“The dream of the 90s is alive in Portland,” sang the protagonists of a US comedy series from a few years back, which mocked the city’s reputation as a haven for hipsters. However, it is not only hipsters that are seemingly stuck in the 1990s, but a good part of the UK political establishment as well.

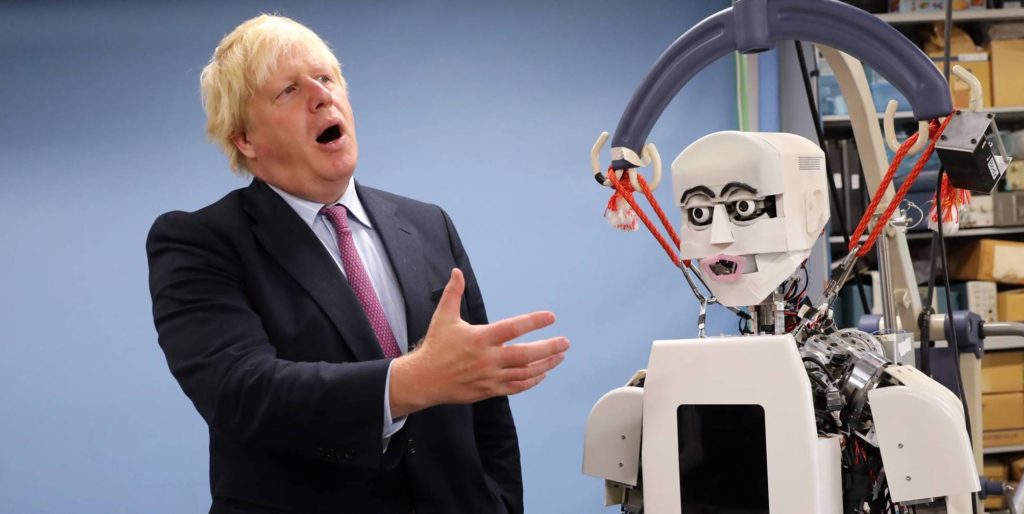

Take William Hague’s editorial in The Telegraph today, in which the former leader of the Conservative party urges Boris Johnson to scrap his opposition to European state aid rules, which has apparently emerged as a key stumbling block over a new trade deal with the EU, raising once again the prospect of a no-deal outcome.

The UK’s negotiator, Lord David Frost, claims that such rules represent an “infringement on [British] sovereignty” and would prevent the country from adequately supporting its industries in the future, particularly in the high-tech sector. Hague dismisses such claims, arguing that Britain’s industries don’t require state support to remain competitive — all they need is for the government to “provide the funding for pure research, open their country to talented people, and keep a tax system that encourages risk-taking”.

Hague’s ideas come straight out of the neoliberal gospel of the 1990s: let the “animal spirits” of capitalism rein free, with minimal government interference, and the free market will deliver optimal outcomes for all.

Recent history, however, has proven this view to be tragically wrong. The financial crisis of 2007-9, and the subsequent recession, are clear evidence of the markets’ inability, if left to their own devices, to efficiently allocate resources between the various sectors of the economy. Indeed, the world’s most competitive economies — Canada, Germany, Japan, South Korea and more recently, and most obviously, China — all rely on heavy state support (both direct and indirect) to their manufacturing sectors.

The EU itself is fully aware of this, as evidenced by its willingness to waver its state aid rules whenever it has been in the interest of its major players, most notably France and Germany, to do so (not to mention whenever banks have needed to get bailed out).

However, the EU’s à la carte approach to its own rules is no good reason to place crucial decisions concerning the future of the UK in the hands of the European Commission. Moreover, following the ongoing global pandemic, state intervention in the economy is inevitably destined to become more pervasive, in order to keep industries afloat and stabilise jobs, investments and incomes in an economic environment that is bound to remain highly volatile for a long time to come.

Thus, binding the country to outdated rules that were dreamed up in a completely different era (and which were never grounded in reality in the first place) makes absolutely no sense today, even from a strictly “capitalist” competitiveness-based view of the economy.

Of course, it makes even less sense from a “socialist” perspective: extending democratic control over the economy, by expanding the state’s role (and downsizing the private sector’s role), in the investment production and distribution system — i.e., in deciding what is produced, how, for whom, and for what ends — should surely be a key aim of socialists, regardless of who happens to currently sit in government.

This is especially true if we consider that we cannot expect markets, with their focus on short-term profits, to spearhead any of the structural changes needed to deal with the social, economic, political and ecological crises that the world is facing today. So why are my fellow socialists not backing Boris’ stance on state aid?

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe