To much fanfare at the end of last week, the Bureau of Labor Statistics (BLS) in the United States published jobs numbers that appeared surprisingly rosy. The BLS reported that the number of jobs grew by 517,000 in January, a figure that, outlets claimed, “surprised economists”. No doubt this was a strong jobs report, but there are reasons to be cautious.

To understand why, we need to rewind back to February 2008. In its report on the January job numbers of that year, the BLS stated that “nonfarm payroll employment and the unemployment rate were essentially unchanged in January”, signalling that all was stable (‘nonfarm payroll’ refers to the entire economy’s employment outside of the agricultural sector). But, in retrospect, the next sentence portended disaster: “The small January movement in nonfarm payroll employment reflected declines in construction and manufacturing and job growth in health care.”

In fact, construction employment had been going down for some time. It had been falling since the summer of 2007 and by January it was registering a 3.2% annual decline. By December of 2008, construction employment was falling at 10% annually and the American economy was in a deep recession.

But what does that have to tell us today? After all, the recent BLS report stated that construction had added 25,000 jobs in January. Surely trying to draw parallels with 2008 is a fool’s errand? Not so. In fact, the fall in construction employment that started in the summer of 2007 was predictable from as early as the summer of 2006. It was then that construction investment started to collapse.

During the summer of 2006 real private residential investment — which is a good proxy for construction investment — fell by around 7% annualised. It continued to fall faster and faster in the following months. Obviously, if investment in a sector is falling then eventually this will translate into workers being laid off. And so it did, almost exactly a year later.

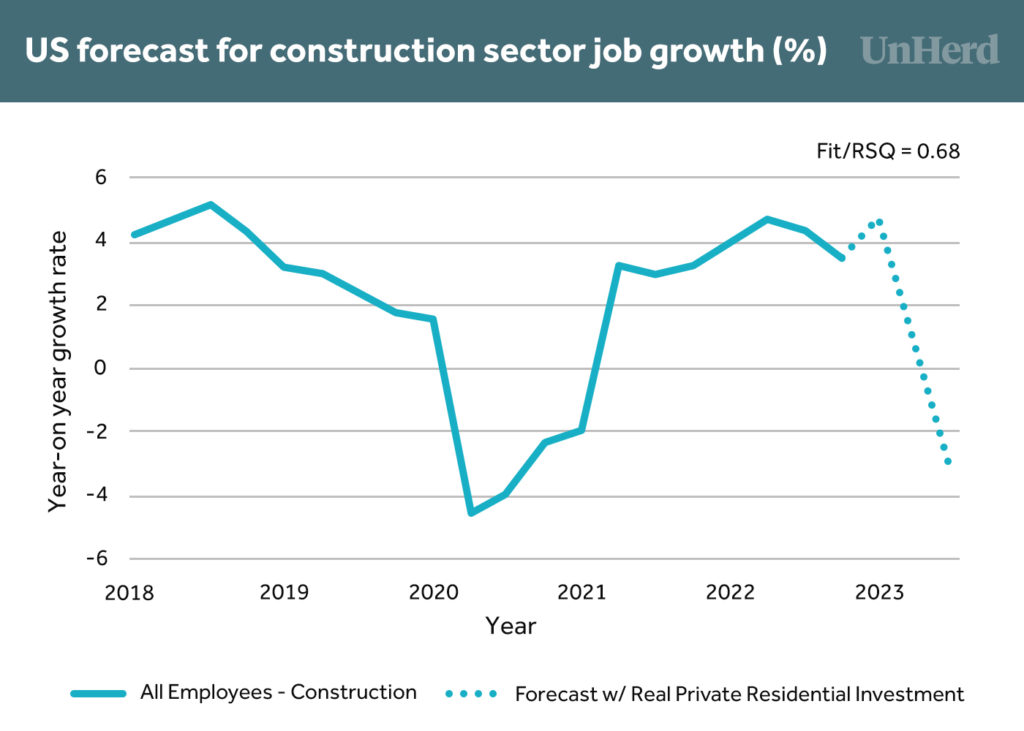

Well, real private residential investment is falling once more. In the fourth quarter of 2022 it fell by around 9% — faster than it did in the summer of 2006. Using this data, we can use regression analysis to predict construction sector job growth in the coming months.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeThe Fed will raise interest rates to curb inflation. Politically, inflation is worse than job losses because inflation hits everyone. It is easier for pols to gloss over job losses, particularly when it only hits a few sectors, like manufacturing.

A recession is when someone else loses his job, a depression is when you lose your job.

We will have another recession this year and it will be worse than last year’s.

The Fed will raise interest rates to curb inflation. Politically, inflation is worse than job losses because inflation hits everyone. It is easier for pols to gloss over job losses, particularly when it only hits a few sectors, like manufacturing.

A recession is when someone else loses his job, a depression is when you lose your job.

We will have another recession this year and it will be worse than last year’s.

Only last week there was an article on UnHerd about bank lending in the USA getting out of control – too much money was being diverted to the real estate market. Banks will collapse. Doom.

The question is, how much of that money was going into new property and how much into house price inflation? Without that information, both articles are not telling us much.

If construction will stop the banks will be safe? A recession (by economic definition) perhaps but not a meltdown. Meltdown sounds a lot more dramatic.

Is all of this tranferable to the UK? Probably because we have to copy the Americans in every way. But, if we had a government which built public-owned houses, doesn’t that mean that we would avoid recession but possibly have a meltdown.

Help me someone.

You should try reading the Daily Telegraph. Its finance and economics writers deal in hyperbolic headlines of doom on a daily basis. If I believed them I’d be living in a hut on the isles waiting for the economic recovery.

I find the DT wildly optimistic on UK Housing Prices – Madly so. The BTL posters there on DT are a stupid bunch – so pro Zelenski as to almost be obsessed, and so anti Russia as to be crazed – and on house prices they think all is well. They say prices rising even

How DT has such an insane BTL crowd is because they only do Up Votes – thus a crazy guy cannot be shown to be a fool by having sane people down vote them – only counted are the up-votes the minority of other crazies who post . No ability to down vote turns the best rated over to the lunatic fringe.

For UK Housing watch Charlie – By Far the best real Estate blogger in UK – he says a 35% drop in 2023 – 24

https://www.youtube.com/channel/UCweRK3vDR6E4LkaMucFkcmw

He is a MUST WATCH if you are British, and fun as well.

I noticed the rabid Russia hate on DT as well. I don’t understand it at all.

I noticed the rabid Russia hate on DT as well. I don’t understand it at all.

I find the DT wildly optimistic on UK Housing Prices – Madly so. The BTL posters there on DT are a stupid bunch – so pro Zelenski as to almost be obsessed, and so anti Russia as to be crazed – and on house prices they think all is well. They say prices rising even

How DT has such an insane BTL crowd is because they only do Up Votes – thus a crazy guy cannot be shown to be a fool by having sane people down vote them – only counted are the up-votes the minority of other crazies who post . No ability to down vote turns the best rated over to the lunatic fringe.

For UK Housing watch Charlie – By Far the best real Estate blogger in UK – he says a 35% drop in 2023 – 24

https://www.youtube.com/channel/UCweRK3vDR6E4LkaMucFkcmw

He is a MUST WATCH if you are British, and fun as well.

You should try reading the Daily Telegraph. Its finance and economics writers deal in hyperbolic headlines of doom on a daily basis. If I believed them I’d be living in a hut on the isles waiting for the economic recovery.

Only last week there was an article on UnHerd about bank lending in the USA getting out of control – too much money was being diverted to the real estate market. Banks will collapse. Doom.

The question is, how much of that money was going into new property and how much into house price inflation? Without that information, both articles are not telling us much.

If construction will stop the banks will be safe? A recession (by economic definition) perhaps but not a meltdown. Meltdown sounds a lot more dramatic.

Is all of this tranferable to the UK? Probably because we have to copy the Americans in every way. But, if we had a government which built public-owned houses, doesn’t that mean that we would avoid recession but possibly have a meltdown.

Help me someone.

USA has had a small net loss on full time jobs – but big increase in part time jobs. This is a sickening economy. People now need two jobs to get by – and many places reducing full time jobs to part time.

Peter Schiff is always good about Jobs in USA

https://www.youtube.com/watch?v=N2y5eiKHkd0

Indeed. The “jobs growth” numbers don’t speak to whether these are truly new primary jobs, or people needing to pick up additional work just to keep their heads above water. Post-pandemic Bidenomics is a house of cards, made worse by deliberate restrictions on energy production, with consequent ripples through supply chains.

Indeed. The “jobs growth” numbers don’t speak to whether these are truly new primary jobs, or people needing to pick up additional work just to keep their heads above water. Post-pandemic Bidenomics is a house of cards, made worse by deliberate restrictions on energy production, with consequent ripples through supply chains.

USA has had a small net loss on full time jobs – but big increase in part time jobs. This is a sickening economy. People now need two jobs to get by – and many places reducing full time jobs to part time.

Peter Schiff is always good about Jobs in USA

https://www.youtube.com/watch?v=N2y5eiKHkd0