Across Europe, once mighty parties of the mainstream Left have withered away. The standard explanation is that they alienated their working class supporters on social issues like immigration.

But that’s not the whole story. In some countries, the centre-Left has also lost the plot on bread-and-butter economic issues too. A case in point is Italy where the Democratic Party (PD) — the most conventionally ‘progressive’ of the four biggest parties — is the one seeking to cut benefits for the poor.

In a piece for Foreign Policy, Georgio Ghiglioni explains how welfare policies have become associated with Italy various populist parties, while opposition to those policies and support for budgetary restraint has become PD’s thing:

In the smallest sense of the word, the progressive party is becoming ‘conservative’ — the primary supporter of the status quo.

Of course, in Italy and elsewhere it’s important to understand what the status quo is — and that is a system of spending controls imposed on nominally sovereign states by the European Central Bank and other EU institutions.

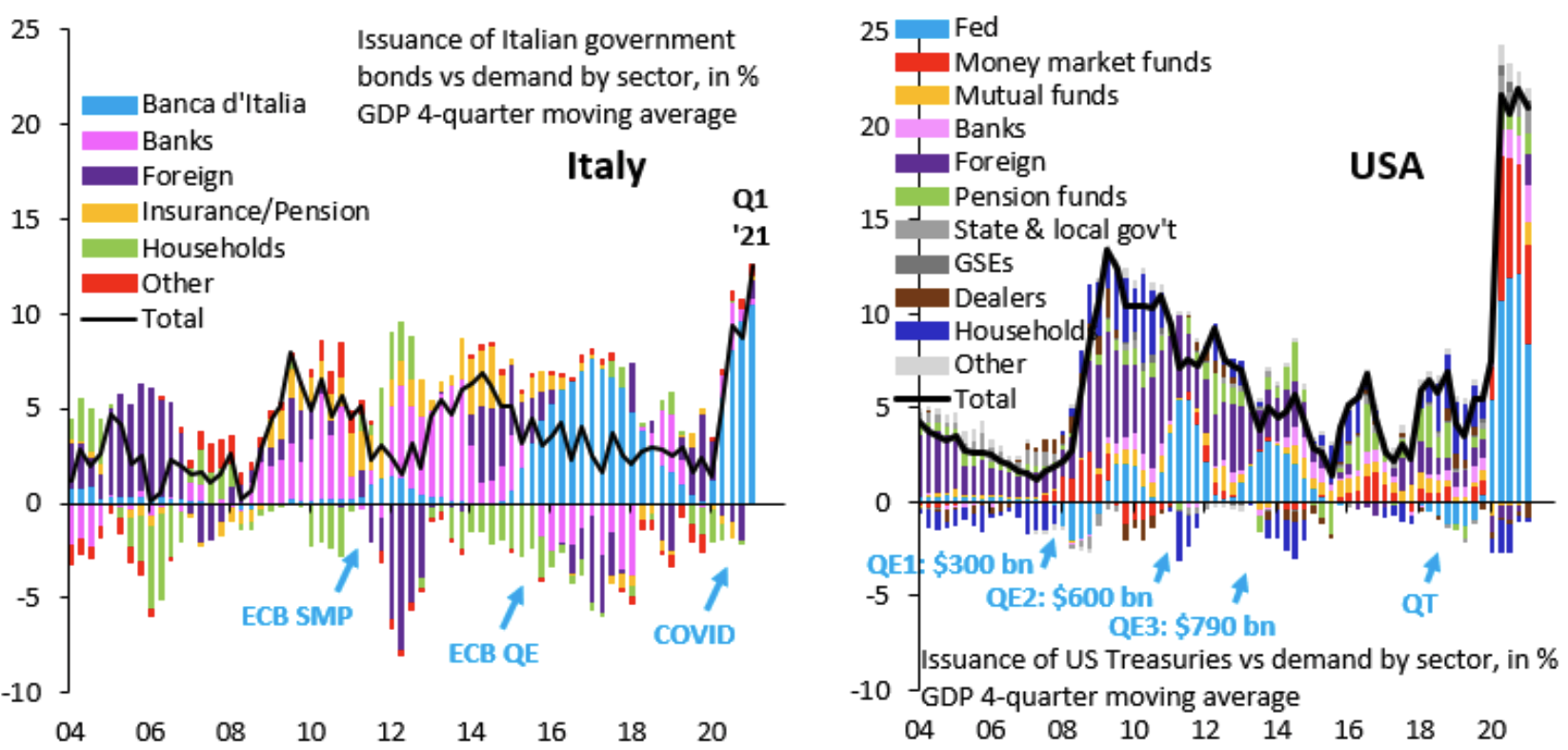

Right now, one else apart from the Bank of Italy (i.e. the ECB’s local branch office) is buying Italian government bonds. Just look at these two charts, tweeted out by the economist Robin Brooks. What they show, for Italy and the US, is how much debt (in the form of bonds) is being issued by each country’s government — and who’s been buying it.

As you can see, in both countries, the central bank steps in at times of crisis to become the lender of last resort — literally creating money out of nothing and using it to buy up bonds. This allows governments to run bigger deficits. The key difference is the totality of the Italian government’s dependency. When things get rough — like during the Eurozone crisis and now with the Covid crisis — just about everyone except the ECB stops lending to Italy.

The ECB, therefore, is in a supremely powerful position to dictate terms to the Italian government. Of course, it needs local agents — which is why the unelected Prime Minister, Mario Draghi (a former President of the ECB) has been installed as de facto viceroy. And it’s why the PD has emerged as the viceregal party.

Support for institutions against rampaging populists provides moral legitimacy for this role. However, within the context of the single currency, these institutions have become instruments of foreign control — a state of affairs the populists can exploit as a never-failing fountain of resentment.

It is a deeply unhealthy situation — which should horrify progressives and conservatives alike.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeNow that left-wing parties have aligned themselves with big business titans in order to promote fashionable woke causes, the people have no-one else to turn to except the far-right.

No, the Left is the boss, there is no where to run to. The Left are spending so insanely on covid response (and for no reason but economic agenda of stealing all the savings of the working class and middle class) that the die is cast. There is no one left to turn to – your goose is cooked, the money is spent.

Here it is in a nut shell.

1) Spend Trillions which can never be repaid. (although this QE stuff is monetary spending and does not bring inflation like Fiscal spending – but Fiscal is also being done) (this buying bonds is to keep interest at ZERO, and the stock market and zombie companies afloat)

2)get enough into the M2 money supply (cash sent out and spent) to create inflation. 4-7%, some say 15%

3) Use the bond buying to keep interest at Zero. (USA Fed buys 120 Billion a month!)

4) Inflation taxes the savings of everyone by debasing the currency. Inflation is a tax, it takes your savings and pension to pay back the debt. (The pointless debt as lockdown did harm, no good)

5) your savings shrink as inflation rages, and zero interest (USA 10 year Treasury Bond 1.3%, USA CPI inflation 4.5%, negative 3% real rates – your savings melting away – AND to avoid this you MUST take risky investments, like the hugely inflated stock market, which WILL crash at some point, taking your savings put there too)

6) the government is Harvesting your savings and pension, and there is NOTHING you can do about it!

7) the wealthy are getting MUCH richer as they own appreciating assets as you own depreciating ones – they win, you lose.

8) inflation is shrinking your income, and till you get the far spaced pay rise your actual income is less and less spending power by inflation.

That is the game, they are bankrupting you, and there is nothing you can do.

You will own nothing and you will be happy – Claus Schwab, WEF.

The underlying problem is the single currency, which prevents any eurozone country devaluing (or revaluing) against the others. It also raises the stakes of leaving the EU to sky-high levels and so binds eurozone countries into the EU (as intended). Italy could leave the eurozone but at the risk of triggering another world financial crisis.

In what way is Italy any different from other EU countries, re the “branch office” of the ECB buying their bonds?

I think the difference is that Italy is the only eurozone country whose bonds are reliably bought only by the ECB, which is thereby protecting Italy from bankruptcy. But yes, some other countries must be getting close to that position, like France.

It would have been nice to see a comparison with other EU states. The comparison with the US is hardly informative for the article.

As I am not an economist, the graphs confuse me. I guess that above the line is the bond issue and below the line is the buying by the various finance houses. There is a greater area above the line than below, so who is buying the rest of the bonds?

If banks just create money, does it matter anyway (except for political control of the country, which is meaningless in Italy where the citizens do the exact opposite of what the government wants them to do)?

Banks ‘Loan Money Into Existance’ – it is cool how. You borrow $100,000 to buy a house. The bank puts your IOU (called a note) in its assett side of the ledger first, now it has a $100,000 asset, and pays the owner $100,000 as a Liability, they equal out. $100,000 was loaned into existence, there is no box of cash in the basement they got it from.

But this was also done based on your credit score, income, and the collateral of the house. $100,000 was just created out of air (ones and zeros chase around – the mortgage is usually then sold, USA FED buys 40 Billion $ of mortgage backed securities a month now)

Now when the Central Bank buys the bonds, in USA The FED buys $100,000 of USA Treasury Bonds – Nothing backs it – no income from a job, no collateral – just the Gov backing it – it is called FIAT money. Money backed by nothing but the word of the Gov.

This video is a MUST watch to get it, really gets going around 17 minutes when it shows how banks REALLY work – give up a night netflix and enjoy this one, I love it….. https://www.youtube.com/watch?v=u8j51XZegsk

And it gets WAY weirder when you find eventually the Foreign banks also loan Dollars into existence – there are so many $ loose in the world no one could figure it out till…… It is great fun to watch – really – (Daniell DiMartino Booth is ex-USA FED, so was deep in the scene, this is real)