The division of society between the richest 1% of the population and everyone else has become a common way of conceptualising inequality.

However, 1% is still a very large group. For instance, in the UK it comes to more than half a million people or over a quarter of a million households. According to Simon Lambert of This is Money, an income of at least £120,000 is required to make the cut. That’s a great deal of money for most people, but not an extraordinary level of wealth.

In a new paper, the economists Emmanuel Saez and Gabriel Zucman look at a rather more exclusive group — the richest 0.00001%. In America, this means “a group that includes 18 individuals with more than $50 billion in wealth in 2021.”

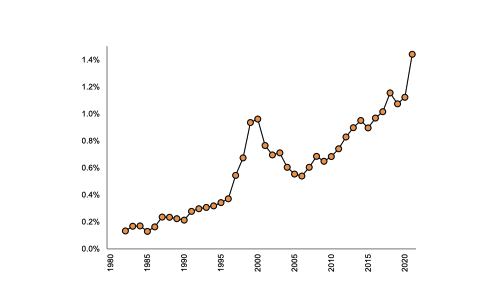

The key point is that this tiny handful of people don’t just own a vast amount of the country’s wealth — but a growing share of it:

In the early 1980s, the 0.00001% owned between 0.1 and 0.2% of America’s riches, but in the decades since their slice of the pie has “multiplied tenfold”.

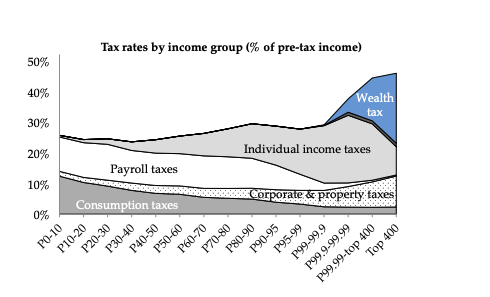

What sort of taxes are the ultra-wealthy paying? In percentage terms, the answer is not as much as ordinary Americans. Saez and Zucman summarise the situation in the following chart:

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribeinteresting wee article, but isn’t the conclusion back to front?

After all, billionaires are used to telling senior politicians what they want in return for their money.

Is this like the thought experiment of who really has the power? The king, the priest or the knight?

In this case, who really has the power: the people who make laws or the people who can buy the people who make the laws?

“effect of a hypothetical wealth tax” – pure speculation. If we we do have such taxation, the incentives for the 18 wealthiest become to spend a great deal of effort avoiding taxation, rather than building better cars, rockets, online stores, search engines etc. Do you also confiscate from the next man down to maintain a differentials, so he too has motivation issues? I think these incentive problems are the main reason Britain grew so slowly before Thatcher’s reforms; British companies were run by accountants minimising taxes while German and Japanese were run by engineers making better products.

The author is describing a system violating the rule of law; it has the President deciding the individual tax rates for the wealthiest 18 people. That is the road to tyranny.

All societies have inequality and the the attempt to remove it both fails in that goal and leads to tyranny. The inequality in North Korea between gulag slaves and Kim Jong-Un is greater that the inequality the author describes. Even if you’re only talking about extremes, and the declining middle, where do you draw the line, and how do you stop short of trying (and failing) to end all inequality?

We should care greatly about absolute poverty, but not relative wealth.

The question is simple for me. Would I want to be Bill Gates?

At some point the wealth that accrues has nothing to do with the improved technology, however good, but is only due to the size of the market. If covid had been the spanish flu and killed between 1 and 2 per cent of us worldwide, there would be fewer people to buy cell phones independent of how good the new models are.

That’s the bit — it’s just a matter of scale — that would be good to tax extra, because it is the same scaling opportunity/problem we have when we want to provide a public good, like healthcare, to everybody.

This reminds me of the old days of The New Statesman when all articles contained the words, ‘get the Rich’ or ‘tax the Fat Cats’. In fact, for tax purposes, the rich means the middle classes. The super-rich or the super-super-rich can get away with it.

It’s not the richest individuals who are the problem. It’s the wealth tied up in corporations, and NGOs (who get their money from corporations, for the most part.) Force the companies to pay out dividends to shareholders, forbid them from supporting political candidates, and regulate and tax the NGOs like crazy.

“an income of at least £120,000 is required to make the cut”

Is this a typo? I cannot believe that a (gross) amount of £120,000 per annum puts one in the top 1% in the UK

It’s around 5x the average salary, and I don’t personally know anybody on six figures so I’d say it’s probably right

If you are PAYE on £120k you take home a lot leas than if you earn that non-PAYE with allowable deductions

This is at the heart of all global problems, and if nothing is done about it, there will be civilisational collapse on a global scale.

Why is it a problem for 18 people to have accumulated $50 billion in wealth in an economy of $20 trillion?

That some people have a lot more than others in the US and other countries is not a catastrophe that will lead to collapse on a global scale unless the extraordinarily rich intend to spend their money on killing large numbers of slaves like to Oba of Benin in the19th century or some other activity directly inimical to a sector of society.

In fact the mega rich spend their money on charity, industry or conspicuous consumption that benefits those catering to their demands. The rich can only eat three meals a day like the rest of us. No one is going to starve because the rich have eaten all the food.

Confiscating the wealth of the rich will have no more affect on the rest of us than another round of quantitate easing.

The common fallacy is that money is like a resource. If someone has billions of dollars, then if they gave away to the poor, the poor would be better off. But the problem with this is super rich don’t consume the same goods as the average individual and there is little cross over between competition for resources of the sectors. Or to put it another way. The price of super yachts, sports car and holidays on desert islands have little to no relation to the cost super market shops and house hold electronics.

Taking wealth from the rich will certainly mean they no longer can afford these luxuries but someone else from another country will simply take their place, and it would do little to nothing to increasing the wealth of the poor. Unless the sectors of the economy they spend their money on can be made more productive, and they are already mostly mature well optimised sectors already, the result will only be inflation.

Most of the wealth that has accumulated in this top 0.00001% has done so in the most productive and innovative companies on the planet and whilst a properly funded state is a benefit to society, I think that the historic record shows that private individuals and companies invest it better that the governments do.

Whilst it may not improve the wealth of the poor, taxing the super wealthy more heavily (or at least at the same rates as people’s labour) could either mean improved public services such as schools and hospitals, or a slight tax cut for workers giving them a little bit more money to spend in local shops and businesses.

It may not lead to them becoming substantially richer, but it does make their lives that little bit easier. All that money sat at the top doing nothing is bad for both society and the economy

The money isn’t doing nothing. It will be being actively invested in companies which increase the productivity and prosperity of the nation.

It wouldn’t help make people slightly richer, you can only redistribute between sectors which are in competition for the same goods and services. Taxing the upper middle class, who do compete for similar goods and services would help but they’re too numerous and too well organised to allow any government to do that. Taxing the super rich any significant amount would just cause inflation and lead to a flight of capital from country. It wouldn’t work.

Look at the Soviet Union. By over spending on public services and subsidising prices they actually prevented the economic growth that happened in the West and condemned their people to far greater poverty.

Like I said. Private investors have a far better record than governments for producing wealth creation. Better the money is in their hands.

Except that so much of it is being actively invested in funding NGOs and lobbying, and capturing regulators, all of which may be great for the stock prices of the companies involved, but isn’t doing squat for prosperity.

If the money was being actively invested by these people then productivity and wages wouldn’t have been stagnant for the last 3 decades, alas it hasn’t been the case.

Instead it’s been pumped into idle speculation which has driven up the prices of things such as housing making them increasingly unaffordable to many, especially the young.

The brand of trickle down economics your describing has left us with record low levels of home ownership, and full time workers requiring government assistance just to cover their living costs

Yes the digital revolution never happened. Public sector over expansion with grossly generous pensions and mass migration driving down wages has cancelled out the benefits for much of the population but unless you’re blind you cannot deny we have live though one on the greatest changes on technological a advancement in history. If you cannot see that or understand economics, then I can’t help you.

The only flaw in your theory there is that the new digital age is only possible thanks to the internet….whose creation was largely down to being funded by the US government.

The tech giants such as Facebook and Amazon have been disruptive, and their founders are billionaires many times over, but they haven’t improved the wages, working conditions or standard of living for their employees, quite the opposite in fact.

For 40 years now we’ve been fed the lies of trickle down economics, that if we enrich those at the top then everybody below will benefit. For 40 years taxes on high earners have fallen, interest rates have plummeted, labour never been more mobile, unions destroyed, etc, in the belief that this would improve the lot of the working classes, yet it never seems to happen.

Home ownership rates are at record lows and dropping every year, wages have been stagnant and jobs increasingly insecure and precarious. Privatised public services barely function and are propped up with vast amounts of taxpayer money. How long are we supposed to follow your ideology before it delivers the results we were promised, when if anything it appears to be doing the exact opposite?

Like the communists, whose answer to the failings of communism was always to double down, neoliberals seem to believe that just a bit more deregulation and a bit more wealth for those at the top will finally lead us to the land of milk and honey

The compound interest formula is the perfect model for the results deplored in this article. So it is the first place to look if one is unhappy with increasing wealth concentration. Taxing income as it is earned instead of realized would make accumulation that much more difficult. Taxing all income from capital at the same rate as income from labor would make it more difficult still. More moral, too.