Back in October, the Telegraph reported that the eurozone was at “risk of financial meltdown”. According to experts, the European Central Bank could soon have “no choice but to follow the Bank of England and step in to prevent market disaster.”

Except that, while the British meltdown was bad enough to topple Liz Truss, there’s been no equivalent upheaval on the continent. And for that, we should all breathe a sigh of relief.

The last thing we need right now is another eurozone crisis. The first one was bad enough — and taught us there are no quick fixes when it comes to something as fiendishly complicated as the European single currency. Unlike recent events in the UK, ending the first eurozone crisis required a lot more more than a swift change of prime ministers.

Despite the multiple impacts of Covid, the cost-of-living crisis and Putin’s invasion, the eurozone is currently holding it together. Unlike 10 years ago, we haven’t seen the interest rates on public debt diverge uncontrollably between Germany and the so-called “peripheral” member states like Italy and Spain.

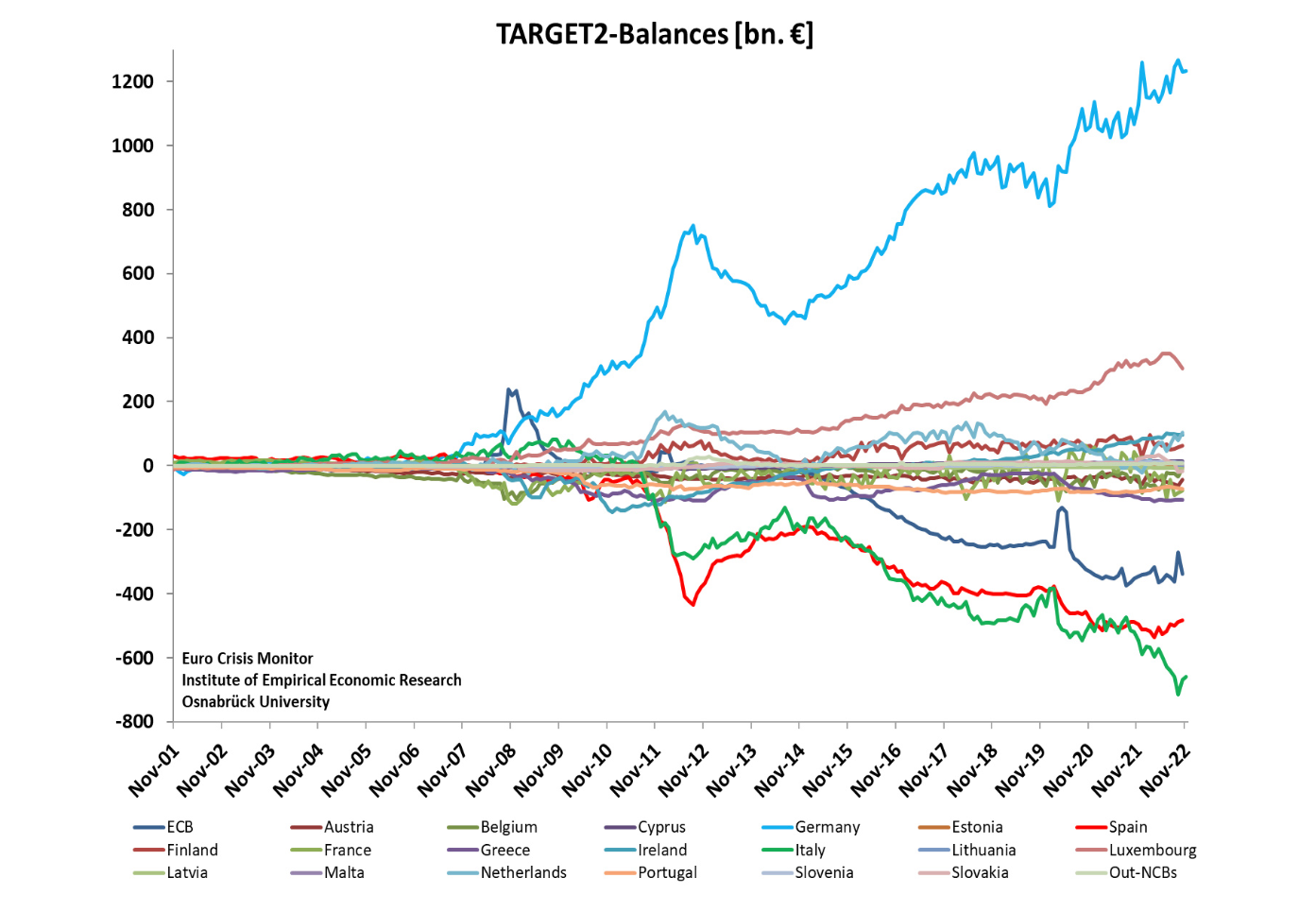

However, there is another indicator worth keeping a wary eye on. It concerns TARGET2 — which can be thought of as a running tab between the central banks of each eurozone member state. If there is a net flow of euros from country A to country B, then that would be recorded by TARGET2 as a negative balance for A and a positive balance for B.

Normally one would expect these balances to shift back and forth with the free movement of goods, services, people and capital. Except that’s not the way things have worked out. The imbalances between eurozone nations have become permanent and they’re growing year-by-year.

You can see the long-term trend in the chart above from Osnabrück University. Countries like Italy are going deeper and deeper into negative territory — while other nations accumulate ever-larger positive balances. Germany alone now has a positive balance of more than a trillion euros.

It is sometimes claimed that this isn’t real debt, just an accounting quirk of the system. But this is wrong. Money is quite literally a promise by a central bank to pay the bearer on demand. Money circulating in a national economy has to be backed up by assets held by a country’s central bank, otherwise the bank would be insolvent.

Therefore there can’t be a net flow of euros from, say, Italy to Germany unless the German central bank acquires a balancing claim on Italian assets. This is what TARGET2 is actually keeping tabs on. It’s a special kind of debt, but still a debt.

The big question for the eurozone is how long can this great divide — between creditor and debtor nations — keep growing? Anyone who says forever is fooling themselves.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe