Across Europe, once mighty parties of the mainstream Left have withered away. The standard explanation is that they alienated their working class supporters on social issues like immigration.

But that’s not the whole story. In some countries, the centre-Left has also lost the plot on bread-and-butter economic issues too. A case in point is Italy where the Democratic Party (PD) — the most conventionally ‘progressive’ of the four biggest parties — is the one seeking to cut benefits for the poor.

In a piece for Foreign Policy, Georgio Ghiglioni explains how welfare policies have become associated with Italy various populist parties, while opposition to those policies and support for budgetary restraint has become PD’s thing:

In the smallest sense of the word, the progressive party is becoming ‘conservative’ — the primary supporter of the status quo.

Of course, in Italy and elsewhere it’s important to understand what the status quo is — and that is a system of spending controls imposed on nominally sovereign states by the European Central Bank and other EU institutions.

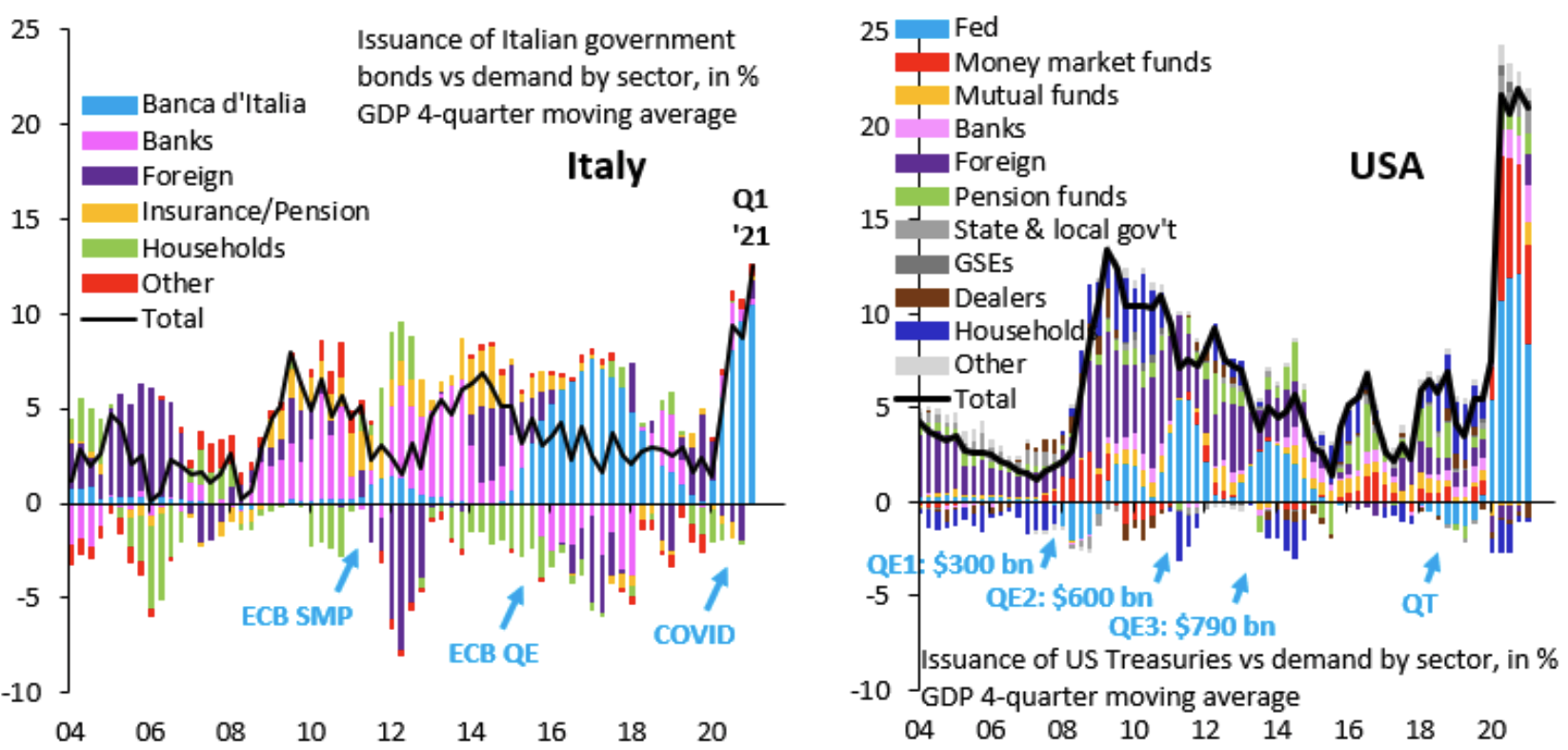

Right now, one else apart from the Bank of Italy (i.e. the ECB’s local branch office) is buying Italian government bonds. Just look at these two charts, tweeted out by the economist Robin Brooks. What they show, for Italy and the US, is how much debt (in the form of bonds) is being issued by each country’s government — and who’s been buying it.

As you can see, in both countries, the central bank steps in at times of crisis to become the lender of last resort — literally creating money out of nothing and using it to buy up bonds. This allows governments to run bigger deficits. The key difference is the totality of the Italian government’s dependency. When things get rough — like during the Eurozone crisis and now with the Covid crisis — just about everyone except the ECB stops lending to Italy.

The ECB, therefore, is in a supremely powerful position to dictate terms to the Italian government. Of course, it needs local agents — which is why the unelected Prime Minister, Mario Draghi (a former President of the ECB) has been installed as de facto viceroy. And it’s why the PD has emerged as the viceregal party.

Support for institutions against rampaging populists provides moral legitimacy for this role. However, within the context of the single currency, these institutions have become instruments of foreign control — a state of affairs the populists can exploit as a never-failing fountain of resentment.

It is a deeply unhealthy situation — which should horrify progressives and conservatives alike.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe