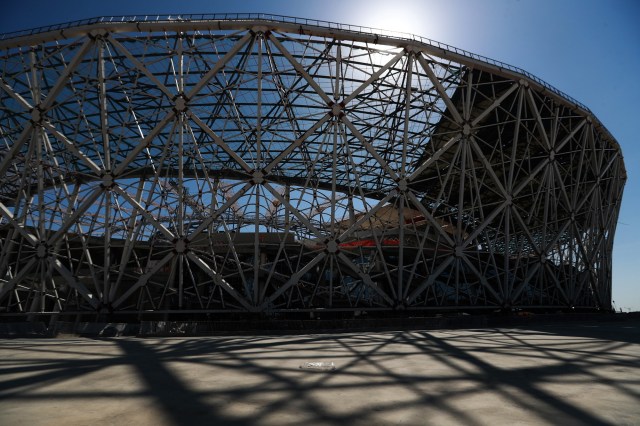

Under construction. Sergei Fadeichev/Tass/PA Images

VoxEU has a fascinating, if depressing, analysis of the long-term decline of growth across the developed world. The three authors – Antonin Bergeaud, Gilbert Cette, Rémy Lecat – identify faltering productivity growth (in the form of ‘TFP’ or total factor productivity) as the main cause of the slow-down:

“…GDP growth appears particularly low since 2005 in all four economic areas [the USA, the Euro area, the UK and Japan]. The main accounting origin of this low growth is a declining contribution from TFP. Are we therefore facing a risk of ‘secular stagnation’ in the sense that there is not much TFP gain to be expected in the future?”

There are many theories seeking to explain the general slowdown in productivity growth, but something to bear in mind is that performance in some sectors is a lot worse than others. And worst of the lot, according to the Economist, is the construction sector:

“Construction holds the dubious honour of having the lowest productivity gains of any industry, according to McKinsey, a consultancy. In the past 20 years the global average for the value-added per hour has inched up by 1% a year, about one-quarter the rate of growth in manufacturing.”

In some economies construction productivity growth hasn’t just slowed, but stopped altogether or gone into reverse:

“Trends in rich countries are especially bad. Over the same period Germany and Japan, paragons of industrial efficiency, have seen nearly no growth in construction productivity. In France and Italy productivity has fallen by one-sixth. In America, astonishingly, it has plunged by half since the late 1960s.”

What could be to blame? Not the cost of building materials (which aren’t factored into the calculations) nor the cost of regulation (much):

“The burden over time of complying with regulation—applying for permits, for instance—is only partly responsible. In America such rules account for one-eighth of the productivity lost since 1987, according to the Bureau of Labour Statistics.”

The Economist does, however, put forward two other explanations, one of which is more convincing than the other. The less convincing theory is that the construction industry is performing badly because it has failed to consolidate:

“America now has about 730,000 building outfits, with an average of ten employees each. In Europe there are 3.3m with an average of just four workers. Competition is fierce and profit margins are thinner than for any industry except retail.”

Shouldn’t competition be a spur to efficiency? As for thin profit margins, those have hardly held back the retail sector, which is (in)famous for its disruptive waves of innovation. Furthermore, some countries’ construction sectors have consolidated. For instance, in the United Kingdom, house building is increasingly dominated by a handful of big developers, and yet the UK market is notorious for its lack of innovation – advanced construction methods commonly used in Germany and Scandinavia are all but unknown in Britain.

There’s a lot more to be said for the other explanation:

“…the industry has become less capital-intensive, with workers replacing machinery. This shift is more understandable in countries with access to inexpensive labour. In Saudi Arabia, for example, it is cheaper to import workers from India or Pakistan than to buy machinery. In many countries, however, labour costs might be expected to spur firms to substitute workers with capital.”

Western nations have also imported construction workers to keep labour costs down. The number of eastern Europeans working on western European building sites is testament to that. But it’s not just about wage levels:

“‘The industry has learned through bitter experience to prepare for the next recession,’ says Luc Luyten of Bain & Company, a consultancy. Capital-heavy approaches to construction bring high fixed costs that are difficult to cut in downturns. Workers, in contrast, can be fired.”

The ebb-and-flow of migrant labour across borders facilitates this business model – and, in some ways, it’s very efficient (not to say ruthless). However, it is also a big reason why the construction sector isn’t investing in the innovation that would boost productivity, allow workers to earn more and even save lives (by using machines instead of people on the riskier jobs).

Other things need to be done to fix the construction sector (not least wholesale land reform), but we need to be aware that the free movement of labour isn’t always good for the long-term health of the economy. The ability to turn the labour supply on-and-off like a tap is supportive of labour-intensive, low wage business models that define the sector as it is, not as it should be.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe