How does one identify a tax haven — specifically, a corporate tax haven?

One thing to look out for is when subsidiaries in a low tax country appear to be generating revenues out of proportion to the wages they pay in that county. Unless those local employees are freakishly productive, it would suggest that revenues earned elsewhere are being reclassified through the various tricks known to cunning tax lawyers.

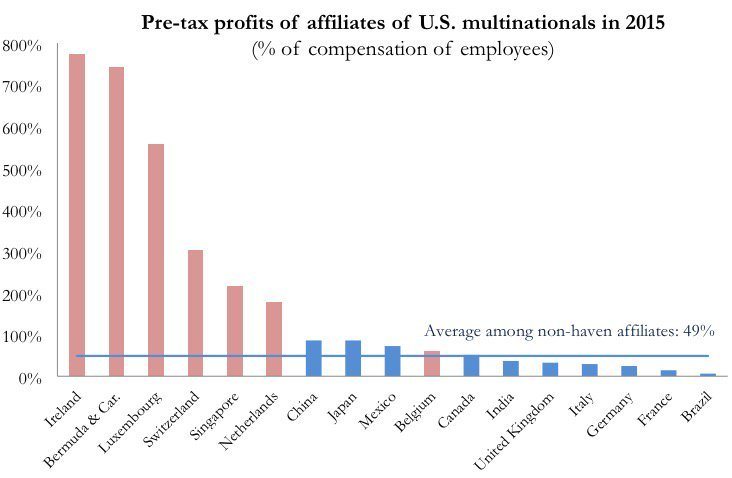

Take a look at the charts tweeted the other day by Jonathan Tepper. This one, for instance, focuses on the “affiliates” of US multinationals — showing their pre-tax profit as a percentage of employee compensation:

In normal countries, profits are lower than payroll. But in a few jurisdictions they are a multiple of the wage bill. By an amazing coincidence these just happen to be well-known tax havens. As one might expect, we see Switzerland and the Caribbean featuring heavily. More interesting though are the EU’s tax havens — and especially the Republic of Ireland.

Creating a competitive, enterprising economy is one thing; depriving your neighbours of tax revenue is another. I wonder how long the rest of the EU is going to put up with it? Some action has already been taken — not least the ongoing legal battle to force the Irish government to take billions in taxes from Apple.

What happens if the EU’s reformers win — and not just on this particular case, but more generally?

In 2016, the Irish government announced that the country’s GDP had increased by an unfeasible 26%. Most of that is an artefact of the intricate tax accounting of US-owned subsidiaries, so much so that new indicators have had to be invented to measure the size of the real Irish economy. Nevertheless, Ireland does get tangible benefits from hosting multinational companies — which is why its government is fighting so hard to protect its tax regime.

Of course, the EU’s harmonisers wouldn’t just need to overcome Irish objections, but also those of other member states with a lot to lose — not least Luxembourg. The Grand Duchy may be small, but it wields an outsize influence in the EU.

We tend to associate the worst excesses of western capitalism with the US. But the EU is not exclusively on the side of the angels.

Ironically, it may be Brexit that reveals the balance between the EU’s reformers and its defenders of the status quo. Will the forthcoming free trade negotiations feature an attempt to stop the UK from diverging too far on tax? If they do, that would require (and help support) the alignment of tax regimes within the EU; but if they don’t, we can assume that EU’s tax havens will he allowed to carry on regardless.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe