Globalisation is becoming an increasingly dirty word — and for good reason. Over the last two to three decades, the West’s opening up to low-cost, export-oriented economies like China has hurt the working class and made us worryingly dependent on distant and fragile supply chains.

But did all that free movement of labour, capital, goods and services make us as rich as we were promised? A stunning set of charts from American Compass provides part of the answer (and from a US perspective, obviously).

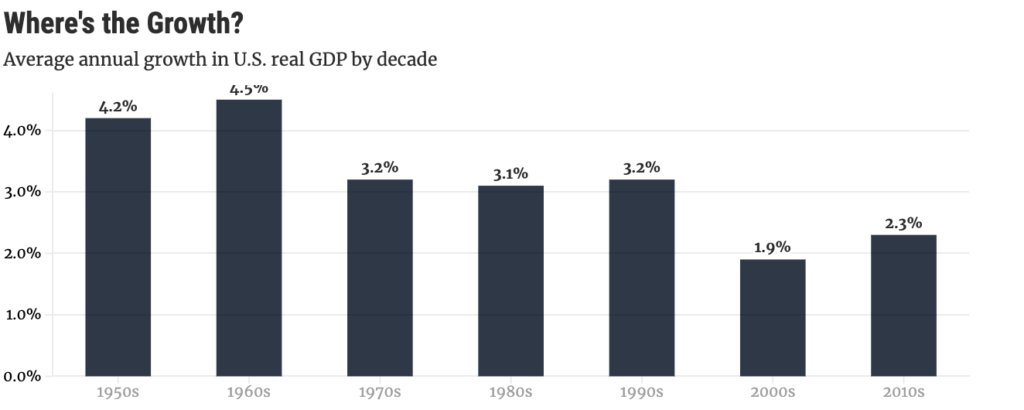

Let’s start with growth. The good news is that the US economy has continued to get bigger — and so Americans are richer than they’ve ever been before. However, in the 21st century the rate of growth has been significantly lower than in previous decades — an average of 1.9% during the 2000s and 2.3% during the 2020s, compared to more than 3% in the 1970s, 80s and 90s.

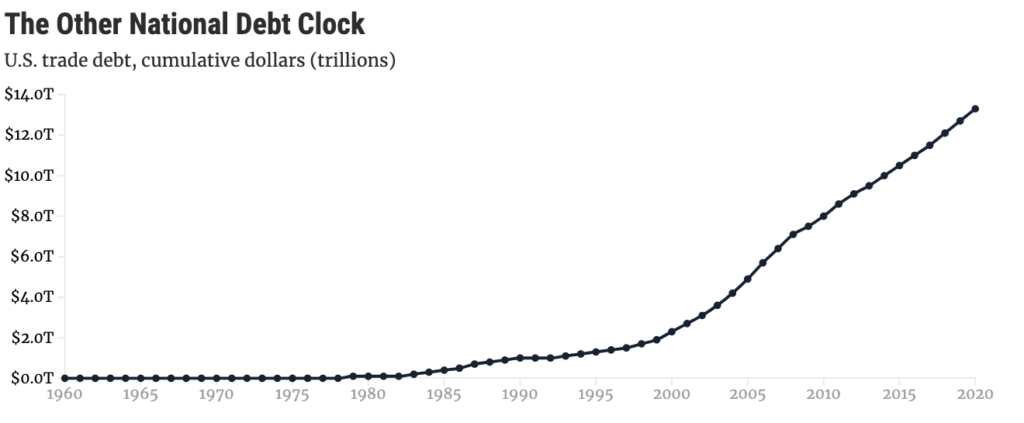

Another problem is chronic trade deficits. It turns out that these are not self-correcting. America’s cumulative trade deficit has ballooned from over $2 trillion at the start of the century to nearly $14 trillion twenty years later.

How is this being paid for? “With financial assets—claims against the nation’s prosperity that will burden future generations.” One can argue that globalisation has increased the supply of cheap credit to our benefit. But if all that opening up was supposed to be so good for the West, then why do we need so much debt just to get by?

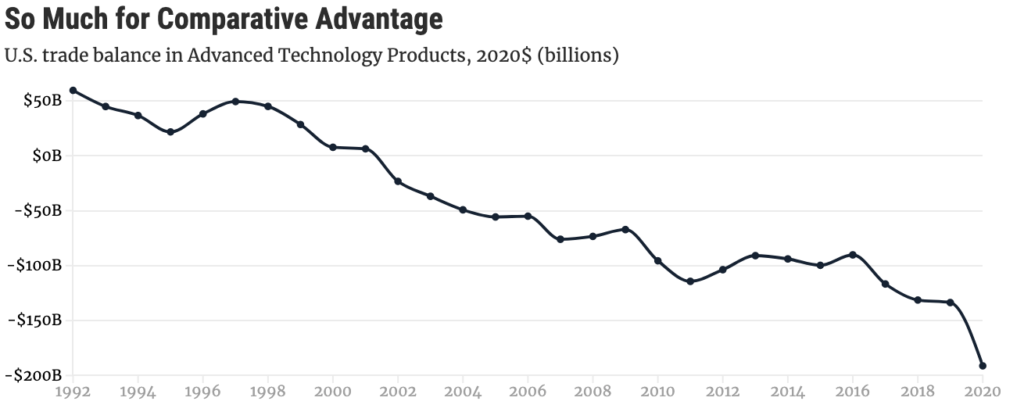

We were also told that globalisation would liberate the West to specialise in the economic activities where we can add the greatest value. Let other countries make the basic stuff, while we concentrate on the leading edge. But look at what’s happened to America’s trade balance in advanced technology products. It has deteriorated from a surplus in the 1990s to a near $200 billion deficit by 2020.

Other charts in the presentation tackle issues like business investment and productivity growth — and they too point in the wrong direction.

We should of course acknowledge the upsides of globalisation. For instance, as consumers, we’ve benefited from an ample supply of cheap imports. However, we’re now experiencing the downside of that upside. Disruptions like the Covid pandemic and Russia’s aggression in Ukraine have exposed the vulnerability of our supply chains. Inflation has been unleashed and our security undermined.

We need to draw a distinction between free trade as a principle and globalisation in practice. They are not one and the same. The globalised economy of the last few decades is a lop-sided creation in which the degree to which the West has opened itself up to China and other countries has not been reciprocated.

Of course, such asymmetry doesn’t matter if one believes that the advantages of openness are overwhelming. But it is now abundantly clear that they are not.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe