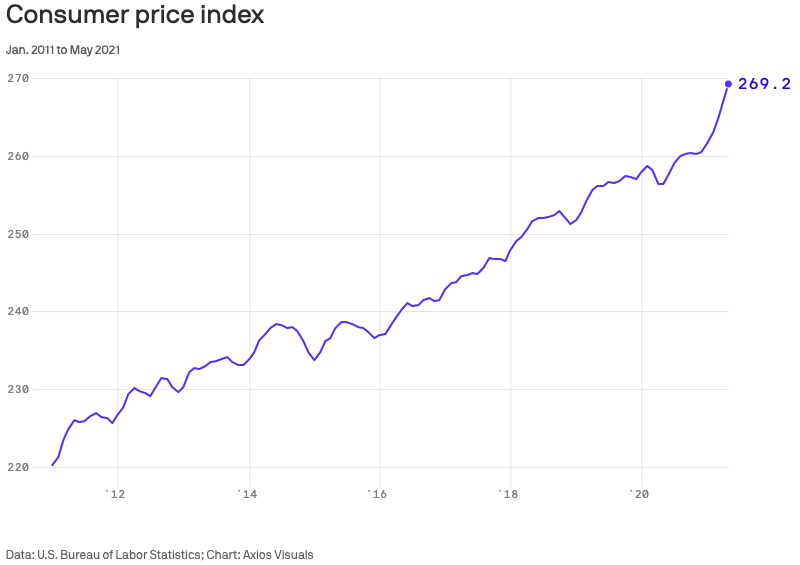

How worried should we be about the latest inflation figures from America? A 5% rise from May 2020 to 2021 is a big jump. In fact, prices haven’t gone up that fast since 2008.

What’s going on? There are two nightmare scenarios — and both could be true. The first is that the impact of the pandemic has disrupted global production so badly that supply hasn’t a hope of matching demand anytime soon. The second is that government has overdone stimulus spending thus unleashing the inflationary monster.

If one or both of those scenarios are right then prices will keep rising fast for the foreseeable future. At the extreme we could find ourself trapped in 1970s-style inflationary spiral.

But don’t despair just yet — there are some less terrifying explanations.

After the unprecedented disruption of the pandemic, it’s unsurprising that the supply side needs a bit of time to soak up the bounce back in demand. In fact, an inflation rate still in single digits is proof that the global economy can adjust to just about anything these days.

Also don’t forget where we were a year ago. Stuck in deepest lockdown, consumers slashed their spending and entire industries closed their doors. Demand fell fast and so did many prices. The crude oil price even went negative for a while. So measured against that low point, a bit of inflation is entirely to be expected.

So who’s right, the Jeremiahs or the Pollyannas?

The short answer is that it’s too soon to tell. The longer answer is that we need to look beneath the hood of the headline figure and examine the different components of inflation. For instance, the US figures show that food prices are up by 2.2% (not too scary) while energy costs are up by 28.5% (not too shocking, given the volatility of that sector).

We should be worried about the continuing rise in house prices, but that was a problem long before the pandemic. Wage inflation is something we probably can blame on Covid, with restrictions on movement causing labour shortages, but should we panic about workers getting paid more?

Above all, we need to look beyond the short-term. The release of pent-up demand won’t keep the economy going forever. So instead of piling in with stimulus when and where it isn’t needed, governments would do well to husband their resources. The post-Covid boom could be short-lived and after that we’ll need properly funded policies to tackle the deeper weaknesses of the economy.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe