Credit: Jonathan Brady/PA Archive/PA Images)

“I was absolutely astonished when I discovered there was a proposal to put into law the ability of shareholders to stop these excessive payments… I thought this was a power shareholders had always had”

That’s what Jacob Rees-Mogg said when I asked him about fat cat pay packages. “What is the point of owning the business,” he continued, “if you can’t even vote down the remuneration committee’s answers?” It’s a good question, but I think it misses the point.

Last year, the British Prime Minister referred to excessive executive pay as the “unacceptable face of capitalism”. Her manifesto, a few months earlier, had pledged to change that by legislating “to make executive pay packages subject to strict annual votes by shareholders”.

It’s easy to see why legislating to change behaviour – by giving the owners of capital the absolute right to vote against, for example, executive pay packages – looks attractive. Certainly, the current non-binding “say on pay” requirements – of which the UK was an early adopter, with the US following suit in 2011 – are a damp-squib.

Research by Stanford Graduate School of Business found that, overall, “granting shareholders the right to vote on executive compensation contracts has a fairly limited impact on pay”, which helps explain why pay levels haven’t been shifted in countries that have adopted it.1

There is the odd case – like that of the construction company Crest Nicholson –where, despite shareholders voting against a pay package, the “advisory” nature of the vote has allowed the business to push ahead regardless. But, more commonly, where a majority of shareholders has voted no, action has been taken. The real problem is that shareholders are too often asleep at the wheel, and executives disinclined to moderate their behaviour.

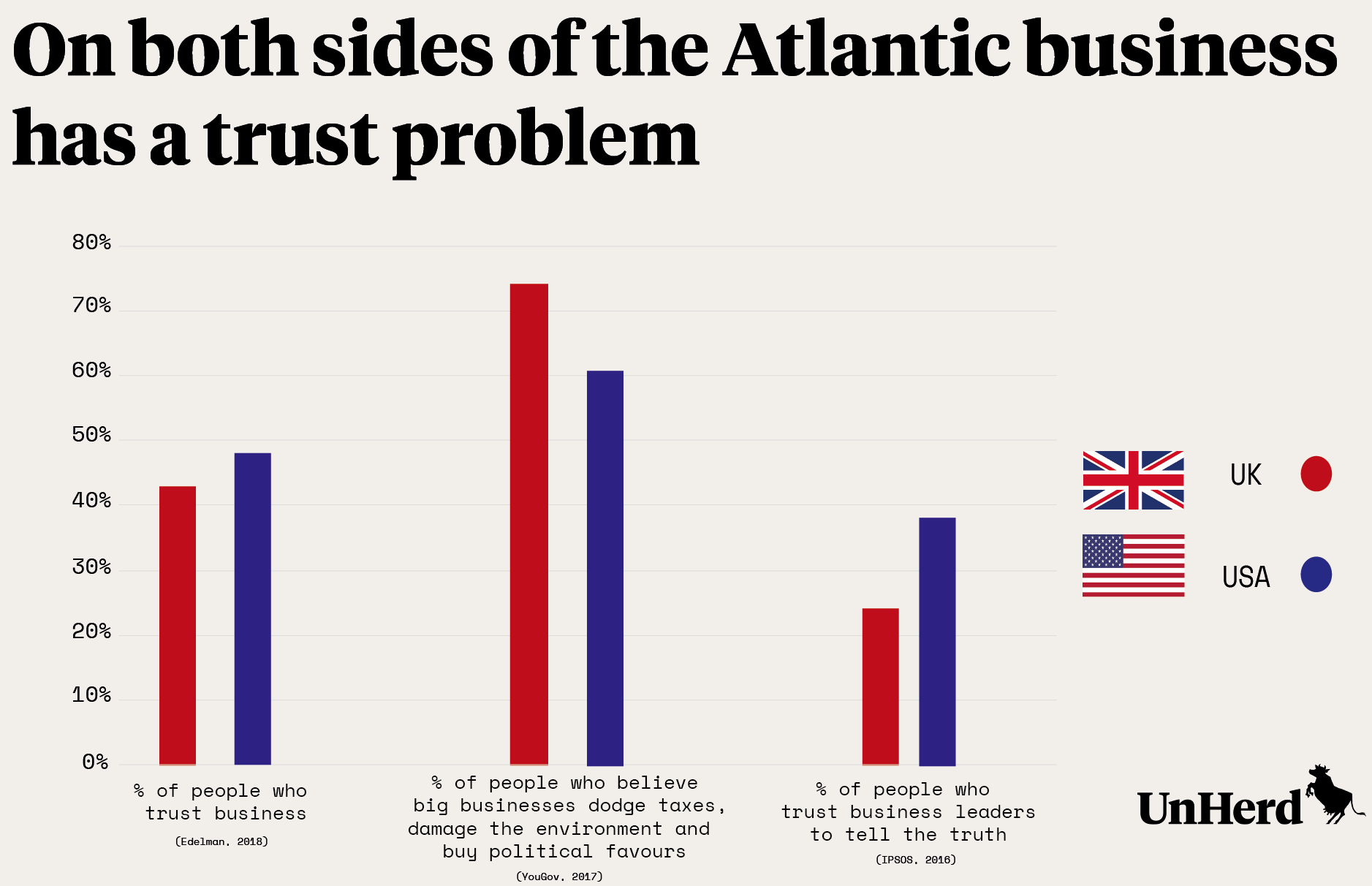

So, while it’s disappointing that the Prime Minster has backtracked on her manifesto promise, the real question is: why do capitalists need legislation to make them do the right thing?

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe