Oldham From Glodwick painting - James Howe Carse, public domain

It’s fast becoming a well-known fact amongst economists, but one which isn’t often aired in public: there is a correlation between the state and prosperity. And it’s not a negative correlation. It’s strikingly positive.

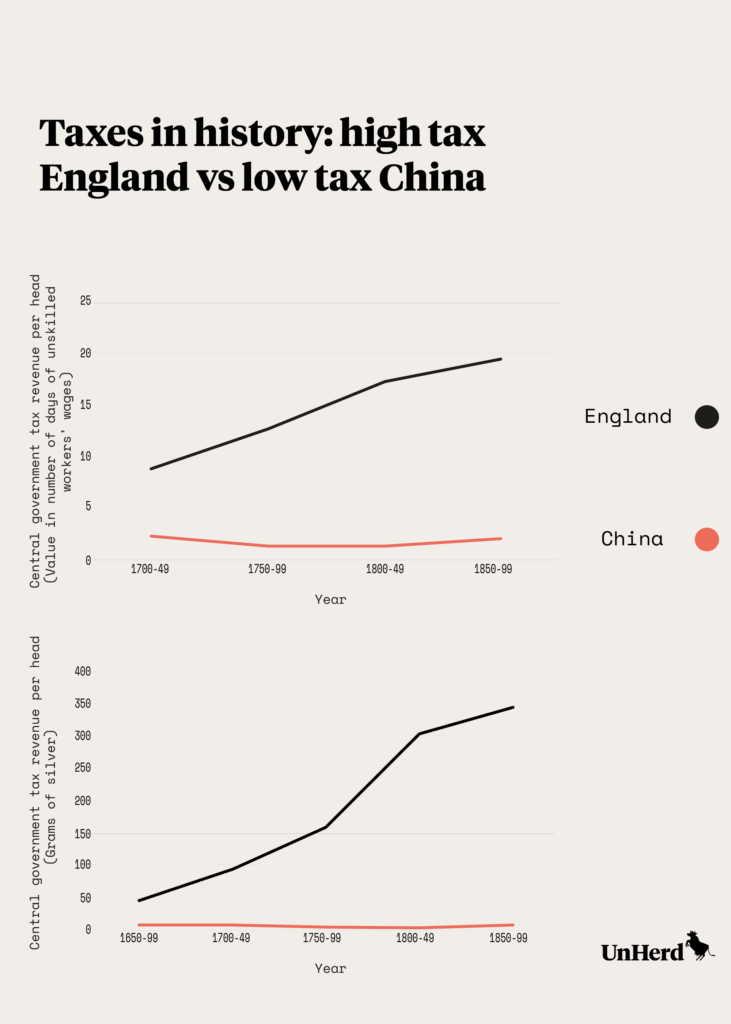

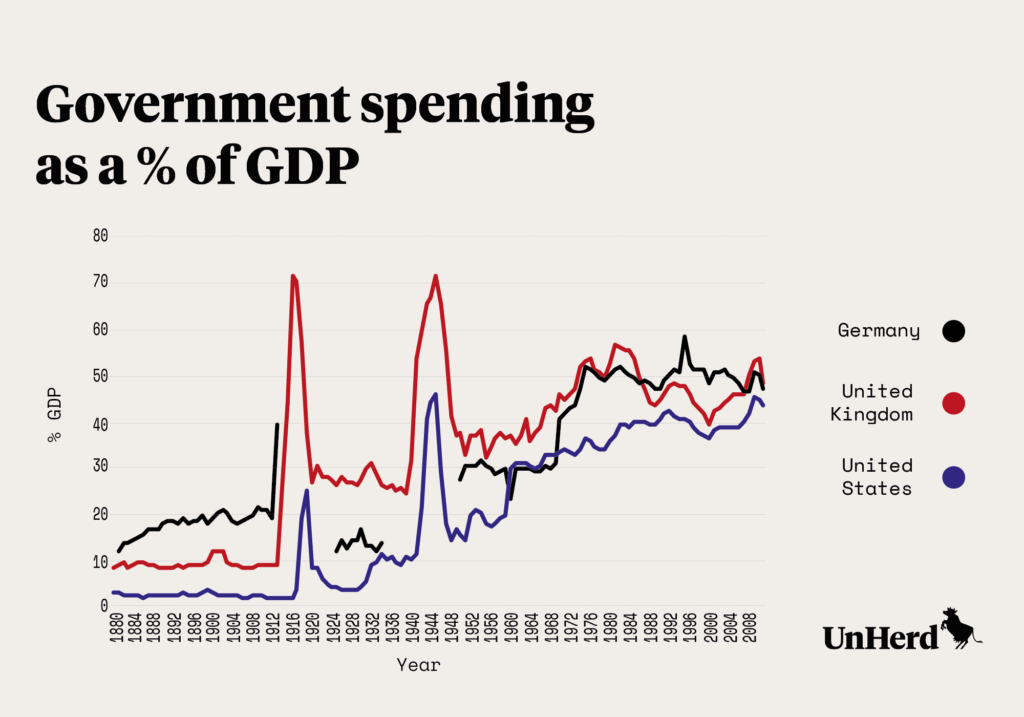

Alongside the astronomical rise in living standards over the last two centuries, we have seen an unprecedented expansion of the state. Whilst the tax take of preindustrial states typically represented less than 5% of GDP, in the typical modern day OECD country taxes represent 20-40% of GDP.1 And, perhaps ironically, it wasn’t a low-tax part of the world that spurred the process of modern economic growth. It was high-tax Britain that was home to the first industrial revolution in the late eighteenth and nineteenth centuries.

Not only do comparisons across the ravages of time suggest that states and prosperity go hand in hand, so do comparisons across countries today. Indeed, some of the poorest parts of the globe lack well established and capable governments. They also tend to be fragmented and experience significant internal conflict, including civil war. As economists Noel Johnson and Mark Koyama note:

“Today’s richest countries possess both sophisticated market economies and powerful, centralized, states. In contrast, the poorest people in the world tend to live in regions with dysfunctional markets and weak or failed states”.2

The conclusion of a 2013 report for the National Bureau of Economic Research was as follows:

“[i]t is now widely recognized that the weakness or lack of ‘capacity’ of states in poor countries is a fundamental barrier to their development prospects. Most poor countries have states which are incapable or unwilling to provide basic public goods such as the enforcement of law, order, education and infrastructure”.3

Even in the US, where there is a tradition of arguing that the state is inimical to growth, there is increasing evidence of a historic link between the state and prosperity. That includes the work of Alex Marshall, author of The Surprising Design of Market Economies,4 and that of Daren Acemoglu, Jacob Moscona and James Robinson, who, using postal stations as a proxy for state infrastructure in history, find a strong link with innovative activity, as measured by patents.5

The positive correlation between the state and prosperity is hard to square with the popular idea that having a small government is necessary for building a rich economy. It’s difficult to deny the fact that big government can indeed be bad for the economy. Ask any New Yorker about William M. Tweed,6 one of the most corrupt politicians the city has ever known, and you’d soon understand why America is much more sceptical of big government than is Europe. And we all know the problems with communism and central planning.

So how do we explain the fact that many of today’s richest economies also have sizeable states?

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe