Tuesday’s US inflation report brought a rare bit of good news. After the figures came in lower than expected, traders uncorked the champagne. The narrative that had been building, that the Federal Reserve has turned the corner in its war on inflation and interest rates will soon come back down, received apparent reinforcement. Bond yields plummeted and stocks surged, heralding the start of a so-called Santa Claus rally before the Christmas break.

Of course, the celebration could yet turn out to be premature. Even though it came down more than expected, core inflation remains elevated, and its trend is not yet unambiguously downward. The evidence can be read to support either that core inflation is falling or that it has levelled off around 4%. Which of these one chooses to believe remains essentially a matter of faith.

But, at their current level, real interest rates remain barely positive, which suggests markets are priced for perfection: traders have more or less baked in that the inflation surge has run its course, the pre-pandemic normal will be fully re-established next year, credit will become cheap again, and markets will resume their unending ascent. All it would take to burst this bubble would be for next month’s inflation report to reveal core inflation as remaining stubborn. If that happens, the rally could quickly reverse, and it could turn out to be a dark Christmas for markets.

If, however, next month’s inflation report produces more good news, it could suggest that something really significant is at play in the US economy. In Europe, inflation has fallen on the back of economic weakness and slowing demand. In the United States, it has done so despite an economy that steadfastly refuses to go into recession. On the contrary, job markets remain strong and real wages are even improving. Meanwhile, after falling from last year’s peak, corporate profits now seem to have levelled off.

What that would suggest is that producers are able to cut prices not by slashing wages or profits, but instead because workers are producing more. The most recent productivity report from the US recorded a sharp rise in labour productivity, which allowed labour costs to fall despite better wages. One shouldn’t make too much of a single report, as productivity figures can be quite volatile, but it’s significant that the US surge breaks with the trend in other Western countries, where productivity remains flat or is even falling.

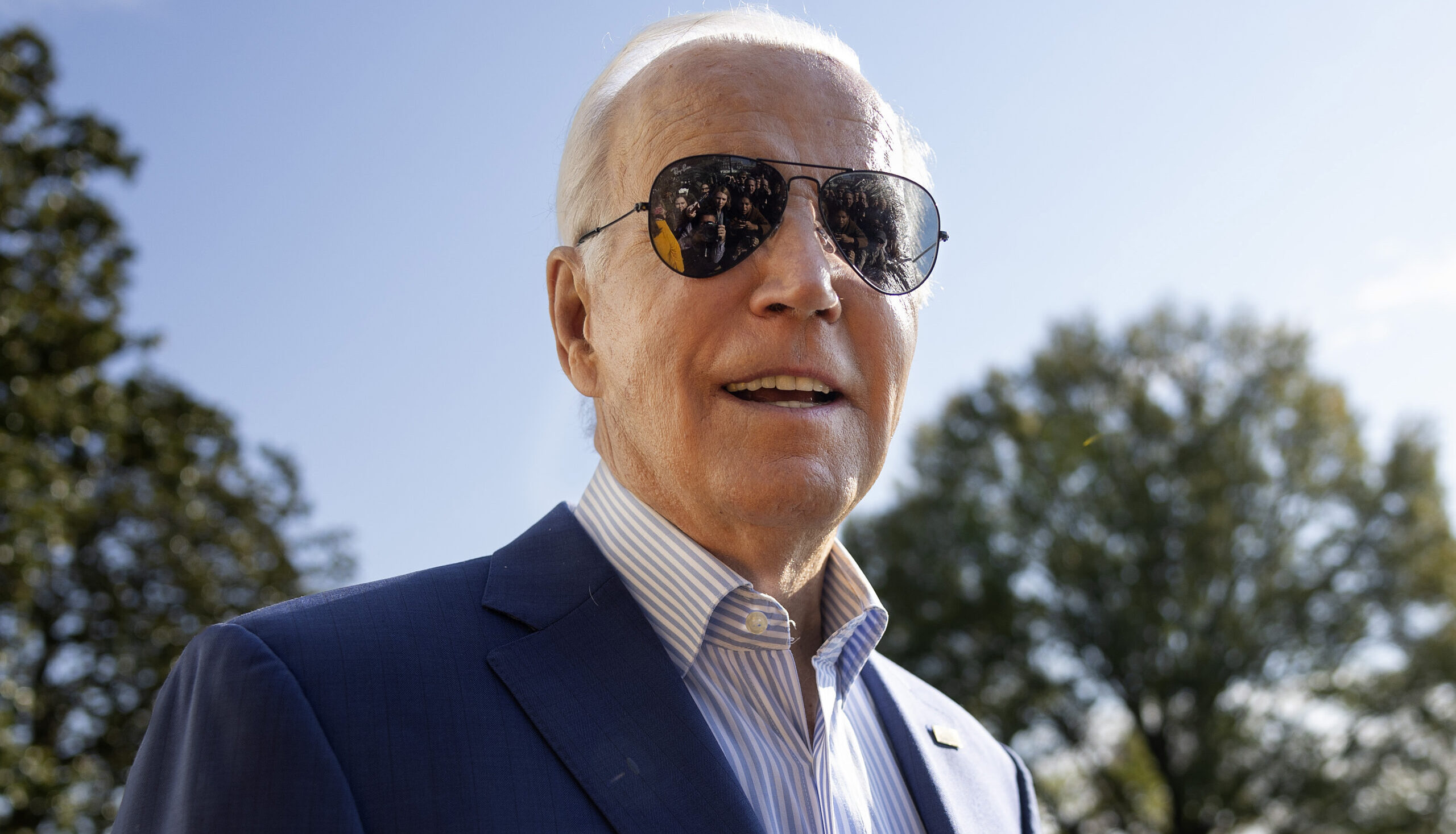

This is, of course, just what the proponents of the Biden administration’s industrial policy said would happen. By pouring public money into new industries, particularly those that advance the decarbonisation of the economy, they claimed they could kickstart a new industrial revolution. The rise in productivity would sustain economic growth, boosting tax revenues and thus allowing the debts incurred to fund the programme to be easily paid off.

In contrast, the long experiment in austerity and tax cuts, of the sort to which the British and German governments continue to cling, has yielded nothing similar. This report could just point to the emergence of a new economic orthodoxy — as the Biden administration has put it, the end of the old Washington consensus and the start of one that is more reminiscent of the New Deal economics of the more distant past.

Whether or not this turns out to be another false dawn, one thing can be said with confidence. In the midst of other uncertainties, we can be sure that dramatic economic news will keep coming from America.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe