Almost 70 years ago, John Kenneth Galbraith explained that during a bull market there is a period when an embezzler enjoys his ill-gotten gains, but the victim does not yet know he has lost out. Think of rich Europeans who invested with Bernie Madoff, and spent their summers in Saint Tropez and their winters in Saint Moritz believing that Madoff was compounding their assets at a steady 12% a year. While the “bezzle” was on, the economies of Saint Moritz and Saint Tropez hummed along nicely, and the world seemed better off. In this interval, there were two engines of “unfounded” economic activity: Madoff bought watches, yachts and holiday homes, while the investors he was conning spent as if their balance sheets were still rock solid.

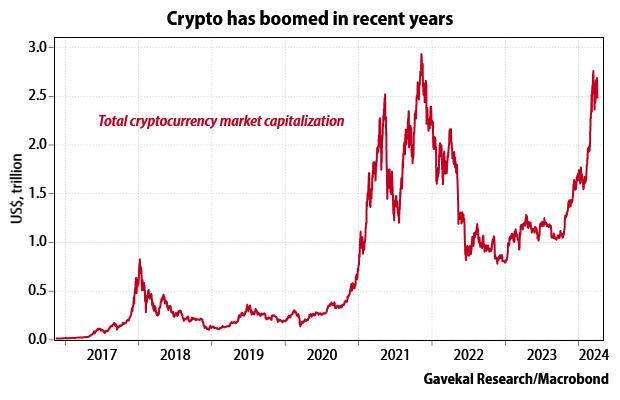

This idea is notable again in light of the $2.5 trillion in crypto market capitalisation that essentially emerged from nowhere five years ago. The resurgence in cryptocurrency prices again raises the question: what really is its “value proposition” — or put another way, what function does it serve?

Most industries earn money because they make our lives better. Microsoft makes money because it helps us manage information; Netflix because it entertains us; McDonald’s because it feeds us. Absent a social function, it is hard to understand why an industry should make lots of money for a long time. We need shelter, food, clothing, transportation and entertainment, and will pay the entities that duly satisfy us. So exactly what value do cryptocurrencies provide to society?

Most industries earn money because they make our lives better. Microsoft makes money because it helps us manage information; Netflix because it entertains us; McDonald’s because it feeds us. Absent a social function, it is hard to understand why an industry should make lots of money for a long time. We need shelter, food, clothing, transportation and entertainment, and will pay the entities that duly satisfy us. So exactly what value do cryptocurrencies provide to society?

The answer does not seem to be that they make transactions easier and cheaper. More than a decade after the emergence of Bitcoin, cryptocurrencies are still very far from being a means of exchange. Rather, their main purpose seems to be that of a “store of value”, if a volatile one. Talk to any cryptocurrency enthusiast and the main argument is that Bitcoin, Ethereum and others will help protect capital in the context of unfolding currency debasement — which brings us back to Galbraith’s bezzle.

If, as many crypto enthusiasts believe, Western democracies are on the cusp of massive currency debasement in order to maintain their welfare states, the roughly $100 trillion held in global government bonds is worth, in real terms, a small fraction of that amount. But if this scenario turns out to be wrong, the $2.5trillion of crypto money represents today’s bezzle.

Calling government bonds a bezzle could be seen as crude sensationalism. No one is suggesting that bonds will not be paid back. Most Western sovereign debt issuers are neither Argentina nor Greece, and almost all bonds will be redeemed at par. The question is what the purchasing power of par will be. And, just as crypto has gathered pace, the returns on bonds have gone from bad to worse. Investors in US treasuries suffered real-terms purchasing power losses in all of the last three years, and the trend is set to continue in 2024. Worse still, for the past 20 years US treasury investors have essentially made no real return. That represents a genuine euthanasia of the rentier.

The reason this matters is that bonds and cryptocurrencies are usually not owned by the same people. The former are typically owned — directly or indirectly — by older people who are either retired or about to be. In contrast, cryptocurrencies are usually the domain of younger investors who have years ahead of them to make up for any incurred losses.

Right now, the market suggests that bonds issued by Western governments will remain a poor store of value. Given the record budget deficits in the US, France, UK, Japan, this is understandable. Indeed, since many investors consider OECD fiscal settings to be unsustainable — thereby rendering bonds certificates of confiscation — they will likely keep seeking out alternative stores of value. Cue the current rally in gold, silver, high-yielding energy names and broader equity markets. Such trends are likely to continue until we see a significant shift in fiscal policies across the developed world.

This leaves us with the question: what happens if the main building block of most pension fund portfolios ends up delivering negative real returns of -5%, not just this year but in the coming years to boot? Those approaching retirement may have to work longer, which isn’t a feasible option in more physically demanding professions; otherwise, they may have to adjust to lower pension payments, at least in real terms. This, in turn, could impact residential real estate as people look to downgrade.

Then there is the chance that taxes will have to be raised, allowing pension payments to compensate for real losses on bonds. All the while, alternative stores of value will continue to boom. Whatever happens to pension funds, crypto could be the real winner.

This is an edited version of a piece which originally appeared in the Gavekal Research newsletter.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe