Why is the Government talking-up tax rises? Surely, what our pulverised economy needs right now is a tax cut.

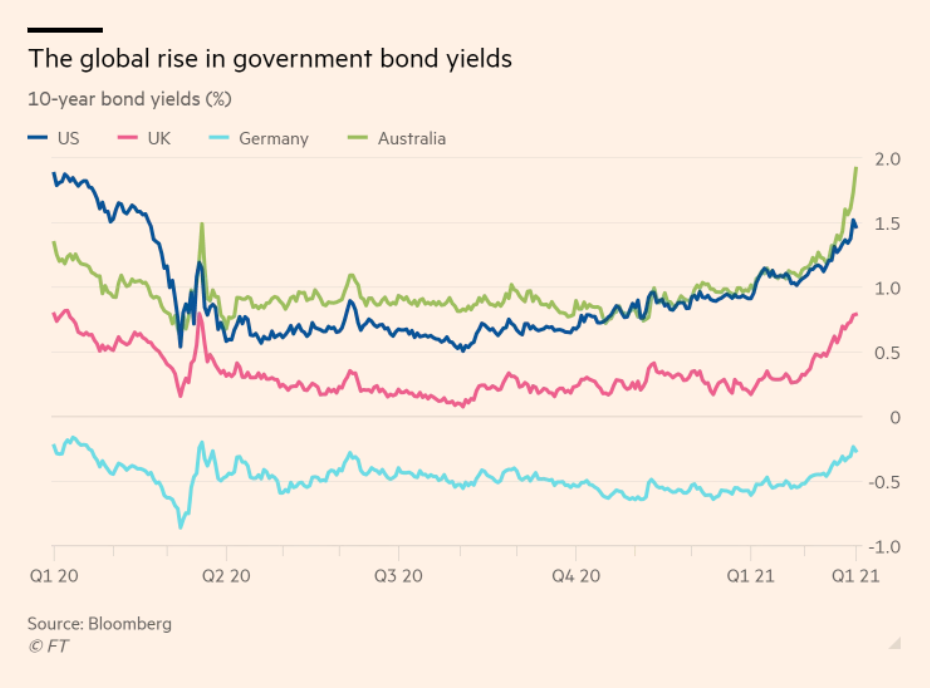

Well, yes — a confident Chancellor would be unveiling as much stimulus as possible in this week’s Budget. But if you want to know what’s got Rishi Sunak spooked, take a look at the following chart:

This shows bond yields — i.e. the rate of interest at which the money markets lend to governments. As you can see, these are ticking-up quite sharply. The idea that governments can borrow at “record low interest rates” cannot be taken for granted.

There has to be some limit to each country’s debt mountain — and by demanding a higher return the bond markets are sending a signal that those limits are within sight.

On his Substack, Adam Tooze writes about the role played by ‘bond vigilantes’ — meaning the role that the markets play in constraining government policy. Tooze has his doubts about traders acting deliberately to clip the wings of the state. Even in cases like the Eurozone sovereign debt crisis, when rocketing bond yields threatened to bankrupt countries like Greece and blow-up the single currency, he suspects that the markets were only acting in response to political priorities:

In other words, the markets only do what powerful governments ultimately want and allow them to do.

I’m sure that’s true — up to a point. Let’s not forget that the markets aren’t obliged to lend to us at next-to-no interest. If they decline to continue the supply of ultra cheap credit, then that is an act of self-preservation not political interference.

Of course, I can understand if Left-wingers don’t like the idea of the state being dependent on the patience of private capital. That being the case, however, it is for the Left to tell us how else they propose to finance the deficit.

The options include the state borrowing heavily from its own citizens — as the Japanese government does. Then there’s quantitative easing — i.e. the central bank ‘prints’ money and uses it to buy bonds back from the market. Finally, the state could do without the bond markets altogether, and directly create all the money it needs to spend (which is what the Modern Monetary Theorists propose).

And yet that still leaves the foreign exchange markets to deal with. A government that indulges in too much borrowing or too much money-printing will find that its currency becomes devalued — meaning that imports become prohibitively expensive.

This is not to argue for another decade of austerity. Governments are not like households and deficit financing has its place. The ability of the state to borrow and print money is a precious resource. However, it is also finite. We must use it accordingly.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe‘The options include the state borrowing heavily from its own citizens — as the Japanese government does. Then there’s quantitative easing — i.e. the central bank ‘prints’ money and uses it to buy bonds back from the market. Finally, the state could do without the bond markets altogether, and directly create all the money it needs to spend (which is what the Modern Monetary Theorists propose).’

As always, the one option not mentioned is to substantially shrink the size of the state, most of whose activities and amployees are useless and, more often than not, counterproductive in terms of shaping a civilised and productive society.

I think you need to get out more.

Religiously reading Ayn Rand is no substitute for real life.

Why the personal insult? I don’t see how that connect to Fraser’s post.

It would be more interesting if you were to make a counter-argument…

It’s difficult to argue with Fraser. Not because he’s always right, but because his assertions are so general that it would take a long article or book to do them justice. I don’t doubt there are lots of poor quality public sector workers and a lot of wasted money. But what %? What exactly would Fraser do differently? I appreciate it’s hard to put forward detailed arguments, but equally I’d cut someone some slack when they reply in a general way too.

Actually, the only Rand I have ever read is her first novel. which chronicles the Soviet Union in the 1920s. She had a lot of problems getting it published because all the leftie publishers refused to believe her account.

I am not, in principle, opposed to a large state if that state is possessed of competence and integrity. The British state, however, has long since ceased to display or embody either of these virtues.

Sorry – comment should be to Mark H (see below).

A somewhat broad sweeping and totally lacking in evidence point of view. I may as well say in response that the UK state is the most efficient , effective and valuable state in the world and the backbone of British society and civilisation. Neither of our statements mean anything at all unless backed up with detailed cases and argument

Thanks Fraser, for smashing the Overton window.

Your option is not going to happen.

Our real options are:

1) get nuclear fusion working = get rich

2) debase the currency = get poor

We can’t rely on 1) therefore prepare for 2).

Buy and hold gold.

Thanks for saying that because after the crash in commodities last spring, a good bit after, when they were already high, I put my spare cash into silver thinking a 1980, or 2010 Bull Run was coming, but no, so now worry about a 1981, and 2011 Bear crash.

The theory is when real interest (interest from bonds minus inflation) goes negative you buy metals. But they keep raising interest, and officially discount inflation!

Now as I am a tradesman I have to stop the project I was to begin as Lumber has gone up 150% – YES!!! 150% since last year! It now costs more to build a wood frame house than it is worth! Crazy!

House prices keep rising too, as does copper, steel, and every other commodity, but they say 1.5% inflation!!!

Something very strange is going on! PS my next buy is uranium mine stock, but the market just keeps rising in equities, WTF is going on?

Do yourself a favor and read “Austerity: The History of a Dangerous Idea” by Mark Blyth.

To do that, you’d need to enact legislation in order to remove the obligation of statutory services.

“counterproductive in terms of shaping a civilised and productive society” do you mean the BBC?

Hahaha why is the uptick in bond yields a surprise to anyone? Why will the uptick in inflation that follows be a surprise to everyone?

Delapsus Resurgam: when I fall, I shall rise.

“The ability of the state to borrow and print money is a precious resource. However, it is also finite.”

The bond markets are rigged. Governments can award themselves money to finance their spending. The threat of losing money due to a bout of QE keeps the ‘bond vigilantes’ at bay. This will continue even as inflation starts to rise. The only limit to governments’ ability to lie to its citizens, as Harold Wilson did in 1968, is the threat of hyper-inflation.

Governments were sweeping their unsustainable leveraging under the carpet long before the 2008 adjustment. They are behaving like gamblers who’s habit becomes an illness so severe that they will do anything to get the money for that one last punt that will win big. I suppose this is because most politicians and civil servants are protected by either inheriting wealth or extracting it from the working population, or both. They assume that the payback effects of their insane borrowing can be passed off onto the rest of us normal people without the risk of push back. History suggests otherwise.

That’s not how sovereign debt works. It’s not like your household budget nor your personal credit card.

No surprises here. What wil be surprising is if UK businesses manage to get over Covid etc plus Brexit and then start expanding, making profits , employing people and becoming a lot more productive than the last few decades. What happens over the next 5 – 10 years is anyone’s guess.

Tax appropriately and spend well to take advantage of the multiplier.

https://www.taxpolicycenter.org/briefing-book/how-do-taxes-affect-economy-short-run

Public sector spending cuts are virtually impossible since austerity measures have already thinned the public sector to statutory services.

Yep. When did spending more than you earn and living on debt become a long term sustainable option for running a business, economy or family?

You can slice it anyway you like but it doesn’t change the fact that since governments were able to create “currency” without having anything valuable, desirable, rare or tradeable – ie. gold – to back it, they have treated us voters to lifestyles beyond our means and we have voted for it.

It is all going to get pretty real very soon. This article from the excellent Finish economist Tuomas Malinen about why the rest of the world can’t just do what Japan has done makes it pretty clear and simple.

https://gnseconomics.com/2020/12/23/can-the-world-economy-japanificate/

whatever the truth of bond yield as an indicator is, can we agree that UK government borrowing is near its market limit? Will the UK government turn its desperate eyes to China, like the US did, when UK sources dry up?

This ridiculous notion that the UK government has to “borrow” the currency over which it exercises a monopoly of issue needs to go away permanently. It is illogical nonsense, and hasn’t been operationally accurate since the abandonment of Bretton Woods (which dictated convertibility of all currencies to the $USD, which in turn was pegged to gold) almost 50 years ago. How many years is it going to take for these risible, Monetarist gold-standard shibboleths to die?

Ye gods …

So are you suggesting that they continue to issue currency ie “print” money ad infinitum, thereby debasing the currency even further

“Print” is an archaic term which no longer has any relevance in terms of current monetary operations. As for currency debasement, are you claiming that the UK is a failed state, or is on the verge of failure as a state?

define failed state

The sad part is they can issue fiat currency as much as they wish. The notes in circulation will equal the value of the nation, and more just mean each note is worth less as a percent of the nation minus growth, but it is not inflation, it is something new, and thus the government can issue more fiat currency to pay its bills because the world prints more currency, uses it to buy USA Bonds to back their fiat currency, and get interest (neg or positive depending ) and so the USA can issue more currency based on the bond sales, bonds which the world buys to back its increased printing… and on – it go on for ever, but it is not inflation as all, as everyone, even China, (where 98% of its foreign purchasing is done in $ at some level) are doing it as one.

Not inflation but ouroboros monetary polity. A new digital reality.