‘Margin debt’ is an inconspicuous name for a potentially explosive issue. It’s the jargon for borrowing from a stock broker to buy shares. Instead of using money you’ve already got to fund the whole of the purchase, you buy a proportion of the shares on tick.

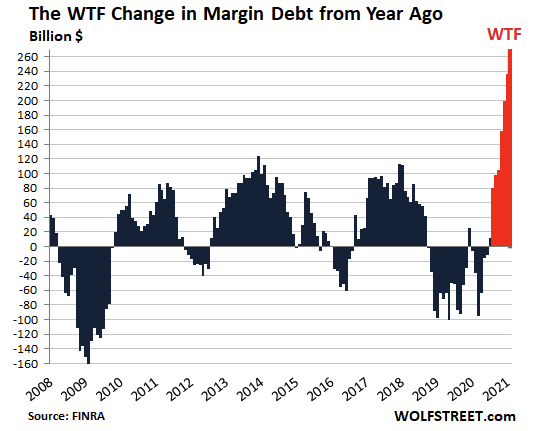

It’s a long established practice, but during the pandemic, margin debt has gone through the roof. In America, some financial analysts are beginning to sound the alarm. For instance, see this chart from the Wolf Street blog, which shows the ups and downs in margin debt levels since the global financial crisis of 2008:

As you can see, the last year or so looks intensely spiky. Or as the author, Wolf Richter, puts it: “the zoo has gone nuts.”

Certainly it helps to explain why share prices have recovered so well following their precipitous fall at the beginning of the Covid crisis. Once it became clear that western governments would borrow and print to keep their economies afloat, investors regained their confidence. Indeed, they began to salivate at the prospect of what all that economic stimulus was going to do to artificially inflate asset prices.

So no wonder investors have piled back into shares — if necessary borrowing the money to maximise their purchases.

Arguably this has been a good thing — at least in the short-term. If stock markets and property markets had crashed without recovering, the whole world could have tipped over into Covid-fuelled economic depression.

But as we vaccinate and unlock our way back to recovery, there’s a danger of unleashing an unsustainable boom, followed by a post-stimulus slump. Debt has a habit of exaggerating both the highs and the lows. Debt used to buy shares is especially risky. Obviously it helps to pump money into overheating markets, but when bubbles burst it also helps to accelerate the bust. That’s because when share prices are falling, brokers demand more cash from, and extend less credit to, their clients — who then get hold the cash by selling shares, thereby further reducing prices.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeGood article.

Also point to note is the rise of cryptocurrency esp since Covid initiated bust and recovery ! There is an intoxicating element to this computer generated idea which is very appealing to youngsters who have lost faith in the tangible economy. All this is giving way to incomprehensible stuff like exorbitant outfits for your computer image or ownership of the first tweet of Twitter boss or computer generated art !!! These should be taxed utmost .

However we do have to live in the real world . When it does come crashing, again the the most vulnerable & poor will suffer the most.

YES! insane NFTs! (Non-fungible token) I have never herd of such madness. It is like the end days of Louis the XVI out there. If the poor cannot afford Tesla stock let them buy tweets and stop frame sports goals and bad digital art and such block-chain NFTs.

https://en.wikipedia.org/wiki/Non-fungible_token

The stock market, assets and property, and crypto currency is soaking up all the excess cash – taking inflation away from the economy.

We could have a period of deflation followed by a rapid change to inflation.

I am storing up all my Schadenfreude for when Bit Coin crashes to zero, as when it hit $12,000 I laughed, and a year later when it hit $37,000 I said I wanted to buy one but dallied and Musk bought 1.5 billion$ of them and it rocked up, what is it now? 58$ thousand?

Actually, it always was too hot for me, it is based on nothing, and using it as broad scale money is not that viable as it trades at about a thousand times slower than the speed of normal money due to its built in mechanisms. And governments will try to ban it as they produce their own Fiat crypto, and it seems like the Tulip and Ponzi more than money, but then it has made unbelievable profits – if you get out in time.

But I do look at Ethereum wistfully….now at $1700….

What if BTc does not crash? I listened to a smart guy who said gold is for pessimists and BTC for optimists. People have been burying gold for centuries so I guess there is something in the pessimist theme. One of the attractions of BTC I suppose is that you can go anywhere in the world and access it. Short of torturing you nobody else can get hold of it. Then it is a bit like gold. A hedge against uncertainty.

I read that there was a technological risk to Bitcoin from the coming Quantum Computers. I feel certain in the end the crypto currencies will crash, probably with the help of government regulation.

But, there could be vast profits to make for those who enter and exit at the right time.

FOMO is the investor word for what you say, fear of missing out. Yes, I feel that syndrome achingly, and every few hours think of how bit coin may become the world’s reserve currency and each coin worth millions…. But then I think, maybe not as things are too stacked against it, like it has no value, and governments will ban it, and so pass.

Tax the windfall profits? What about the windfall losses on the way down? Each seller in a rising market gains but the last buyer can lose a lot in the fall. The answer to excessive speculation is an increase in margin requirements. At the moment the bigger fools keep coming in to buy using their excess money created by the Fed. There is always an end to bubbles and they are never pretty.

I tend to be a Peter Schiff Harry Dent kind of stock market follower (Youtube, ‘End is Nigh’) and every day am amazed there is not the beginning of a 50% crash, but instead it just goes up again, and again.

I am Doubling down on missing the amazing tripling, the Tesla, the Carnival Cruse, Amazon, VW, Boeing, on and on, it was Money Trees everywhere and I was busy staring at the dead weeds…..So I buy commodities now, at their high. Uranium mine shares and Copper ETFs and Silver rounds to hide in my sock drawer…..

Whatever is the opposite of FOMO had me, and one would think for good reason. 9 trillion $ in USA just conjured out of air (if you include the Mad Biden’s 3 Trillion Green stimulus coming) The EU and UK gone mad and killing their business, making their young more ignorant, and printing money without anything to back it….

It has to happen, doesn’t it? I was there for 1980, 1999, 2008, I am very worried I will not make a bunch of money off this disaster (like the speculators have done, big time! Those Trillions went right into the player’s pockets.), but just lose.

‘9 trillion $ in USA just conjured out of air (if you include the Mad Biden’s 3 Trillion Green stimulus coming)’

Ha, ha, yes, I asked my broker if we were suitably positioned for the Green New Deal racket. He pointed out that one green/sustainability fund in which we were invested had increased in value by 50% over the last year.

The Fat Cats do love their GREEN ENERGY SECTOR. If only I had been thinking that way I would have had Tesla with their GIGA battery factories, which cannot fail in electrification as there is no other source sufficient to supply them – that is why Tesla is gone mad.

Ballooning debt and a falling GDP cannot exist together. Seems that simple to me.

” they need to send a long-term signal to the markets that real investment in actually productive economic activity is going to be consistently favoured over financial engineering. ”

It’s called “rising interest rates”.