The decline of American manufacturing has been a cause for concern for decades. A point of focus for Donald Trump’s 2016 presidential campaign, his successor Joe Biden has — ironically — continued and expanded this agenda for reshoring manufacturing.

As part of his plan to “build back better”, Biden pushed through the Inflation Reduction Act (IRA) and the CHIPS and Science Act (CHIPS), which were designed to promote economic activity in domestic manufacturing — mainly green energy technology and semiconductors. Most importantly, both sets of legislation provide significant government subsidies to these sectors.

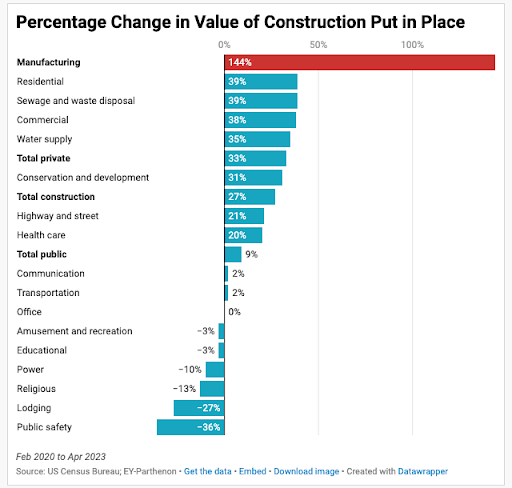

To understand if this initiative is having any effect on the market, a helpful proxy is current construction spending in manufacturing in the US. From February 2020 to April 2023, total construction spending saw a 27% increase. Within that field, manufacturing grew by a whopping 144%, with construction spending increasing by about $122 billion. This is unquestionably a significant jump, but is it going to Biden’s preferred sectors?

The CHIPS Act put a heavy emphasis on semiconductors because of geopolitical concerns. Consequently, more than 40% of recent manufacturing construction spending is in the computer/electronic/electrical (CEE) sector, which includes semiconductors. When examining the trends across these sectors, CEE appears to be driving almost all of the growth in construction spending. This means that increased activity in the semiconductor industry is happening, as far as construction of factories is concerned.

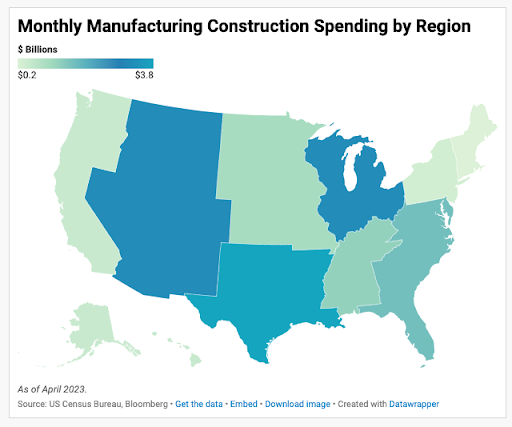

In an effort to de-risk its dependence on Taiwan as a semiconductor source, the US has made efforts to transfer Taiwanese operations, labour and capital to America. For example, the Taiwanese have broken ground on a massive semiconductor plant in Arizona that was spurred on by Trump’s strategy and continued by Biden, representing a clear boost in US manufacturing competitiveness. This project makes up a large part of the US mountain region’s $3.2 billion in recent monthly spending.

The fabled US Rust Belt has seen a relatively smaller share of spending. These areas tend to vote Democrat but also were prime locations for Trump-style populism. Rather, it is the bigger southwestern area led by Arizona and Texas that has been on the radar of American industrialists as a replacement for the Rust Belt due to its lower tax, labour, and energy costs.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeBiden thinks that Studebaker still make cars…

Biden thinks that Studebaker still make cars…

“…but what is still not proven is whether this construction spending can translate into robust economic growth and security that prevents China from superseding America.“

Hasn’t China’s economy already exceeded the US by purchasing power parity?

Besides, what difference does it make?

The military and technological capacity of the US is what supports our ability to position the dollar as the world’s reserve currency.

The dollar’s status as the world’s reserve currency is what allows the US an almost infinite capacity for borrowing.

Borrowing in US dollars is what supports American’s lifestyles.

Americans lifestyles will not be threatened as long as America has the technology and military capacity to defend the dollars status.

The size of a nation’s economy is only an indirect measurement of that capacity.

I think that’s true as long as people are purchasing the US dollar. There have been daily stories for years now about why that is coming to an end, but it hasn’t happened yet.

I think that’s true as long as people are purchasing the US dollar. There have been daily stories for years now about why that is coming to an end, but it hasn’t happened yet.

“…but what is still not proven is whether this construction spending can translate into robust economic growth and security that prevents China from superseding America.“

Hasn’t China’s economy already exceeded the US by purchasing power parity?

Besides, what difference does it make?

The military and technological capacity of the US is what supports our ability to position the dollar as the world’s reserve currency.

The dollar’s status as the world’s reserve currency is what allows the US an almost infinite capacity for borrowing.

Borrowing in US dollars is what supports American’s lifestyles.

Americans lifestyles will not be threatened as long as America has the technology and military capacity to defend the dollars status.

The size of a nation’s economy is only an indirect measurement of that capacity.

man u facturing?… like soo sexist n stuff yurr?? and also what about man city facturing yurr? Nonbinarym/fufacturing?

man u facturing?… like soo sexist n stuff yurr?? and also what about man city facturing yurr? Nonbinarym/fufacturing?

In other words, 50 years of hollowing out of the American industry and manufacturing is not completely undone in 3-5 short years. Wow, what a surprise! Basically, the author is making an extremely obvious point – that more needs to be done. Fair point, and thanks for making it, but I’m guessing that another 10-40 years will be need to revert back to what America had before. By the way, what is Britain doing with the Falklands these days? It’s the forgotten land, won back, and neglected forevermore. How about making it into the next Big Thing?

Britain isn’t “doing” anything with the Falklands. But as a self-governing British Overseas Territory, the Falklands are doing very well for themselves.

https://www.thetimes.co.uk/article/how-the-falkland-islands-became-one-of-the-worlds-most-affluent-places-f9kc8fzjk#:~:text=The%20conflict%20generated%20unprecedented%20economic,Britain%2C%20and%20just%20as%20cosmopolitan.

Like Bermuda?

Like Bermuda?

Britain isn’t “doing” anything with the Falklands. But as a self-governing British Overseas Territory, the Falklands are doing very well for themselves.

https://www.thetimes.co.uk/article/how-the-falkland-islands-became-one-of-the-worlds-most-affluent-places-f9kc8fzjk#:~:text=The%20conflict%20generated%20unprecedented%20economic,Britain%2C%20and%20just%20as%20cosmopolitan.

In other words, 50 years of hollowing out of the American industry and manufacturing is not completely undone in 3-5 short years. Wow, what a surprise! Basically, the author is making an extremely obvious point – that more needs to be done. Fair point, and thanks for making it, but I’m guessing that another 10-40 years will be need to revert back to what America had before. By the way, what is Britain doing with the Falklands these days? It’s the forgotten land, won back, and neglected forevermore. How about making it into the next Big Thing?