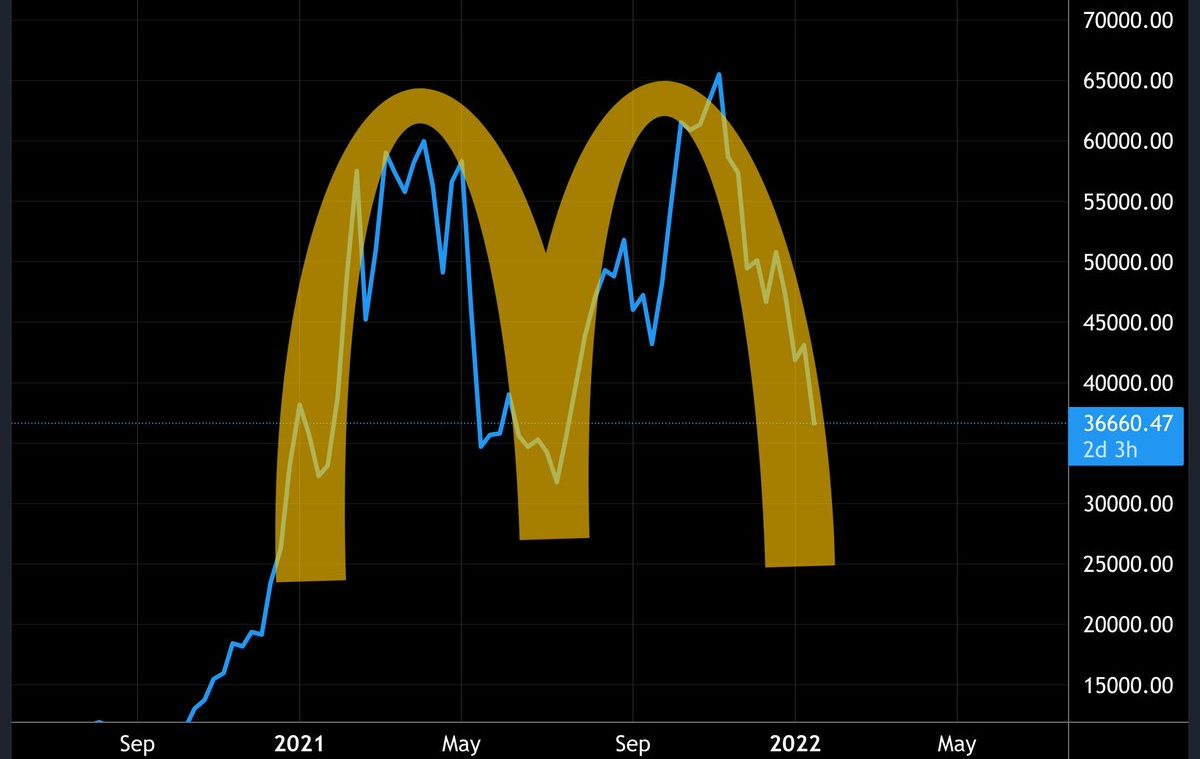

The McDonald’s Bitcoin meme — where newly impoverished crypto investors depict themselves sporting the fast-food behemoth’s iconic logo — perfectly captured the sentiment of crypto enthusiasts this week. During what looks to be the latter part of the latest crypto crash, the McDonald’s logo manifested itself on Bitcoin’s long-term chart (above).

The recent rout — in which the Bitcoin price fell to as low as $34,000 — arrived two months after the cryptocurrency reached its highest level of adoption. Similar to investors of other dubious assets (like the now-disgraced fund manager Cathie Wood’s so-called Innovation ETF), new Bitcoin “HODLers” have lost almost 40% of their holdings in just a few months. As for altcoin investors, they have endured even greater losses.

Once again, we’re at that familiar moment where it looks like it’s all over for Bitcoin bulls, and then usually see prices not only bounce back but reach all-time highs. Will this time be different? Well, that depends on the regulators. If the damage to retail investors’ purses is too much for the authorities to ignore, Bitcoin and other cryptocurrencies might be in serious trouble. But this means that authorities face the ultimate regulatory dilemma: how do you take down a global market for privately-issued digital money, especially one that’s already installed its influence in high-up places?

The lust for massive financial gains via Bitcoin has created conflicts of interest between the crypto underworld and public figures. Former Interpol arrestee and Tether co-founder Brock Pierce mingles with high-profile characters like NYC Mayor Eric Adams (who regrettably announced he would convert his first pay cheque into Bitcoin right before the crash). Meanwhile, the CTO of Bitfinex and Tether, Paolo Ardoino, can nonchalantly hold a speech in public, go back to his home office, and print billions of dollars in fake currency. You’d think he’d be called into question for running a counterfeit operation that creators of digital cash pre-cryptocurrency are serving jail time for, but no.

It goes all the way up to the White House. The billionaire founder of the crypto exchange FTX, Sam Bankman-Fried, was one of Joe Biden’s top political donors. And politicians have up hundreds of thousands in cryptocurrency. Many members of congress openly hold the fluorescent orange coin, such as Cynthia Lummis and Pat Toomey, who tried to prevent an anti-crypto bill from passing through the Senate.

The resistance to regulation goes even wider. Even if public servants gave up their Bitcoin to protect the sanctity of the U.S. dollar (or to just follow standard counterfeiting laws) authorities would still have to bring down the major players (Tether, Bitfinex, and Blockstream). But since these are elusive global entities, the only way of thwarting them is to devise a globally coordinated crackdown through the Financial Action Task Force (FATF), the sole intergovernmental agency that tackles money laundering.

Of course, if you somehow manage to pull off a global anti-crypto cooperative, during a period of ever-increasing geopolitical tensions, it’s doubtful if this will still lead to a crypto prohibition. The likelihood at this point must be that regulation will not happen, and that Bitcoin will rise — and fall — again.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe