House Majority Leader Kevin McCarthy and Speaker of the House Paul Ryan congratulate each other on passing the Tax Cuts and Jobs Act in the House of Representatives. – Credit: CNP/SIPA USA/PA Images

“Senate approves major tax cuts in victory for Trump”. The headlines will have certainly pleased ‘The Donald’.

Last weekend, after more than a year of wrangling, the US President finally succeeded in pushing his cherished tax plan through Congress. The package has been billed as the biggest change to US tax laws since Ronald Reagan was in the White House in the 1980s – a comparison Trump will no doubt enjoy.

Since taking office back in January, the President has struggled to score a major legislative victory – failing in his election pledge to repeal and replace Obamacare. These new tax reforms are “just what the country needs to get America growing again”, said Republican Senate majority leader Mitch McConnell, who steered the legislation through America’s Upper House.

Despite the triumphant headlines, though, there is a significant probability Trump’s tax changes will backfire. Many Republicans, despite having had their arms twisted by McConnell, remain concerned the reforms will initially cost money, adding to America’s already massive national debt. And Democrats claim, with some justification, that Trump’s tax cuts are skewed towards corporations and America’s most wealthy.

If this message sticks, and it might, Trump’s opponents will say, ahead of next year’s mid-term elections, that his only major piece of legislation makes a mockery of his repeated claims to be an economic populist, working for ‘ordinary Americans’. Trump’s prized tax package could then act as a rallying call, rousing the Democrats from their post-Clinton stupor, provoking the party to put forward a compelling candidate and mount a serious bid for the White House in 2020.

Grand Old Party

The precise details of Trump’s tax reforms are yet to be finalised. The Senate now needs to merge its legislation with that passed last month by the House of Representatives, with the differences being reconciled in conference committee. The tax bill can be then be signed into law by the President – which Trump hopes will happen before the end of the year.

It’s already clear, though, that the bill benefits the wealthiest Americans the most, lowering tax rates for the middle class initially but permanently cutting the corporate tax rate from 35 percent to 20 percent. There is a one-off levy on the overseas balances of foreign subsidiaries, a move that is expected to hit the high-tech giants hardest, not least as they’ve paid little tax in the past. Apple, Amazon, Microsoft, Google and Facebook between them hold some $450 billion overseas.

Shares on Wall Street hit a record high in the wake of the Senate vote, amid heavy buying of telecom, bank, financial and other shares in sectors seen to benefit from the tax cuts. The Dow Jones Industrial Average is up almost 20% since the start of 2017 – on strong corporate earnings and the hope that Trump’s tax reforms would happen. The markets have shrugged off concerns that Trump’ tax package, like that of Reagan in the 1980s, will lead to a ballooning of the US budget deficit.

Investors have instead bought the White House line that economic growth will compensate for lower tax rates, bringing higher revenues overall. The non-partisan Senate Joint Committee on Taxation disagrees, recalling the Reagan years, and warning that Trump’s reforms will worsen America’s federal deficit, adding some $1.4 trillion over 10 years to the $20 trillion national debt.

“I am not able to cast aside my fiscal concerns and vote for legislation that… could deepen the debt burden on future generations,” said Bob Corker, the only Republican senator who ultimately refused to back the legislation, possibly because he is about to retire. His sentiment, though, was shared by many party colleagues, who remain outraged at America’s spiraling sovereign debt.

Moderate Republicans are also worried that their constituents will now have less scope to deduct their state and local taxes from federal tax bills. That allowance has now been limited to a relatively modest $10,000 to help pay for corporate tax cuts. It’s a measure that could see millions of middle-class Americans paying higher taxes.

While Trump is nominally a Republican, many influential party members, on Capitol Hill and elsewhere, view him as an imposter – and this Congressional ‘victory’ will do little to change that.

The framework for this tax bill, in both the Senate and the House, has been developed in secret by a cadre of Trump advisors and Republican congressional leaders. There has been little input from the party’s rank-and-file.

There is also a feeling that, under Trump, the party is more than ever in hock to corporate vested interests – to an extent that makes mainstream Republicans uncomfortable. There has certainly been exceptional corporate pressure exerted to push this tax bill through. “My donors have basically been saying, ‘Get this done or don’t ever call me again’” remarked Chris Collins, a widely respected New York Republican Congressman.

2020 Vision

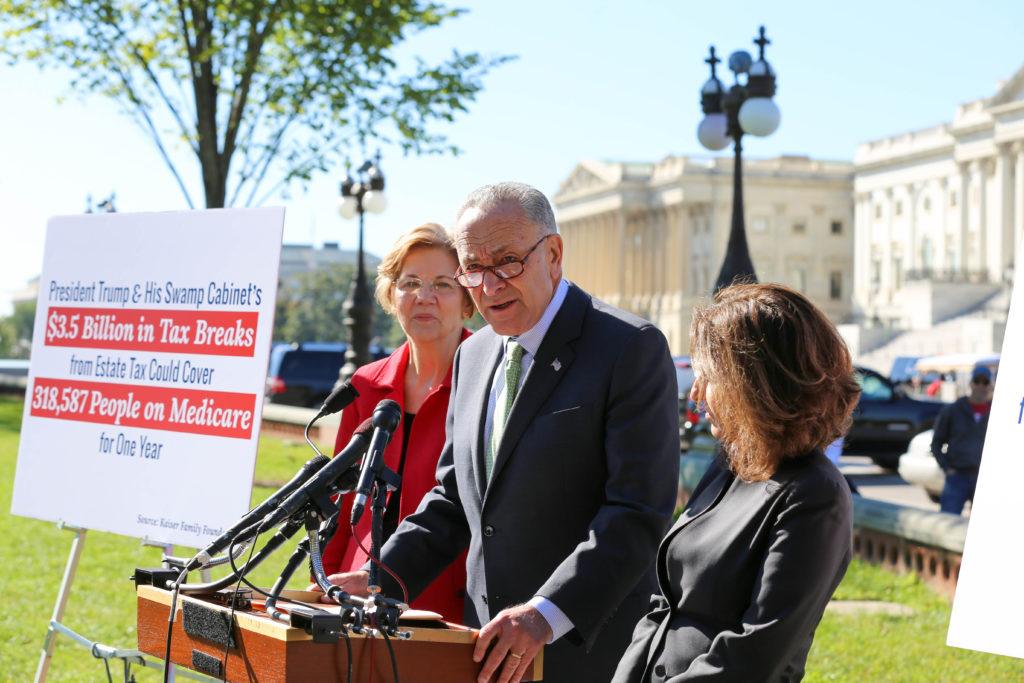

The Democrats are likely to make good use of Collins’ statement ahead of Congressional mid-term elections in November 2018 – in which they will attempt to upend Republican majorities in both Houses. Trump’s tax bill “stuffs even more money into the pockets of the wealthy and the biggest corporations,” says Senate Democratic leader Chuck Schumer, in what will become a widely-repeated campaign message.

Schumer and his colleagues can point to a Senate Joint Committee report that finds, on average, households earning between $20,000 and $40,000 will end up paying more tax, not less, under Trump’s bill. Several other credible studies have found that America’s middle class will ultimately be disproportionately hit.

The non-partisan Institute on Taxation and Economic Policy, for instance, estimates that the richest 5% of households will receive 61% of Trump’s tax cuts by 2027, with the middle fifth getting just 8%. The bottom 60% of US households will share just 14% of the cuts, less than a third of what the top 1% will receive. These are devastating numbers for a President who has vowed to help hard-pressed rust-belt communities, while turning his back on the plutocrats.

This tax bill amounts to “something beautiful”, Trump told supporters at a New York fundraising dinner last weekend, hours after his success in the Senate. “We got no Democrat help and I think that’s going to cost them very big in the election – as basically they voted against tax cuts, and I don’t think that’s politically smart”.

These reforms do amount to the Republicans’ first major legislative achievement of 2017, having controlled the White House, the Senate and the House for almost a year. Dogged by White House in-fighting and a federal investigation into possible collusion between his election campaign team and Russian officials, Trump badly needed this victory.

These measures seem so skewed, though, that they could end up being less a boost for Trump than a present for his Democrat rivals. Billing these reforms as “permanent” is an invitation for his opponents to reverse them. “Repeal Trump’s tax cuts for the rich” could easily become a rallying cry, as the Democrats try to reconnect with their traditional blue-collar voters, a constituency Hillary Clinton so little understood and managed to alienate.

I’ve argued for months that Trump will be a two-term President, given the strength of his electoral base. The more outrage he causes among metropolitan liberals, the more his core voters like him. These crass tax cuts could see the Republicans lose control of Congress next year further limiting Trump ability to pass legislation and causing him endless procedural headaches.

Charges of ‘cronyism’ are toxic, jarring with the kind of populist President, backing ‘the forgotten men and women’, that Trump said he would be. Far from a victory for the President, these tax cuts are an opportunity for a Democrat opponent with the courage and vision, ahead of 2020, to give The Donald a run for his money.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe