Narratives, the Nobel Laureate Robert Schiller reminds us, drive both markets and economies. Lately, the story that has driven the American stock market to new heights, led by the Magnificent Seven tech companies at the vanguard of it all, has been the AI revolution. But recently the Magnificent Seven have started to falter, and on Wednesday they drove market indices to their sharpest declines in two years.

Until now, the decline was driven by a rotation out of tech stocks and into the broader market — or, in market jargon, from growth to value stocks. Driving the shift were recent reports suggesting the economy might be on its way to a “soft landing” of lower inflation but continued growth, which would allow the Federal Reserve to cut interest rates. Such a scenario would mean the innovation boom might slow, but that reliable companies selling the quotidian things we all want would start to prosper. So while the Big Tech stocks took a bruising, the broader market of smaller companies did better.

However, a new narrative is also doing the rounds. Some wonder if the good days are behind us, worried that the economy may contract rapidly and sink into recession, or that inflation might turn back up and postpone rate cuts. As a result, some investors have begun to cash out and seek shelter.

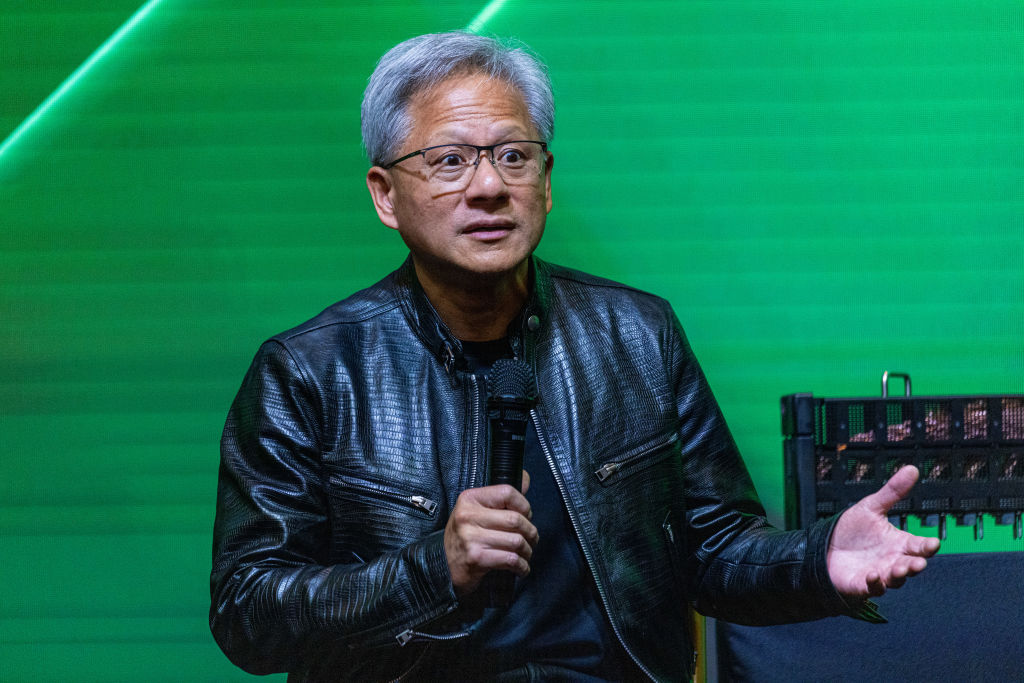

Behind this caution is a growing worry that the AI story may turn out to be a fairy tale. Nvidia’s stellar performance this year is as real as it can be, built on soaring earnings and massive sales. However, Nvidia isn’t making AI. It’s making the chips and software that other companies need to create AI.

Similarly, the explosion of data-centre construction, while equally real and lucrative, isn’t giving us any AI products. It’s just adding the capacity that will be needed for AI systems to operate. While this infrastructure is tangible, thereby justifying the valuations of the companies involved, the expansion in capacity will only make sense if further innovations in AI render it useable. And given how expensive all this is, further innovations in AI will need to be as truly transformative as its exponents claim they will be, if all this is to make any sense.

And that’s a big if. AI has given us some nifty new tools, such as ChatGPT. But so far, their impact on the overall productivity of the economy has been pretty underwhelming. We’re still waiting for the “killer app” that is going to play the 21st-century role that the spinning jenny did in its day.

In that respect, Nvidia has been likened to a shovel-maker at the start of a gold rush: orders are piling in, making the company rich, but if no gold is found the shovels will become worthless. By the same token, should the economy slow more than expected and the source of new investment dry up, the innovation machine may grind to a halt before that killer app is found.

That’s where we find ourselves now, in that anxious moment where expectations remain high but doubts are creeping in. Any number of events could permanently change the dominant narrative — the soft landing could turn into a hard landing, inflation could tip back up, or the doubts about AI could become inescapable. If, say, Nvidia’s earnings next month disappoint, that could suggest the companies buying its chips to develop new products are losing faith that those products merit further investment.

So while we watch and wait, we can probably also assume that this correction hasn’t yet run its course.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe