What is the biggest threat to the West right now — China or inflation? Stupid question, you might think. One is a country, the other an economic indicator. They belong to different categories, so comparing them is ridiculous.

Except there’s a very deep connection between the two. Right up until Covid, we’ve enjoyed a twenty years of miraculously low inflation. Over the last decade, we’ve really pushed our luck — forcing interest rates down to zero and instructing our central banks to turn on the printing presses (or QE as it’s politely known).

In any other era this would have meant runaway inflation. But not in the pre-Covid 21st century. In fact, some countries have struggled to avoid deflation — i.e. falling prices. So how did we defy the laws of economics for so long?

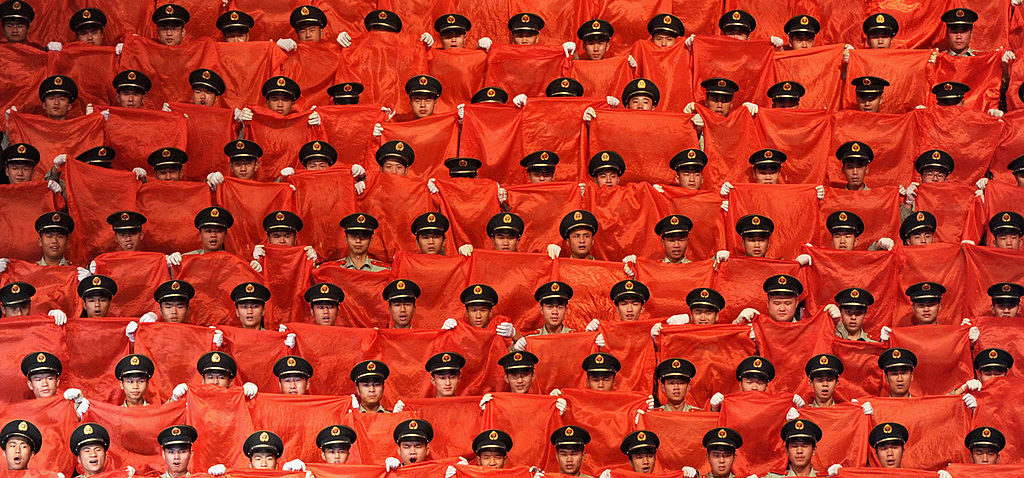

A huge part of the answer is China. By opening ourselves up to cheap Chinese exports we kept inflation at bay. But that doesn’t mean there hasn’t been a price to pay. There has and there is — and it can be seen in the following chart from the The Economist:

Maps du jour: More trade with US or more trade with China (2000 vs. 2020) pic.twitter.com/qpsnSbJ744

— Michael Li 李之樸 (@mcpli) July 18, 2021

In just twenty years China has displaced the US as the number one trading partner of most countries across the world. That includes virtually all of Asia, Africa and Australasia; and also most of South America and the majority of European nations (though not yet the UK, France and Italy).

Worried? We should be — but expect endless excuses. For instance, some people complain this a comparison of China with America alone. For instance, the map would look different if the European Union were included. To which the obvious response is: how many divisions have they got?

Another cope is that China’s trade position is built upon low value items that the West imports to make high value items. But if that were the whole story, then why is the West struggling to build 5G networks or nuclear power stations without high level Chinese involvement? China isn’t just the Saudi Arabia of widgets, it is an economic, technological and military superpower.

Rather than face up to the strategic implications, the West right now is more worried about the internal threat of inflation. Thus the news that the export side of China’s economy is roaring back into life will have been met with pathetic relief not foreboding.

Clearly, governments need to ensure that post-Covid inflation is no more than a transitory phenomenon. However, the fact remains that Covid has left China stronger and the West weaker — and that our leaders have no idea what to do about it.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe