To much fanfare at the end of last week, the Bureau of Labor Statistics (BLS) in the United States published jobs numbers that appeared surprisingly rosy. The BLS reported that the number of jobs grew by 517,000 in January, a figure that, outlets claimed, “surprised economists”. No doubt this was a strong jobs report, but there are reasons to be cautious.

To understand why, we need to rewind back to February 2008. In its report on the January job numbers of that year, the BLS stated that “nonfarm payroll employment and the unemployment rate were essentially unchanged in January”, signalling that all was stable (‘nonfarm payroll’ refers to the entire economy’s employment outside of the agricultural sector). But, in retrospect, the next sentence portended disaster: “The small January movement in nonfarm payroll employment reflected declines in construction and manufacturing and job growth in health care.”

In fact, construction employment had been going down for some time. It had been falling since the summer of 2007 and by January it was registering a 3.2% annual decline. By December of 2008, construction employment was falling at 10% annually and the American economy was in a deep recession.

But what does that have to tell us today? After all, the recent BLS report stated that construction had added 25,000 jobs in January. Surely trying to draw parallels with 2008 is a fool’s errand? Not so. In fact, the fall in construction employment that started in the summer of 2007 was predictable from as early as the summer of 2006. It was then that construction investment started to collapse.

During the summer of 2006 real private residential investment — which is a good proxy for construction investment — fell by around 7% annualised. It continued to fall faster and faster in the following months. Obviously, if investment in a sector is falling then eventually this will translate into workers being laid off. And so it did, almost exactly a year later.

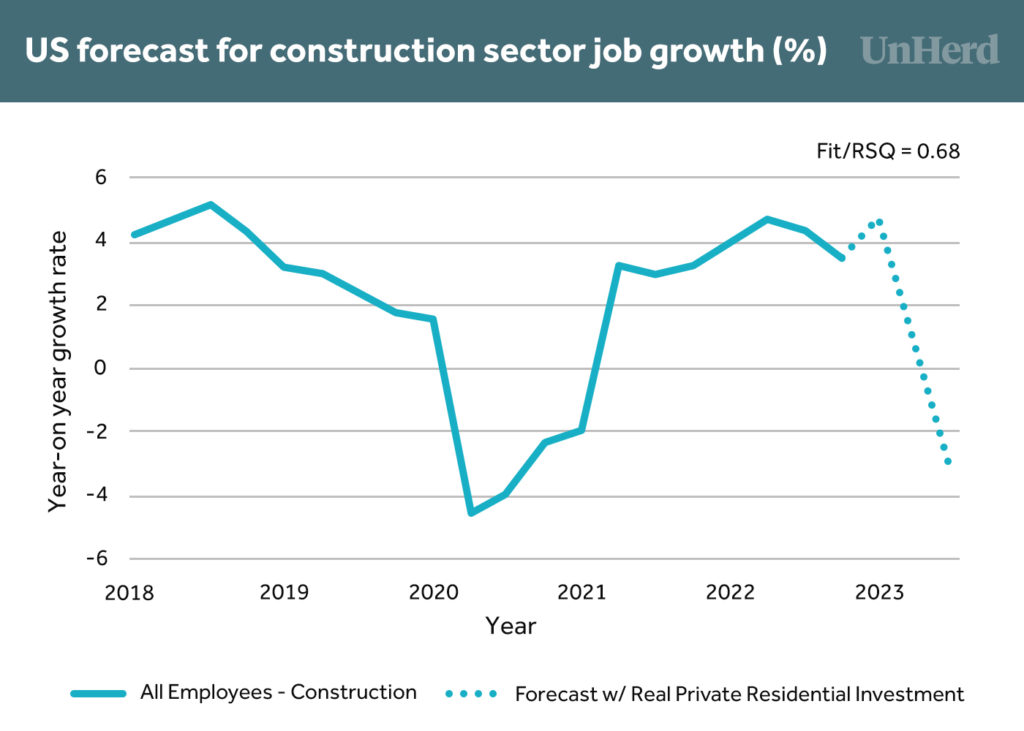

Well, real private residential investment is falling once more. In the fourth quarter of 2022 it fell by around 9% — faster than it did in the summer of 2006. Using this data, we can use regression analysis to predict construction sector job growth in the coming months.

As we can see in the chart, residential investment growth predicts that construction layoffs will begin this summer in the United States. This is actually an optimistic prediction, given the underlying weakness of the economy, and those layoffs may well happen sooner. So long as residential investment continues to fall, the layoffs in the construction sector will rise — and eventually the US economy will tip into recession, potentially between the summer and winter of this year.

In fact, the rosy jobs numbers themselves could accelerate this process. These figures will put further pressure on the Federal Reserve to raise interest rates given that financial markets are betting on rates above 5% after the report. These high interest rates will only further discourage residential investment, and so could themselves speed up construction layoffs.

This matters for us here in the UK, too. For one, if the US slips into recession we will undoubtedly follow. But more immediately, Fed rate hikes spur the Bank of England to raise rates further to ensure that the value of sterling does not erode. This will spark less investment in the construction sector here and, unlike in the US, we are already seeing construction employment fall. So whatever happens on that side of the Atlantic, we should be doubly prepared for it to come to us, too.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe