Last Friday the Office of National Statistics (ONS) released the latest balance of payments data from June of this year. The balance of payments measures the transactions that Britain undertakes with other countries, and the latest report was grim. It showed that Britain is now running a trade deficit of over 4% of GDP, the largest trade deficit on record since comparable records began.

The response by leading economic commentators was bizarre. Economics Editor of The Financial Times Chris Giles tweeted the chart out with a comment reading “I hear #Brexit is going swimmingly”. But the increase in the trade deficit had nothing to do with Brexit, as anyone who read the ONS release can attest.

If Brexit were driving the deficit, we would expect exports to the EU to have fallen. Yet the data shows that between January and June of this year, exports of goods to the EU have increased 33%. In fact, the ONS release has a whole section showing charts where the Brexit transition period is clearly marked. The chart shows no unusual activity during this period with exports to the EU tracking exports to non-EU countries closely.

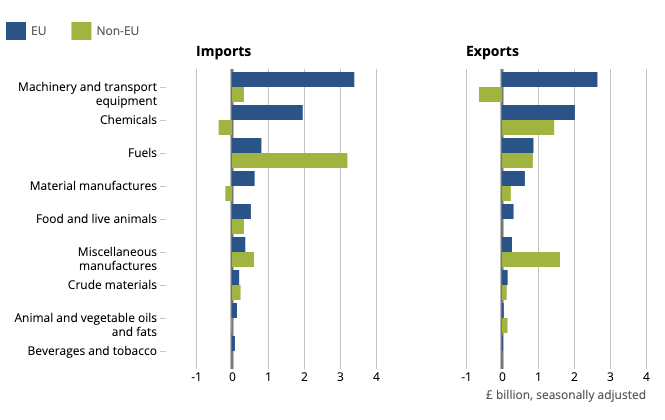

It is obvious what is causing the deterioration in the trade account and is clearly stated in the ONS report: rising energy costs. Britain may not be as reliant on Russian oil and gas as our European neighbours, but the price rises caused by the sanctions and Russian counter-sanctions are impacting Britain just the same. The ONS report notes that: “Increasing imports from non-EU countries in Quarter 2 2022 were driven by a £3.2 billion increase in imports of fuels, which is linked to the increasing price of oil during this period”. The chart below shows that the category where imports increased massively without being offset by higher exports is obviously fuels.

Rising energy prices do not just hit consumers, they also ruin the trade balance of countries who rely on energy imports. That category clearly includes Britain. Yet at the same time, many are using the deterioration of the trade balance to fight old political battles while ignoring the real problems. Why? Perhaps because when the sanctions were announced, many economists supported them – or, at least, they did not put very much effort into warning of their implications.

This winter Britain confronts the worst economic situation it has faced in decades. Forecasters are now saying that energy bills will cost the British consumer £5000 next year. This is simply not affordable. Our commentators and leaders have still not wrapped their heads around the economic implications of their favoured sanctions policies. But it seems unlikely that they will be able to continue to ignore these realities as the cold of winter bites.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeThe only way to reduce natural gas imports is to produce more natural gas at home. The only way I know to that is to start fracking.

Come on Liz! Buy off the locals with £0 gas for 10 years, stand up to the eco loons and show a bit of steel.

Are there still reserves of gas in the North Sea?

There are still some. There is a big field that could be opened up but has been a political football for years about whether to approve the licence. Hopefully the current situation will concentrate minds.

Do you mean Cambo? (It’s not really North Sea but Atlantic Margin). https://www.siccarpointenergy.co.uk/our-portfolio/corona-ridge-area#:~:text=Cambo%20Field&text=Cambo%20would%20also%20provide%20a,million%20homes%20for%20a%20year.

It will probably go ahead. The protests were all aimed at Shell who aren’t even the operator and pour loads of cash into green projects, more fool them.

There are. But the government has been a boot on the face of our domestic oil for years now, and it’s open to question whether we now have the capability to exploit it.

No mention of Covid? Prices and inflation were going steadily up well before the war in Ukraine.

Definitely been a double whammy!

I do wonder if it is a single whammy (assuming such a thing exists)

When the FT says anything about economics, I assume that the opposite is true.

It’s a pity, because at one time, I think, the FT was a fairly unbiaised paper. People used it to make financial decisions; they didn’t much care about party politics, just should I invest in company A or think about these particular Futures, but then I started seeing more and more a political slant, easy to miss if the slant is the way you slant, and I did miss the start. Much of the change became more obvious just before the referendum, which I do understand, the editor was concerned about a financial implosion; the point is this doesn’t seem to have happened, at least not very badly anyway, but they are behaving as if it did. It’s a shame, we really do need a newspaper which at least tries to be even-handed, but we are stuck with either Right biaised or Left biaised papers which make no attempt to look at both sides. I suppose at least you do know which way they slant and therefore you can make allowances, this is the reason that I semi-regularly buy both a Left and a Right biaised paper (or magazine).

You’re correct. I had a corporate subscription to FT when I started as an expat in Russia with a company in 2000. I noticed a foreign policy bias (particularly against Russia) was visible at that time and it got worse over time. But foreign policy is one thing but it then morphed into a woke bias and in Covid the FT, along with most MSM, became a government mouth piece. I still have a free subscription, but would never pay for the FT myself.

The rot started under the overrated Barber…his rabid Remainer tendencies earned him the Legion d’Honneur!

To follow that up, they promoted woke, woman of colour Rana Farooha to check the old diversity box. Never mind that her journalism was worse than most of her colleagues.

Over half the journal is filled with activism of one sort or another.

I wrote to Barber directly talking about feminist overkill.

He wrote a snarky letter back accusing me of over reacting. I resent every feminist article they had published the preceding two weeks: 37 in all!

He never replied. Like most newspapers they have clearly had a diversity/feminist makeover.

I’m surprised they didn’t blame the recent heat wave on Brexit too.

You might well be right, Mr Pilkington. But the alternative to sanctions was to give Russia a free rein to do what it likes in Eastern Europe. Doing the right thing, as the UK has done, often carries short-term pain. However, you are right to point out that this has nothing to do with Brexit.

Meaningful negotiations at the outset would have helped. Russia wanted Ukraine to be neutral and (I believe) that this might have been achieved if the EU and America had not encouraged Ukraine to refuse, assuring it of their backing.

That has led to the situation the EU and the UK now find themselves in with fuel prices rocketing and the Russian market closed to imports, like fish, which prevailed in the past..

It is our citizens, not the Russians, who are suffering and with public sector employees now wanting pay increases to match inflation, strikes are inevitable, with those working in the private sector (Conservative voters?) the ones who will have to bear the increased burden…

.

What facts do you have to back up your assertion that the “Russians are not suffering” ? I’ve seen a lot of people claiming this, but never any evidence.

The actual facts that Western companies have almost all closed down operations in Russia must have created both huge unemployment and a consequent brain drain of skilled labour (like skilled technical professionals who worked for the Russian offices of US companies) leaving the country.

I cannot see how those things – which we know have happened are having “no effect”.

In the medium term, the brain drain out of Russia may well turn out to be a win/win for the West – Russia loses skilled labour and the West (that’s “us” for those of us who don’t hate our own countries) gain it.

The initial estimate of 20% to 30% reduction in Russian GDP has shrunk to 4-6% due mainly to the increase in fuel price, according to the latest from the Russian central bank.

The exit of foreign investors has not stopped production in many. Most had local supply chains and management took over (hence brain drain is less than you think). And a lot of business was sold on the cheap. The higher technology ones (like the car industry) do have problems. But no mass unemployment at all. Russia was always short of labour, importing a lot from the CIS.

There’s a problem already in the west with too many graduates, so I don’t see how any exodus of graduates from Russia helps the West.

Ah so you’re relying on the economic figures produced by Russia? Of course these are reliable! Maybe try a different source that was in the news recently, showing the Russian economy is indeed going to hell in a handcart? I’ll let you look it up, though you probably prefer not to.

Who do you think is going to stop Russia when they move into the Baltic states? NATO! It’s been proven to be a busted flush, and even if the weapons were any good the west can’t build the ammo.

Anyway, sanction away as you please, even they’re making the Russians you hate so much richer.

Your statement sound just like the many Russian trolls in the comments sections of some of the “more popular”newsgroups.Your apparent disdain for the effectiveness of NATO weapons is not borne out by events in the field.

The more NATO weapons have poured into Ukraine, the much less effective Russias artillery has become.

If NATO was attacked the combined air forces would wipe out the Russian ground offensive in a matter of weeks

Stop being so clever with perspective!

We get it Pilkington, you don’t think Russia should have received any pushback for their actions in Ukraine. Change the record would you

That isn’t how I read it. Putin’s hold over us is due to Europe’s self-induced dependence on Russian energy production. It didn’t have to be that way.

Indeed, it’s a total lack of foresight and strategic planning. However every article from this writer has implied that the west is a day from collapse while autocratic regimes such as Russia and China are to be admired

My take too Billy Bob. Ridiculously narrowly spun analysis.

Unlike Brexit, but like Covid, energy and fuel prices affect everybody. If rich countries cannot afford the energy prices, what will poor countries do, or even more middle-income countries that have already adopted our urbanised, motorised lifestyles?

errr…. and what about foreign currency inflows from finance, investment, insurance, advertising, media, consulting, law, accounting?

On the plus side, we are currently exporting lots more electricity and gas to the continent than normal.

Fair bit of spin on this – Is the article sponsored by Putin?

No it is all down to Brexit. But who cares? Blue passports. Sovereignty. More powerful vacuum cleaners. Makes it all worth while. The uplands are definitely sunny, although suffering from drought, to be fair