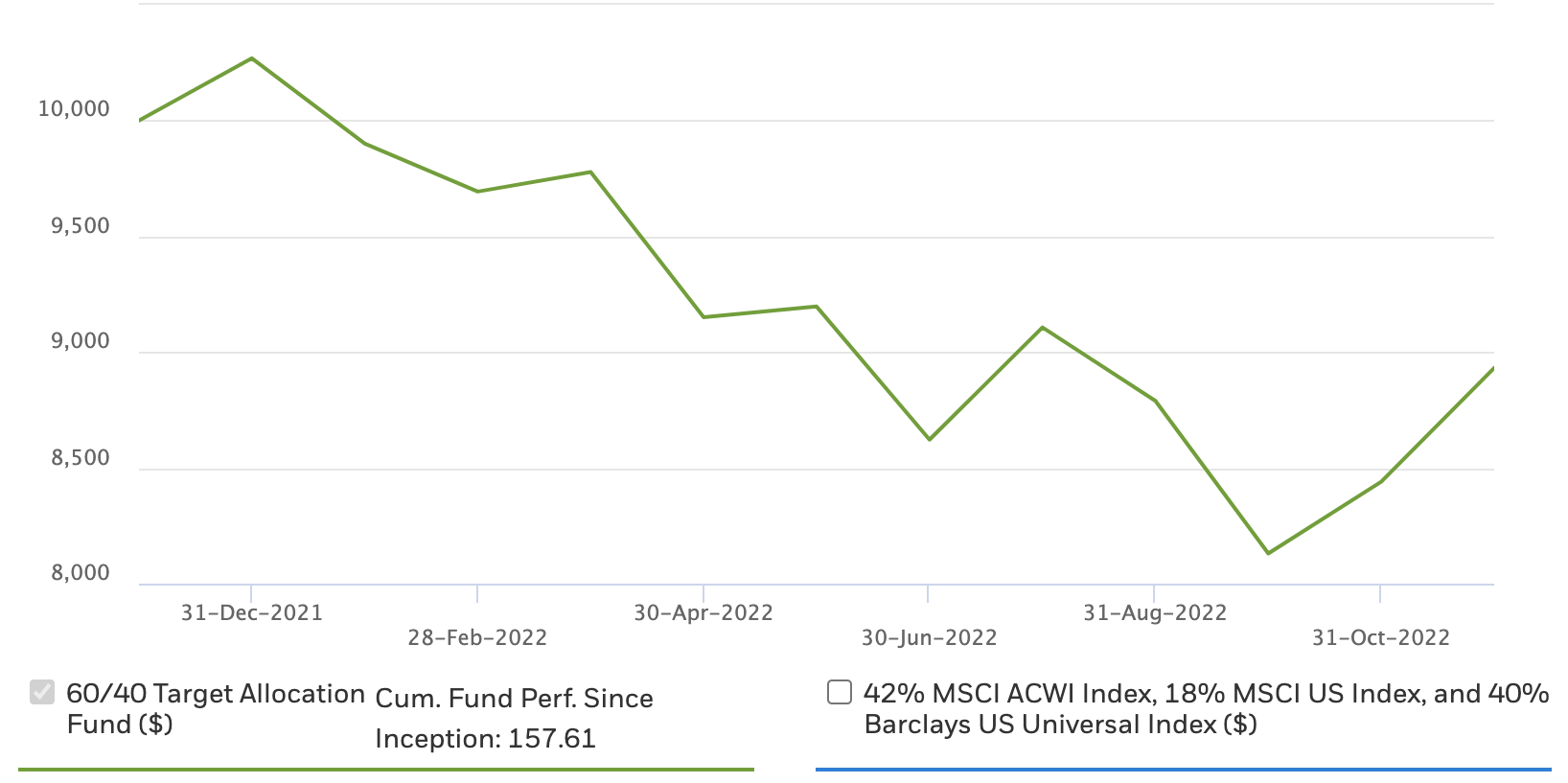

This year has been one of the most brutal in recent memory for those who hold savings. Typically, a saver who parks most of their money into stocks and bonds can expect a healthy return above inflation. The average return of a 60/40 portfolio — that is, a portfolio that is 60% invested in stocks and 40% invested in bonds — over the past 30 years has been around 8% or around 5.4% when adjusted for inflation. In 2022, the 60/40 portfolio delivered a return of -11.6% or -17.5% when adjusted for inflation.

This represents a huge loss of wealth for anyone with investments or a pension invested in markets. The problem is that every asset class is getting hit. The reason people invest in stocks and bonds is that when stocks go through a rough patch, bonds usually overperform. This smooths out the returns of the portfolio. But in 2022, stocks and bonds are getting butchered at the same time.

The reason for this is twofold. For over a decade now, central banks have been engaged in so-called Quantitative Easing (QE) policies. These policies have driven interest rates to zero and pushed bond prices sky high. At the same time, the QE policies have juiced stock markets. But now, with inflation raging, central banks are pulling back from their QE policies and raising interest rates. The result is that stock and bond markets, both addicted to the loose money policies, get clobbered at the same time.

Meanwhile, there is one asset class that has done well out of all the turmoil: macro hedge funds. Macro hedge funds make big predictions about global economic events and bet accordingly. They became famous in the 1990s when the likes of George Soros stared down the Bank of England and broke sterling’s peg to the European Exchange Rate Mechanism in 1992. Soros’s bet against the pound was a classic in the macro hedge fund genre: he thought he could predict the British economy better than the Bank of England and made a large bet on it. As a result, he pocketed $7 billion for his investors.

During the cheap money period of the 2010s, macro hedge funds went into a lull. There simply wasn’t enough going on for them to make the big bets they needed, in order for them to do what they do best. But with a decade of global chaos facing investors in the 2020s, there is every chance that this could be a decade to remember for macro hedge funds — and other investment funds that undertake agile, contrarian investment strategies.

This raises a serious problem for savers: these non-standard asset classes are only accessible for wealthy people. It is not unusual for a macro hedge fund to have a minimum investment of $1 million. What this means is that the wealthy may be able to ride out the market chaos, while the average investor gets left behind.

This introduces the problem of income inequality into the market for savings. The wealthy gain access to the creative-thinking funds that can benefit from global turmoil, whereas average savers are stuck with the standard investment products that are falling apart. Inflation and global turmoil are awful for anyone who invests their money, but they are far worse for the average saver.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe