The financial press is reporting that the Chinese economy is returning to growth since the lockdowns have been lifted. The reports come on the back of improving Purchasing Managers Indices (PMIs), which are based on surveys passed around by purchasing managers — that is, those who lead teams of people responsible for procuring goods and services.

The western interpretation of this data isn’t wrong, but the data itself might be. This is not surprising to those who have gotten familiar with China’s statistical games and how they are played. When I spent the better part of a year studying the Chinese economy and familiarising myself with Chinese statistical methodology, I realised that sensitive metrics like PMIs are mostly fake.

The trick to getting a read on the Chinese economy is to find indicators that cannot be faked. My favourite has always been Chinese import growth. Import growth tracks GDP because, as economic growth rises, people buy more — and since some of these purchases come from abroad, they buy more imports. Import data is impossible to falsify because both the buyer (in this case, China) and the seller (in this case, China’s trade partners) have a record of the transaction.

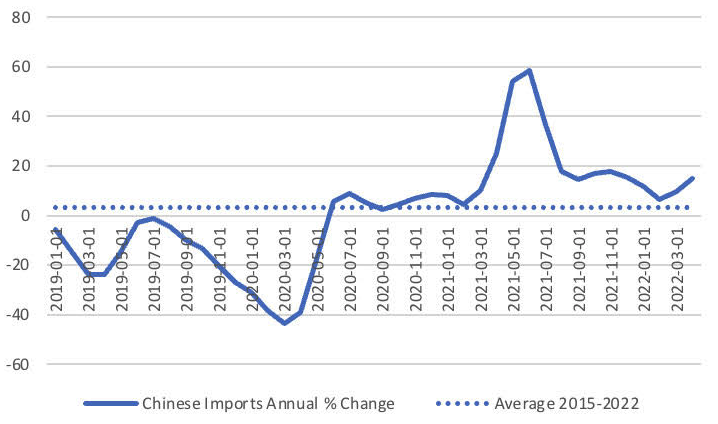

If you have been following Chinese import data recently you have not seen much evidence of a severe slowdown. The chart below plots import growth together with average import growth since 2015. The latest data from April shows imports growing around 15% from the year before. The average annual growth rate since 2015 has been around 3%. So, anyone following this metric would be unimpressed with the prognostications of an imminent Chinese recession.

The idea that China is entering is a recession is symptomatic of a bigger problem among economic and financial commentators today: they do not factor into their views the process of decoupling that is taking place in the global economy right now. They think that because the developed world is facing a recession, countries like China must be too. But the reality is that countries like China are rapidly delinking from the developed economies.

In the next few months and years, the real metric to watch in China is the inflation rate. Right now, it is very low, running at 2.1%. Compare this with the UK (9.1%), the EU (8.1%) and the US (8.6%) and you see a huge discrepancy.

What does this mean? A few things, all of which will be extremely relevant as the new world order emerges in the coming years. Firstly, it makes the goods we sell to China ever more expensive, thereby damaging our competitiveness. Secondly, and related to this, it means that in the coming years — unless the Chinese government intervenes to prevent it — our currencies will lose value against the Chinese yuan. This will make Chinese imports more expensive domestically.

In short, if inflation in the developed world continues to run hot, we will get poorer and less competitive. These two trends will reinforce each other and living standards will fall. This is yet another reason why the sanctions policies driving much of the inflation are so self-destructive: they are weakening us economically in just about every conceivable way.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe