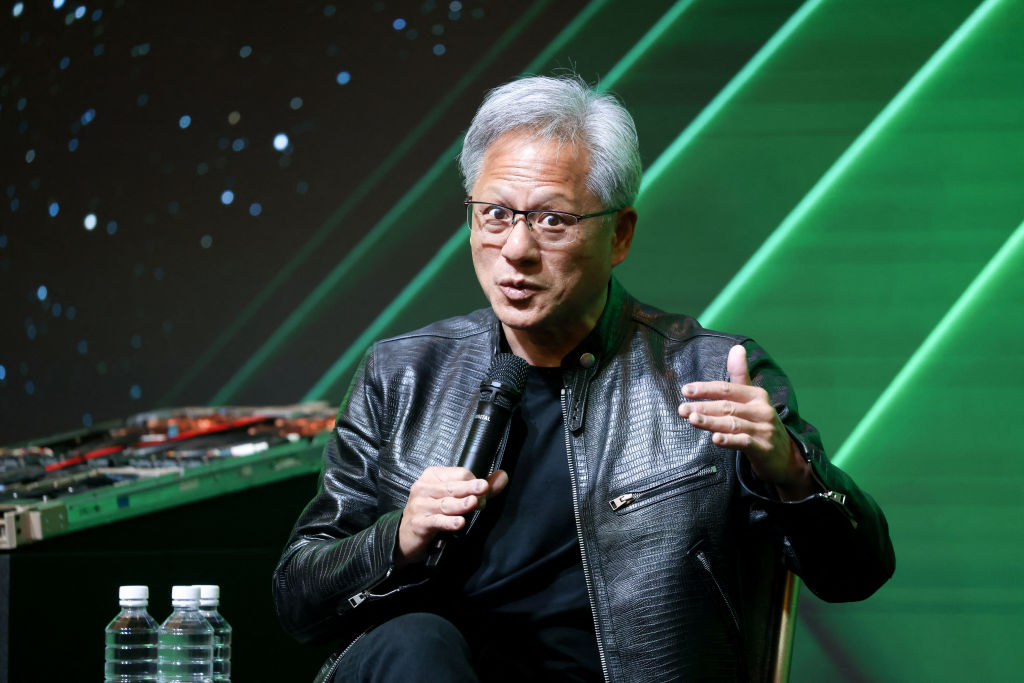

The AI rally steams onward, lifting the US stock market to new highs and raising its share of global market cap to its highest level since the financial crisis. The infectious optimism has led many brokerages to raise their targets for the S&P 500, with some foreseeing a rise of another 10% by the end of the year. Leading the charge has been Nvidia, the chipmaker whose earnings have been growing by 50% per year.

So its sudden recent implosion, its stock shedding half a billion dollars of worth in just a week (before correcting somewhat), can’t help but ring alarm bells. That’s because, when AI-related stocks are taken out of the mix, the rest of the stock market has actually been falling. In fact, so have a wide suite of assets. Commercial real estate keeps imploding; government bonds, despite rebounding from last year’s lows, are several years into what appears to be a long bear market; crypto is having an especially rough ride just now, with Bitcoin down more than 20% since its peak earlier this year; and the stock markets of most other developed countries have bucked the American trend and begun sliding over the last month.

The falls everywhere else may reflect a major rebalancing, as money from around the world rushes into the American companies leading the AI revolution. If that’s what’s happening, the rest of the economy will begin to capture the productivity gains of the AI giants, and the wider market will in due course get dragged in its wake. What has happened to Nvidia may thus be just a brief correction in an otherwise continued ascent.

Still, it’s also possible that Nvidia’s wobbles are a warning of what may lie ahead. Although some analysts insist the productivity impacts of AI will be huge, we don’t yet know what they will be. In the meantime, extrapolating from Nvidia’s exceptional earnings to make predictions for the rest of the AI sector, let alone the broader market, may be a bit of a stretch. So it may just be that doubts are beginning to creep into the market.

The concentration of the market’s gains in a diminishing number of stocks may instead represent something altogether different from widening confidence, being instead more of a narrowing focus. It may be that the overall market has hit an iceberg and the message just hasn’t reached the ballroom, that iceberg being market liquidity. There are early signs that the freely available money which powered the everything-rally of the last few years may now be freezing up.

As the message from central banks slowly sinks into investors — that whether any or many interest-rate cuts come this year, we will nonetheless probably never again know the ultra-low rates of the past — they may be finally starting to tighten their belts. In that case, they may be cutting back and focusing their funds on the handful of companies that still promise outsized returns. Just as the Titanic’s stern rose high into the air as the rest of the ship sank below the water line, the market may be making a final surge before it all comes falling down.

Eventually one of these two narratives — that we are at the end of the beginning of a whole new era, or the beginning of the end of an old one — will prevail. Until then, this ride is likely to stay wild, with a few very big winners but plenty of losers. As for Nvidia, it will get even more attention than usual, as resuming falls signal trouble ahead for the overall market.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe