This week we witnessed the latest — and perhaps more striking — sign that crypto might not be the future of finance. On Tuesday, Sam Bankman-Fried, founder of FTX, a huge crypto exchange, opened a can of worms by describing “yield farming” — crypto’s makeshift alternative to traditional bank lending — as a Ponzi scheme.

“You start with a company that builds a box,” he said in the latest episode of Bloomberg’s Odd Lots podcast, and “maybe for now actually ignore what it does or pretend it does literally nothing … pour another $300 million in the box and you get a psych and then it goes to infinity … then everyone makes money.”

A stunned guest host and journalist Matt Levine replied with the following: “that was so much more cynical than how I would’ve described farming. You’re just like, ‘well, I’m in the Ponzi business and it’s pretty good’”.

Yes, this actually happened. Here was the most prominent figure in the crypto space, on an extremely renowned financial podcast, openly admitting a major part of the crypto ecosystem was a sham.

Defining whether or not something is — or has become — a Ponzi scheme has been long forgotten; it involves working out if an investment’s underlying structure creates a negative-sum game. With regulated securities, such as stocks and bonds, investors receive a combination of interest payments, dividends, and cash flows, making these, at the very least, a zero-sum endeavour. With crypto, however, investors receive none of these, only benefiting from a potential rise in price — the so-called greater fool theory.

This disparity, among other things, has led many financial commentators to describe even the number one crypto, Bitcoin, as a negative-sum Ponzi scheme (one FT story suggested it was even ‘worse’ than that). If Bitcoin’s ecosystem collapses, funds can’t be returned to holders because its price going to zero means there’s nothing to recover. But with a Ponzi scheme, funds can be recovered and returned to investors. Following the collapse of the infamous Madoff Ponzi scheme, 14 out of 20 billion dollars initially invested have been recovered from offshore accounts.

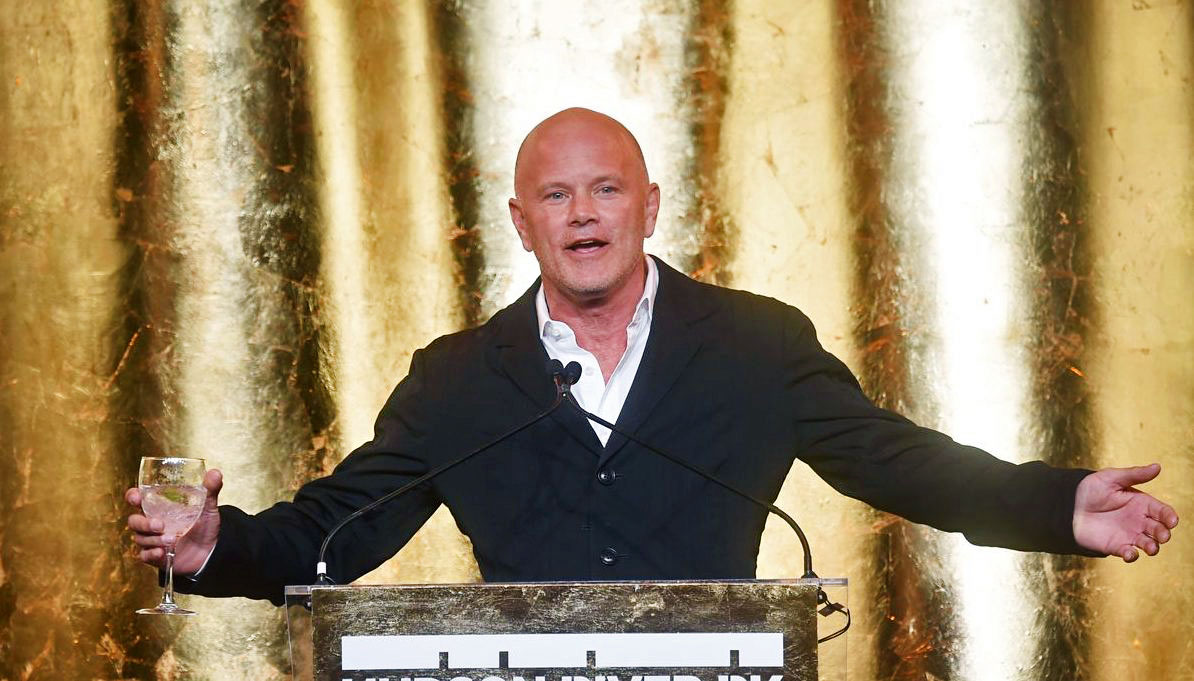

For now, Bitcoin’s Ponzi status is irrelevant. Bankman-Fried has simply joined the increasing list of crypto’s nobility who’ve accidentally gloated about profiting from dubious financial structures. Mike Novogratz, CEO of Galaxy Investment Partners, infamously likened Bitcoin to a pyramid scheme, despite how his company’s primary function is cryptocurrency investments. Meanwhile, outlets in the crypto media have also embraced Ponzinomics, like CoinDesk publishing an article with a lede reading: “Yes, it’s a Ponzi scheme. But who cares?” Not the regulators, it seems.

These candid brags are akin to those of the subprime era, when contemptible realtors wrote risky loans to the vulnerable, knowing they could never make payments, and sold these off to the banks. In a scene from the now-classic movie The Big Short, fictional hedge fund manager Mark Baum and his crew interviewed a couple of dubious agents, who jokingly divulged they were leaving “the income section blank” to underwrite a greater number of mortgages. During a brief intermission, Baum asked his associate why these realtors were so admitting.

“They’re not confessing,” he replied. “They’re bragging.”

It’s now clear that we’ve entered a similar bragging phase in the crypto bubble. When will this bubble burst?

Greg Barker is an independent journalist and quant, who also writes under the name Concoda. You can find him on Substack and Twitter at @concodanomics.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe