Since the last global property bubble in 2006-07 and the financial crisis that resulted from it, central banks have held interest rates close to zero. While few have paid attention, this has led to a reflation of many of the same property bubbles that caused the disaster to begin with. A perusal of the excellent global house price index published by The Economist shows that, since 2008, most housing markets around the world are either registering record valuations or are close to previous records.

Inflation-adjusted house prices across the Western world are reaching their previous peaks, but with interest rates climbing that looks set to change. Over the Atlantic, American house prices have been falling as Canada endures its first annual decline in over a decade. In Europe, British house prices have been falling for four months while the former governor of the Swedish central bank is warning that his country faces a “day of reckoning”.

Does this mean that the world is facing down another 2008-style housing and financial crisis? Quite possibly. But to see if this is a possibility, we need to check a few other metrics. First and foremost is how dependent our economies are on the housing market. House price changes do not hit the economy directly. Rather, the impact on the economy manifests itself as investment; as home-building dries up, builders are then laid off and, through this channel, spending declines.

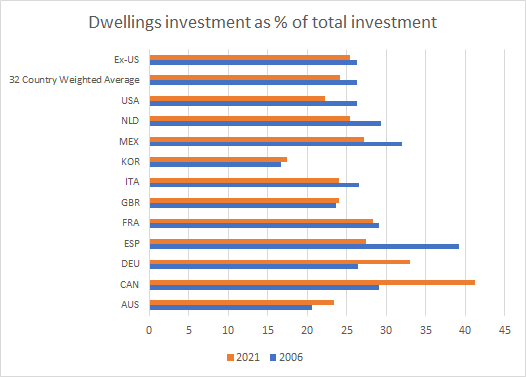

To see how reliant our economies are on booming housing markets, it is worth looking at investment in dwellings as a percentage of total investment. The chart below compares the levels at the height of the last housing bubble in 2006 with 2021.

As the chart shows, our economies have become extremely reliant on homebuilding again. Considering that homebuilding made up for 26% of total investment in 2006, the difference isn’t all that great from today, which is 24%.

Then there is the threat this poses to the financial system. In 2008, we saw an enormous financial crisis as mortgage-holders could no longer afford to repay their loans in the face of rising interest rates. As these loans soured, the public was made aware of a previously arcane financial product called the ‘mortgage-backed security’ that packaged multiple mortgages together and sold them to investors, banks, and pension funds.

Looking at the data on mortgage-backed securities in the United States today, it paints a grim picture. Mortgage-backed securities held by commercial banks have risen from around $990 billion in 2009 to around $2.7 trillion today — in other words, a roughly threefold increase. While we may have expected banks to have learned their lessons the last time around, it appears that low interest rates have pursued them to forgive and forget and once again take the plunge into the market for mortgage-backed securities.

Since October, it has been reported that mortgage defaults are already taking place in the highest risk category of borrower. Meanwhile risk metrics show the potential for a mass default event rising and rising. While the looming housing collapse may not be as bad as the previous edition, it nevertheless looks like it could be quite painful. Considering that the rest of the economy is now much weaker than it was last time around, it could produce similar overall results.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe