates that larger declines may be in the pipeline.

The fall comes as investors wake up to the grim reality of inflation. For a long time, investors had been shrugging off the possibility that inflation might be here to stay. They assumed that it was due to pressures on the economy that were caused by the reopening from the lockdowns.

In fact, the lockdowns have permanently impaired our supply chains. In addition to this, the sanctions we imposed following the Russian invasion have backfired spectacularly and added yet more pressure to our energy markets, food markets and supply chains. The result is embedded inflation — and investors are having a hard time denying this reality.

Now that the markets have woken up to these uncomfortable facts, centrals banks are reacting by raising interest rates to curb inflations. But given that inflation is so virulent, the interest rate hikes will be aggressive and will likely tip an already fragile economy into recession.

The most likely outcome from this is a collapse in stock prices. What does this mean for investors and for the economy?

The implications for the economy are straightforward enough. A fall in stock prices will worsen the coming recession. People with robust stock portfolios are confident and ready to spend money on consumption goods. If their portfolio has gone to the dogs, they tend to retract spending. Such a decline in spending will exacerbate recessionary forces.

But the implication for investors is arguably more profound. The most important component of society’s investment capital comes from our pension funds. These funds are deployed to stock and bond market to generate returns and ensure that we can live comfortably in retirement. If the stock market collapses, it looks like we are facing a pension crisis — perhaps even one of unprecedented proportions.

Bearish investors have been modelling this outcome for some time. John Hussman, for example, calculated that if markets were as overvalued as he expected and they eventually crashed, capital allocated to the standard pension fund portfolio in 2021 would return -2% every year for 12 years. The typical assumption pension fund managers make is that for a fund to pay out its recipients, it should be growing around 6% a year.

Think about that: 12 years of -2% returns, at the end of which £100 invested in 2021 will be worth around £80. And this analysis does not even factor in the inflation we are now experiencing which further worsens investment outcomes from the point-of-view of actual, spendable money. This is so vastly lower than the assumed 6% growth rate that a crisis is all but inevitable.

If this occurs, it will be nothing short of a disaster. It is not at all clear exactly what pension funds and the government will do. We might wait around and see if markets rapidly return to normal — but this is rare after a crash. More likely we will start to see sad headlines appear in the newspapers of people who, through no fault of their own, see the money they thought they were ferreting away for retirement disappear.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe