Why is the Government talking-up tax rises? Surely, what our pulverised economy needs right now is a tax cut.

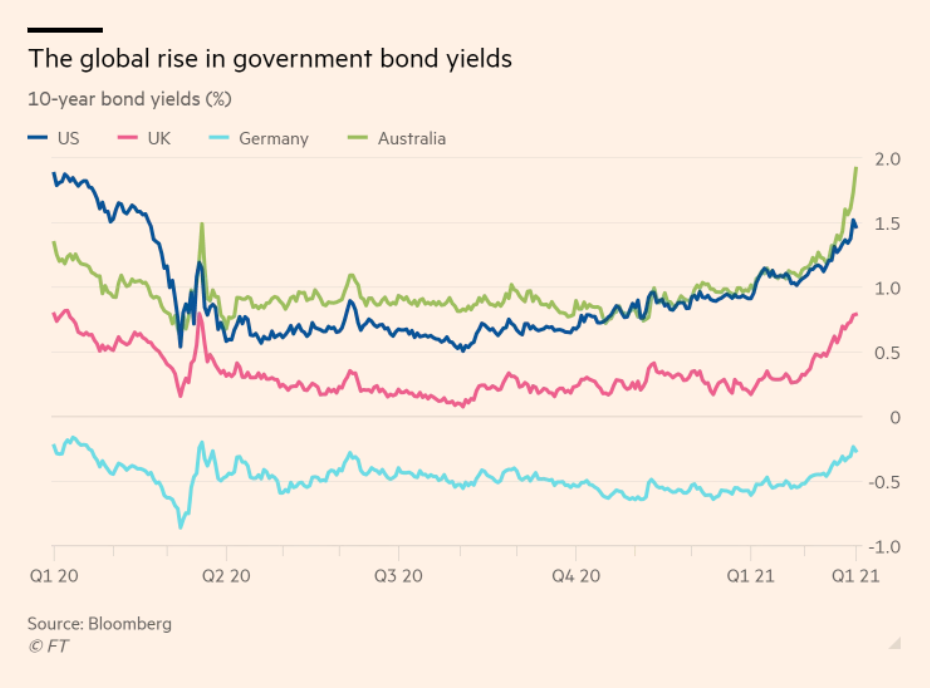

Well, yes — a confident Chancellor would be unveiling as much stimulus as possible in this week’s Budget. But if you want to know what’s got Rishi Sunak spooked, take a look at the following chart:

This shows bond yields — i.e. the rate of interest at which the money markets lend to governments. As you can see, these are ticking-up quite sharply. The idea that governments can borrow at “record low interest rates” cannot be taken for granted.

There has to be some limit to each country’s debt mountain — and by demanding a higher return the bond markets are sending a signal that those limits are within sight.

On his Substack, Adam Tooze writes about the role played by ‘bond vigilantes’ — meaning the role that the markets play in constraining government policy. Tooze has his doubts about traders acting deliberately to clip the wings of the state. Even in cases like the Eurozone sovereign debt crisis, when rocketing bond yields threatened to bankrupt countries like Greece and blow-up the single currency, he suspects that the markets were only acting in response to political priorities:

In other words, the markets only do what powerful governments ultimately want and allow them to do.

I’m sure that’s true — up to a point. Let’s not forget that the markets aren’t obliged to lend to us at next-to-no interest. If they decline to continue the supply of ultra cheap credit, then that is an act of self-preservation not political interference.

Of course, I can understand if Left-wingers don’t like the idea of the state being dependent on the patience of private capital. That being the case, however, it is for the Left to tell us how else they propose to finance the deficit.

The options include the state borrowing heavily from its own citizens — as the Japanese government does. Then there’s quantitative easing — i.e. the central bank ‘prints’ money and uses it to buy bonds back from the market. Finally, the state could do without the bond markets altogether, and directly create all the money it needs to spend (which is what the Modern Monetary Theorists propose).

And yet that still leaves the foreign exchange markets to deal with. A government that indulges in too much borrowing or too much money-printing will find that its currency becomes devalued — meaning that imports become prohibitively expensive.

This is not to argue for another decade of austerity. Governments are not like households and deficit financing has its place. The ability of the state to borrow and print money is a precious resource. However, it is also finite. We must use it accordingly.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe