Tesla is the poster child of cheap money absurdity. On Tuesday the electric car company’s market cap surged past $1 trillion, after Hertz — a once-bankrupt car rental company that fell into trouble during an almost global Covid-induced lockdown — announced it was investing in “the largest EV rental fleet in North America,” by acquiring “100,000 Teslas by the end of 2022”.

Hertz’s financial rescue came was a comic caper. In the heat of the Covid-19 panic phase back in 2020, the company was saved by none other than /r/WallStreetBets: the infamous subreddit of brazen retail investors hell-bent on finding the next stock that might go #ToTheMoon. Armed with excess “stimmy checks”, they bought up Hertz’s shares — while Wall Street elitists deemed these worthless, enabling the company to survive liquidation until two private equity firms saw a recent opportunity to “shake up an industry,” i.e. reviving a dying rental car company with cheap capital and turning it “green”.

This, however, was a slightly glossed-over narrative. The mainstream press presented this story as a heartwarming turnaround tale, one that could easily make it into the history books. Bloomberg Television’s chyron reading, “Tesla: 1st Junk Rated Company to Hit $1T Valuation,” provoked almost no adverse reaction from the entire Bloomberg Surveillance panel. It was normal, even rational, that a so-called innovative company barely making money without state support — and, of course, its Bitcoin gains — deserved a whopping twelve-figure valuation.

What coverage of the Tesla-Hertz hookup overlooked was a massive capital misallocation epidemic present in the economy created by ultra-cheap debt, zero interest rates, and moral hazard. It is, essentially, a plague on society of which Tesla has become the poster child.

As a result, fraud and sociopathy have been allowed to fester, with the wild history of Elon Musk still the most glaring example. Musk has committed securities fraud on multiple occasions. But uncomfortable revelations about the world’s wealthiest man are largely ignored. Musk’s backers — who appear to include regulators and much of the US establishment — don’t want to know about them. They’re desperate to greenwash his offences so they can protect their investments in Musk’s growing empire that, if authorities did their jobs properly, would have likely “gone to zero”.

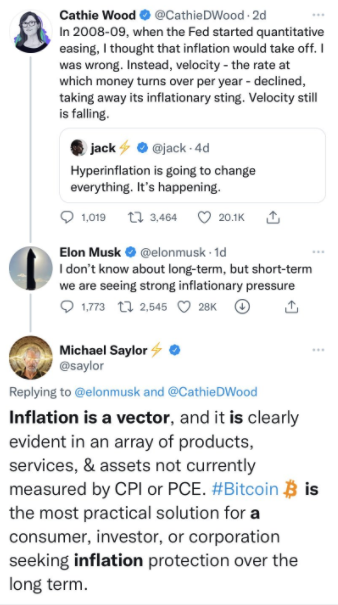

To illustrate Musk’s “dark side”, and the dire consequences of propping up zombie corporations like Tesla, look no further than who we now call upon to answer complex societal problems. Consider four horsemen of the cheap money apocalypse — Elon Musk, ARK Invest CEO Cathie Wood, and two major Bitcoin advocates Michael Saylor and Jack Dorsey — discuss hyperinflation.

Here are four of the biggest beneficiaries of bailout capitalism, whose wealth, fame, and theories have been propped up, multiple times, by the Fed’s absurd interventionist policies, offering the worst thinking imaginable. “Three people who don’t understand either inflation or QE,” economist Frances Coppola said, “are very happy to pontificate about these to their millions of followers.”

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeAll of this high finance is a silly game with potentially disastrous consequences. If the temperature of the Earth drops a couple of degrees in the next ten years, it sounds like there would be another recession because so many companies are banking on rising temperatures. Of course, only the poorer people would suffer.

Good to see some coverage of monetary insanity. Tesla is a valuable company with some real assets and Musk is a somewhat erratic genius at seeing a future. But the valuation of Tesla (nee Musk) can never deliver but the bigger fool theory remains valid – some winners, many losers. Bitcoin is another bigger fool game. Doesn’t matter to many. Inflation is here and likely isn’t going away easily which means some hard times ahead. The pandemic has destroyed some $30T in total real wealth that will take many years to resolve. We were just recovering from the $15T lost in 2000.

I have said Bitcoin is Ponzie for a long time, and so lost the meteoric rise.

I now think it is the economic ‘Preppers’ gearing up for the devaluing of the Global Fiat Currencies. And that is a reasonable expectation. Bitcoin exists outside the Central Banks, and is usable any place in the world, and ‘Crypto’ (hidden). The American preppers buy and hoard their guns and food waiting for the disaster they expect – the economic preppers buy bitcoin.

It still is likely a ‘Pump and Dump

Fugazi, ‘Wolf of Wall St’ https://www.youtube.com/watch?v=xbBD7VIJ4cc

For a really fun clip of how it is….

At least Tesla makes stuff we need. Many of the other big tech companies don’t actually make anything.

They say 20% of the companies on the stock market, USA, are ‘Zombie Companies’ walking dead kept afloat by Bailouts.

“Headlining those stimulus measures, the Fed has been buying $80 billion of Treasurys and $40 billion of mortgage-backed securities every month since June 2020 to help stimulate investment and spur”

This is supposed to begin ‘Tapering’ next month (reducing by some amount, eventually to zero, in the next 9 months or so. Then interest rates will rise also… This according to Powell, head of the FED – but it will not happen, or it will kill the economy dead. When the Zombies go they will drag the living down with them……

Not to mention what rising interest rates will do to housing and all the super leveraged stocks, and the National debt…

I have kept my money in cash and silver/gold all the covid debacle, expecting a collapse on a greater scale than March 2020, on a greater scale than the 2008 GFC. I have lost making huge gains by this, and also lost huge amounts to the stealth tax of inflation.

My problem is I took up with the doom sayers, Jim Rickards, Keiser Report (RT) Jim Rogers, Peter Schiff, Munger even, Kitko, Stansberry, Wealthion, Michael Burry, Harry Dent, George Gammon, and so on (most of them Gold Bugs though, so will be on the crash side). But what the doom sayers say seems so reasonable, so inevitable.

Michael Saylor, Kathy Wood, Musk, Tech – the insane side of prosperity in the destruction of Productivity wile massive debt was created, and then monetized by the Central Banks, QE to infinity. Those 30 Trillion $ pumped out in the West of Stimmie money and QE, and zero interest, acted as a simulacrum of GDP Growth. And the Wealthy doubled their money off it in two years.

To me this was exactly like watching a mass looting of a huge mall – everyone pushing out shopping carts full of Louis Vutton bags, Apple computers, clothes, electronics, and Loot of every kind –

Tesla loses money every car it makes – it makes its money off Carbon Credits, which is total corruption, on top of the Gov handing them the free debt to inflate away, and just the money they pumped into it, bonds bought…

Bitcoin wins as people see the Fiat Currencies cannot survive this debt wile productivity plummets – Bitcoin also mops up money that is in such excess it is looking everywhere for a home….

Wood and Ark, Sayers, Zuckerman, Gates, Dorsey, Bezos, are like the old ‘Daddy Warbucks’ figure of the WWI Billionaire arms dealers. They gain obscene amounts of money by it being redistributed from the workers and middle class to them by the Gov spending, and then the people pay the debt back by inflation Tax stealing their pay and savings. It is the evil side of ‘Corporatism’ and Plutocracy, and sheer corruption.

The Elites are harvesting all your savings and wealth, they are not much different from the Vikings of the 8 – 11th centuries taking Europe and Britain in their plundering and settling. Alll supposedly to ‘Save Lives’.

As you say though, not much has changed. The figures get bigger but that gets lost in the everyday world. People got bored with millions so billions became the aim. People got bored with billions so …….It is all dishonest but wasn’t it always so?

I have to say that the biggest and most damaging dishonesty of all is going to be the banning of discussion about environmental issues. The world is being told, maybe worst of all in your old country, that zillions are to be paid to people who develop these new technologies, even if they don’t work in the end.

What comes after zillions? Is it gazillions?

This is silly at best and just mean at worse. While Elon has his flaws (don’t we all), his ability to negotiate and succeed in three of the worlds most difficult regulatory environments, California, China, and Germany, demonstrates his company is anything other than a fraud which you imply. The man has singlehandedly brought EVs to the market and changed the way transportation will meet its climate change hurdles.

EVs are a scam. The only green alternative to an ICE car is no car i.e. walkable environments.

Elon Musk is to be congratulated for achieving the corporate valuation he has by extremely good personal marketing and, in fairness, being a first mover in high volume production of electric vehicles. Many senior politicians and opinion formers have bought in to his electric energy vision for future transportation.

So many competitors have seen Tesla’s ‘success’ and followed them down the same path without a sensible consideration of the strategic alternatives. Politicians and opinion formers with limited (to non-existent) technical competence are so mesmerised by the aura of Elon Musk and Battery vehicles that they have not taken time to consider the alternatives.

Battery technology is heavy and requires regular lengthy recharging and does not meet the needs of freight transport and other fossil fuel users such as marine, rail and construction. A battery electric vehicle economy will create demands for electric energy that cannot presently be met. Battery technology is a development cul-de-sac.

We should be looking to hydrogen for our future mobile energy needs and avoid the wasted public investment on charging stations. Why is the public sector funding charging stations in the first place? Surely the private sector has funded fossil fuel stations and should thus be investing in the future energy solutions. Maybe their slow uptake should be taken as a sign that this is not a sensible investment opportunity.

It should be noted that Tesla has yet to make a profit and the traditional car industry is catching up fast. Tesla will go the way of many first movers and be superseded by the VAG’s, BMW’s, Ford’s and Mercedes who know how to build cars for a price and have the technical skills to adopt electric powertrains.

Yes, very good. I agree on most things but believe the main downsides of battery technology are the mining and disposal of the chemicals in the batteries. When Tesla started they cleverly bought all of the Lithium mines, which were mainly in Africa. Since then China has joined in and has a major control.

Batteries themselves might not be such a bad idea for delivery vans in big cities. For my first job in the 70s I worked for a company called Chloride Batteries. They boasted then that they had had battery-powered vans working in London for over 10 years, so since the 60s. Of course this didn’t mean Li batteries which came much later. The idea of the trial was that the vans worked from a depot where they had battery charging facilities and spare batteries. They worked on quick-fit, change-over so the vans drove in empty after their rounds and just changed batteries when they were being re-loaded. Not such a bad idea.

Hydrogen for cars, yes. Not sure about very big vehicles. Brazil runs on alcohol distilled from sugar cane, introduced by the government when the demand for sugar cane decreased. When I was in Sweden in 2006 they sold alcohol for cars but not sure about today.

Pleased that that was an “explainer”. Hardly understood a word of it or on what side of what position the writer was taking.

The willingness of people to invest in Tesla and bitcoins provides excellent evidence for John Michael Greer’s article on magic.