The financial press is reporting that the Chinese economy is returning to growth since the lockdowns have been lifted. The reports come on the back of improving Purchasing Managers Indices (PMIs), which are based on surveys passed around by purchasing managers — that is, those who lead teams of people responsible for procuring goods and services.

The western interpretation of this data isn’t wrong, but the data itself might be. This is not surprising to those who have gotten familiar with China’s statistical games and how they are played. When I spent the better part of a year studying the Chinese economy and familiarising myself with Chinese statistical methodology, I realised that sensitive metrics like PMIs are mostly fake.

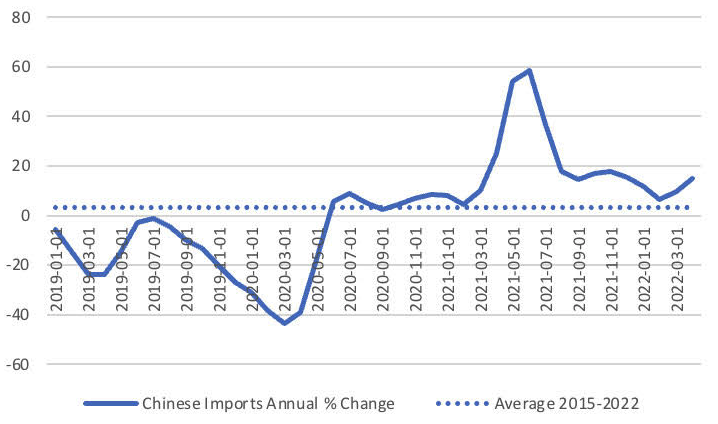

The trick to getting a read on the Chinese economy is to find indicators that cannot be faked. My favourite has always been Chinese import growth. Import growth tracks GDP because, as economic growth rises, people buy more — and since some of these purchases come from abroad, they buy more imports. Import data is impossible to falsify because both the buyer (in this case, China) and the seller (in this case, China’s trade partners) have a record of the transaction.

If you have been following Chinese import data recently you have not seen much evidence of a severe slowdown. The chart below plots import growth together with average import growth since 2015. The latest data from April shows imports growing around 15% from the year before. The average annual growth rate since 2015 has been around 3%. So, anyone following this metric would be unimpressed with the prognostications of an imminent Chinese recession.

The idea that China is entering is a recession is symptomatic of a bigger problem among economic and financial commentators today: they do not factor into their views the process of decoupling that is taking place in the global economy right now. They think that because the developed world is facing a recession, countries like China must be too. But the reality is that countries like China are rapidly delinking from the developed economies.

In the next few months and years, the real metric to watch in China is the inflation rate. Right now, it is very low, running at 2.1%. Compare this with the UK (9.1%), the EU (8.1%) and the US (8.6%) and you see a huge discrepancy.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeThe author is deluded in apparently believing that China has a better future than the West. Much of the current “growth” in China is based on unsustainable over-investment which will never see any return (ghost cities, high speed train lines to nowhere). Add in the awful demographics and I suspect that “Peak China” as already behind us.

Quite why he believes that sanctions policy is (or should be in his view) designed to make us economically better off is beyond me. It’s nothing to do with our short term economic well-being or inflation – and nor should it be.

The economic problems of the West are of our own making and were present long before Russia invaded Ukraine or the ensuing sanctions. Attempting to shoe horn some bogus argument about sanctions in here does no one any favours.

The cure for the economic problems of the West is now inflation and recession. This is expected and necessary now as we ducked taking the corrective action and pain earlier. It is pure fantasy to suggest this is unavoidable.

Finally, I must have missed these reports of a Chinese “recession”. The author seems to confuse “slowdown” with “recession”. Not a good sign.

Sure Peter, let’s not build stuff. I think you’ve explained why exactly the west is lagging. Chinese ghost cities are planned in advance, as they open their economies to rural workers. Trains are nearly always a good investment. And the demographics of China are about the same as the west.

The real question is whether a well educated, smart workforce can catch up per capita with the west, and why wouldn’t that happen. Demographics don’t matter all that much if that is true. It’s not like Nigeria is going to be a super power, although no doubt they will be powerful come 2100.

Demographics always matter. And China is in far worse shape here than the US.

The US also dominates at the top end – most leading edge and profitable part – of technology. China is trying to bootstrap itself from manufacturing – and not making that much progress climbing the value chain yet.

One other thing – why is it that skilled tech workers who have a choice and want to move country almost always move to the US ? How many choose to migrate to China ?

The ghost cities will never be occupied. Communuist central planning doesn’t work. We should have had enough evidence of this now since WWII.

Where did I say “don’t build stuff” ? Are you making this up ?

And let’s not forget the vast amount of debt awash in the regional governments which is hidden from view www dot scmp dot com/economy/china-economy/article/3165411/chinas-hidden-debt-how-much-it-and-what-beijing-doing-curb

Every article this author writes implies that everything the west does is a mistake, and that the Russians and Chinese have some sort of genius, long game economic grand plan for world domination. I tend to take his opinions with a pinch of salt

This was all going well until the author suggested that inflation made our goods more expensive to the Chinese and made Chinese imports more expensive. Both cannot be true. Such a basic error doesn’t give much confidence in the rest of the analysis.

The way I understand it (and I am NO expert) is that now our goods will be dearer because of inflation.

As a consequence, over time our currency will depreciate making their goods more expensive.

But if our currencies are depreciating due to inflation, our exports will be cheaper in CNY terms, offsetting the impact of those cost increases.

The generation that fought WWII would be mortified that they fought and died to rid the world of concentration camps while the current generation won’t even pay a few dollars more for an iPhone. Shame upon anyone willing to accept concentration camps for the sake of economic prosperity. I don’t care how successful China’s economy is because there are more important concerns. I don’t want products made by slave labor in reeducation camps. We should be better than this.

In contrast to China, the ever-increasing trade sanctions imposed by western countries on former trading partners are bound to affect their economies adversely.. .

Surely the observed import growth this year is going to be driven by the rise in the price or oil and other commodities, of which China is the world’s largest importer.