Until recently, with the world breaking into rival blocs, Western central bankers appeared to offer a rare global harmony. Their policies drew from the common wellspring of orthodox macroeconomic theory, and they were largely fighting the same battles: first recovering from the 2008 financial crisis, then staving off the collapse of the world economy in the early days of Covid-19, and finally choking off the inflation surge that came later in the pandemic.

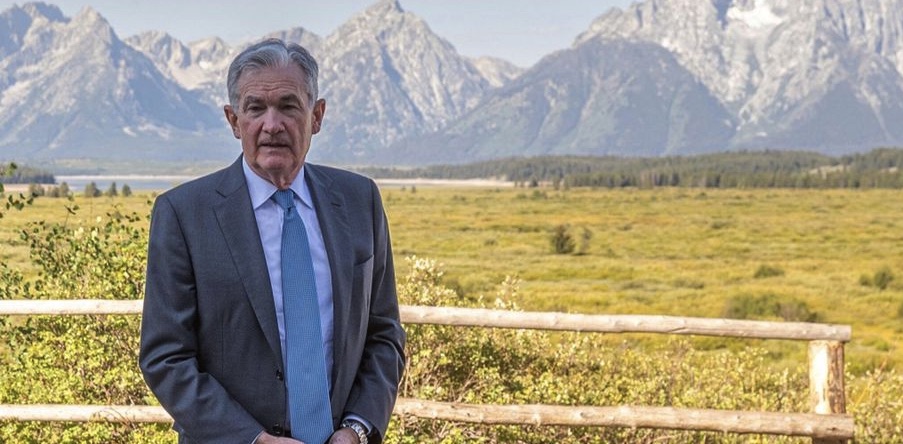

But as we enter the post-pandemic world, that common front is starting to fray. So today’s speeches at the Jackson Hole summit in Wyoming, in particular those by Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde, will be closely watched for clues as to the current thinking of central bankers, and whether they can still find agreement on the way forward.

For starters, central bankers now confront differing problems. The US Federal Reserve faces a stronger economic rebound than it expected, raising fears of resurgent inflation. The ECB, in contrast, faces implosion and possible deflation in its biggest economy, Germany. Meanwhile the Bank of England wrestles with the spectre of a return to stagflation in Britain, one that raises the possibility of both recession and inflation, making policy choices more challenging.

It’s appearing less likely than ever that one policy can fit all systems. Meanwhile, with central banks coming under pressure from politicians for getting things so wrong, we may be retreating from the era of central-bank autonomy back towards the pre-1980s model, when governments provided more direction.

Compounding the differences is that the standard models relied upon by central banks have not worked out quite as they anticipated. They drew on the standard toolbox to conclude that the recent surge in inflation would be transitory. Now that they’ve been proved wrong, they can’t agree why.

Economists in the so-called “team transitory” camp stand by the standard model, pointing to recent declines in inflation as proof that even though the transition lasted a bit longer than expected, their thesis was still correct. But many are the market analysts who counsel prudence, saying that inflation has now bottomed and will soon rise again.

Some, most prominently former US Treasury secretary Larry Summers, bang on that inflation will only come down when unemployment rises and real wages fall. What they fail to explain is how, amid the resilient job markets and rising real wages, inflation has begun to come down. The fact that the recent drops in inflation have coincided with declining profits and falling asset and property prices would seem to vindicate the exponents of profit-driven inflation, like German economist Isabella Weber, who in consequence are starting to receive a hearing at some central banks. The old guard, apparently keen to blame workers, isn’t too happy about that.

Meanwhile, the traditional tool of macroeconomic management used by central banks, interest rates, seems not to be operating as expected. Most economists had expected to see a sharp slowdown in the economy by now. This raises the possibility that the post-financial crisis quantitative easing experiment, during which central banks meddled directly in bond markets to get money into circulation, has changed the rules of the game in ways they don’t yet understand. That, in turn, raises the worrisome possibility of unknown unknowns, such as a central bank overshooting and causing a crash, or undershooting and locking in inflation.

The Jackson Hole summit will provide important clues as to what happens next. However, it may be that we’re entering a new period, when a more varied policy environment ends the veneer of unity previously provided by “economic science”. Because as they improvise their way towards apparently ad hoc solutions, central bankers are finding there’s a good deal more art to economics than they thought.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe