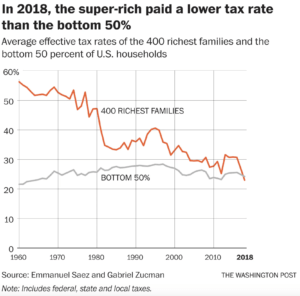

Well, it’s finally happened – America now has a regressive tax system in which the 400 richest families pay a lower effective rate than the poorest 50% of Americans.

That’s according to Christopher Ingraham in the Washington Post, who reports on the latest research into what different income groups actually pay in terms of all taxes, not just income tax :

The following graph shows that the super-rich used to pay a lot more but that the gap has now not only disappeared but gone negative for the first time:

Presidential contender Elizabeth Warren has a plan to put that right. This is her “Ultra Millionaire Tax“, which happens to quote the economists who produced the above research:

This week also brings news that Warren has moved into poll position in the race for the Democratic nomination. Donald Trump who used to call her “fake Pocahontas” has upgraded his insults, now describing her as “Uber Left.”

I’m not sure this will work for him. The idea that super millionaires should pay a higher rate tax than working class and middle class Americans, will strike most voters as fair not Leftwing.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe