Globalisation is becoming an increasingly dirty word — and for good reason. Over the last two to three decades, the West’s opening up to low-cost, export-oriented economies like China has hurt the working class and made us worryingly dependent on distant and fragile supply chains.

But did all that free movement of labour, capital, goods and services make us as rich as we were promised? A stunning set of charts from American Compass provides part of the answer (and from a US perspective, obviously).

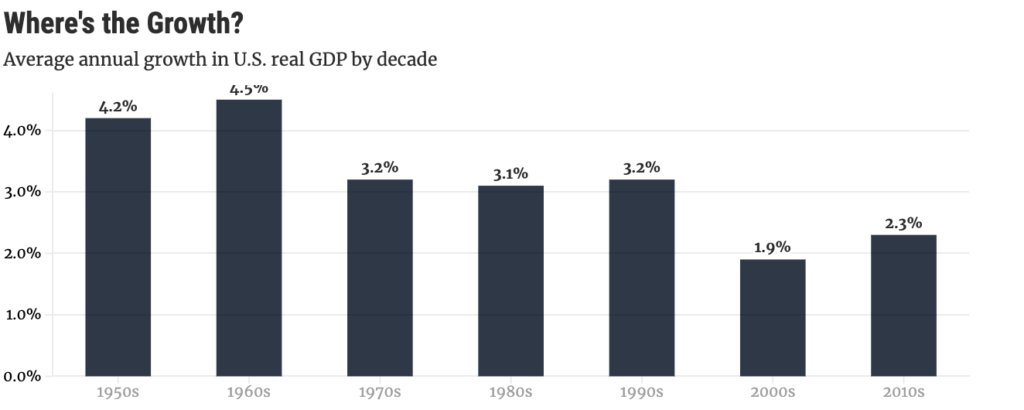

Let’s start with growth. The good news is that the US economy has continued to get bigger — and so Americans are richer than they’ve ever been before. However, in the 21st century the rate of growth has been significantly lower than in previous decades — an average of 1.9% during the 2000s and 2.3% during the 2020s, compared to more than 3% in the 1970s, 80s and 90s.

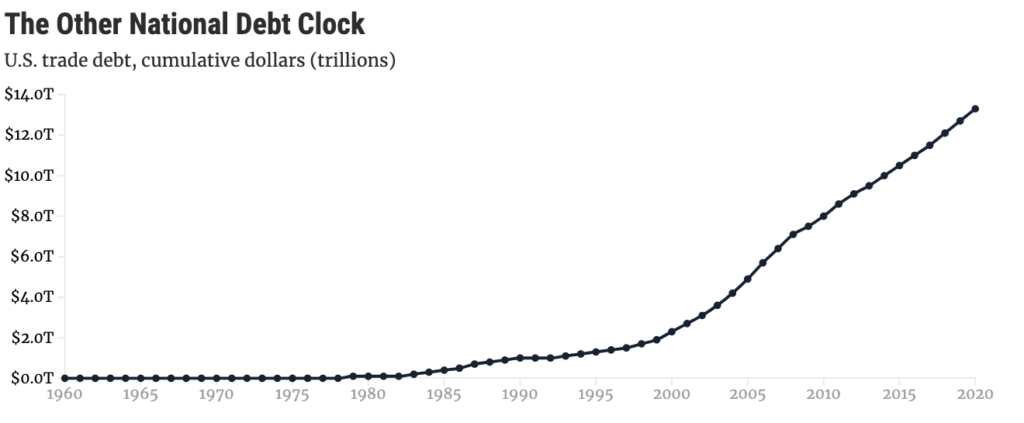

Another problem is chronic trade deficits. It turns out that these are not self-correcting. America’s cumulative trade deficit has ballooned from over $2 trillion at the start of the century to nearly $14 trillion twenty years later.

How is this being paid for? “With financial assets—claims against the nation’s prosperity that will burden future generations.” One can argue that globalisation has increased the supply of cheap credit to our benefit. But if all that opening up was supposed to be so good for the West, then why do we need so much debt just to get by?

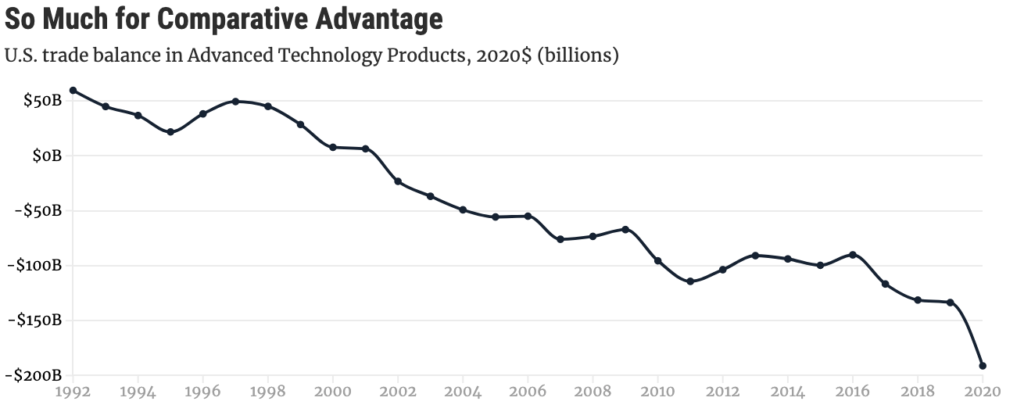

We were also told that globalisation would liberate the West to specialise in the economic activities where we can add the greatest value. Let other countries make the basic stuff, while we concentrate on the leading edge. But look at what’s happened to America’s trade balance in advanced technology products. It has deteriorated from a surplus in the 1990s to a near $200 billion deficit by 2020.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeCost of living…

Younger generation struggling to afford a mortgage despite being in “good jobs”…

WEF control of sovereign leaders for NWO ideology…Net Zero…Covid lockdowns…

Globalisation hasn’t been great imho

Erratum: ‘2.3% during the 2020s,’ should be 2010s.

Thanks for digging out the figures. I do hope we wean ourselves off Chinese dependency somehow. Perhaps Covid and Ukraine might force that to happen.

Excellent article. Short, sharp, and to the point.

What I cant get my head around is that people were forecasting all this from the get go – it seems that the decisions were made by those who stood to gain the providence of all that created debt, knew full well where offshoring would lead and selfishly ,some might say psychopathically , pushed it cynically through. Sad.