In 1900, the London Stock Exchange (LSE) accounted for a quarter of global market capitalisation. It remained the world’s largest market for the next half-century, until after the war when it was overtaken by the New York Stock Exchange. Today, the LSE has fallen to around 10th place in the global ranking, accounting for less than 3% of the global market cap.

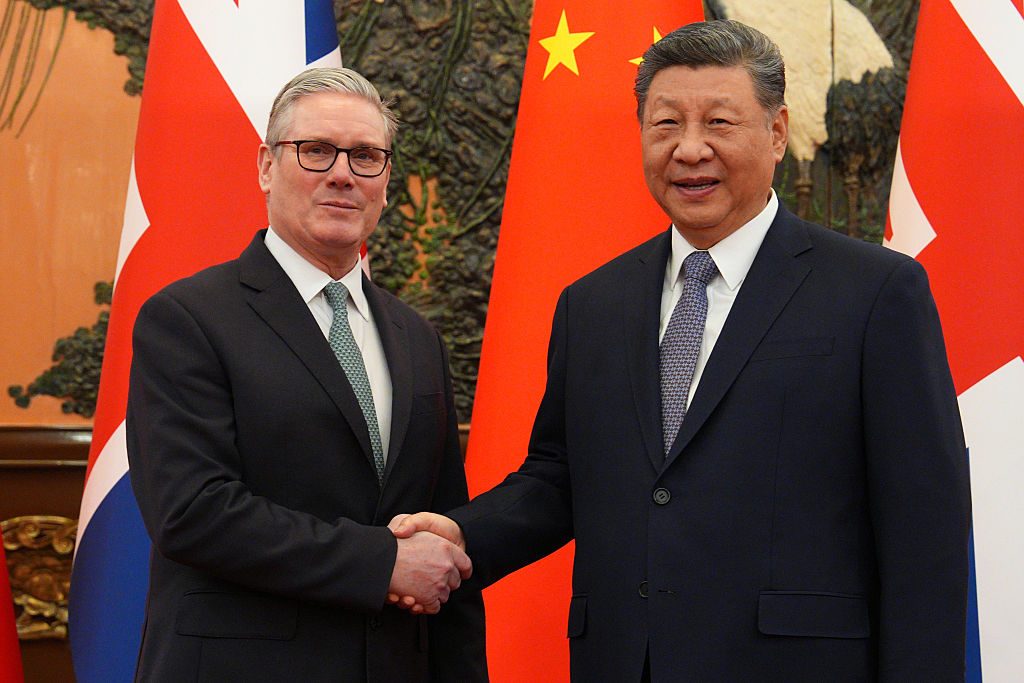

The LSE has been losing business to its American rival for years, as companies wishing to raise funds are drawn to the much deeper pools of capital in the US. British governments have, in turn, tried to reverse this decline in various ways. Earlier this week, it was reported that the Government is interested in loosening accounting standards to allow more listings by Chinese companies.

This change, much like others which have been tried, amounts to fiddling at the margins. The weight of a stock market ultimately reflects a country’s geoeconomic heft, and Britain just isn’t the powerhouse it once was. Today, its global presence has withered, while the postwar Bretton Woods system replaced the pound with the dollar as the principal global reserve currency.

One way to build some weight would be for the LSE to widen its pool of capital, either through mergers with other markets or by fishing in a bigger pond. Reintegration with Europe might help with the latter, although the current fragmentation of Europe’s financial system limits what any market can access. Were Europe to unify its capital markets and move to common bond issuance, the game might change. But, so far, action on these fronts has been limited.

There is, however, one development which may boost the LSE in the coming years. The US share of global market capitalisation has rocketed since the financial crisis, rising from 40% to nearly 60%. Most recently, this has drawn a wave of capital from all over the planet to the US, causing its largest companies to become bigger even than most of the world’s stock markets. But as US finances grow stretched, this rally seems to be running its course.

Most recently, the US has begun falling behind other markets, and the dollar is weakening. We may have entered a new phase in which capital goes hunting elsewhere, justifying the LSE’s attempt to find relevance in other forms.

The Government, though, would do well to tread carefully. Smaller markets like the LSE must be prepared to adapt to attract business. On the other hand, the reputation for solidity that Britain’s institutions acquired during its financial heyday is a strength that is difficult to acquire but easy to deplete. Given some recent accounting scandals involving Chinese companies, and the evidence that overregulation isn’t the reason for the LSE’s sluggishness, the advantages to be gained from loosening standards aren’t obvious.

Given the pivot of many Western countries back towards Beijing in the wake of Trump’s second term, it makes sense to explore partnerships with Chinese stock exchanges. But the country should take care to do so without compromising its principles. London might also reopen the discussion of mergers with other exchanges in like-minded countries. Talks with the Toronto Stock Exchange were abandoned 15 years ago, but given the new geopolitical landscape, it may be an opportune time to reopen this file.

The London Stock Exchange can’t tweak itself into rediscovering its former glory. A mid-sized economy like Britain needs partnerships and fiscal nous to once again be competitive with America, and a coalition with allies such as Canada or Europe may be the only way to truly become a financial powerhouse once again. Appeasing Chinese capital with deregulation only propels Britain further into the doom loop of decline.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe